Woodford's Capita and Sports Direct crash

14th December 2017 13:19

by Graeme Evans from interactive investor

Share on

Poor results seem hard to shake off for fund manager Neil Woodford and Newcastle United owner Mike Ashley at the moment. But even these two star names might have been surprised at the scale of their respective losses at and following updates today.

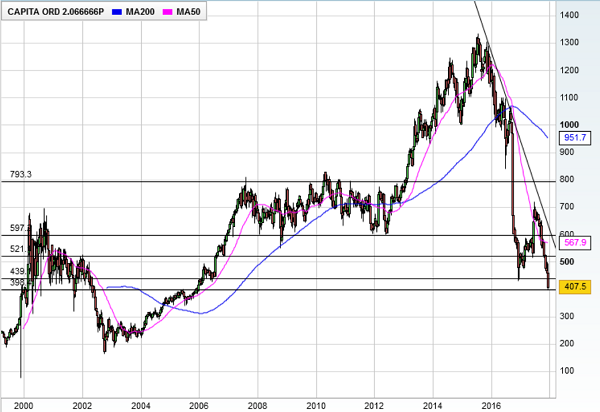

Woodford Investment Management owns more than 10% of Capita, but saw shares tumble 13% to their lowest level since 2005, as the outsourcing group appeared to signal that 2018 was likely to be another challenging year.

The 400p level has been a significant area of technical support and chart fans will hope that this is a floor for Capita shares.

Broker Citi slashed its price target from 535p to 480p to reflect earnings per share (EPS) downgrades based on lower organic growth – EPS for 2017, 2018 and 2019 is cut by 2%, 4% and 6% respectively - and higher net debt.

And there's real concern about the dividend now. "The software businesses provide some valuation support, however, there is much heavy lifting to do in restructuring the business and investing in areas of growth," says Tom Sykes at Deutsche Bank.

"This will inevitably require cash and will put pressure on the dividend payout (currently 6.8% yield)."

Over at Sports Direct, Ashley followed up last night's latest defeat for Newcastle United - a business he's on the brink of selling for £300 million - with a near-10% slump in the company's shares.

Interim profits more than halved as the City also shrugged its shoulders at Ashley's claim that his ongoing plan to transform Sports Direct into the "Selfridges of sport" was already showing spectacular trading results.

While this plan will involve opening between 10 and 20 new flagship stores in the next year, investors are more concerned about the performance of the wider 500-strong UK retail estate, where first-half revenue fell 1.4% to £1.1 billion.

This was blamed on a reduction in online promotional activity and store closures as part of the drive to improve the quality of the retail portfolio. Ashley said underlying profitability remains healthy, and downplayed the fact that net debt had jumped to £472 million from £182 million in April.

The Sports Direct founder and chief executive, who owns about 60% of the business, said: "We will continue to invest for the long-term and our net debt has increased in line with management expectations."

Despite today's fall, shares are still higher than the 298p seen in July.

For Woodford, the latest valuation drop for Capita is another blow after high-profile disappointments at investments including .

Capita's continued struggles come after Woodford increased his fund's position earlier this year, having argued that the company was intrinsically undervalued following a string of profit warnings in 2016.

There was little in the way of respite today as Capita said the market for major business process management contracts had been subdued throughout 2017, particularly in the public sector.

The Capita bid pipeline currently stands at £2.5 billion, but even if a number of these bid decisions come through they are unlikely to boost profits in 2018.

With new chief executive Jonathan Lewis starting this month, Capita is pinning its hopes on its turnaround plan having a positive impact next year.

It said this will include a drive to focus the business and allocation of capital on the markets with the best growth prospects, as well as to improve cost competitiveness.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.