Which cryptocurrency will be the next bitcoin?

30th December 2017 21:11

by Gary McFarlane from interactive investor

Share on

Bitcoin is trading at $12,720, according to Coinmarketcap.com, and $12,899 on US exchange Coinbase, having been rangebound for much of the holiday period. That followed the cryptocurrency's 45% fall from a near-$20,000 all-time high to a low of $12,510 just before Christmas.

It's struggled to find a floor, with the price osciallating as much as $1,500 above and below the $15,000 mark, although drops below $13,000 have been a trigger for buyers, pushing the price back up above $15,000. That said, any breach of that recent low could spark further selling of bitcoin.

On 22 December, bitcoin fell as much as 30% and, despite breaking above $16,000, has been unable to overcome resistance at $16,500.

Data released by the US Commodity Futures Trading Commission (CFTC) on the 22nd, bitcoin's largest daily fall of 2017, showed that 65% of futures contracts were shorting bitcoin, a clear indication that a price battle is in play between bearish professional traders and trading companies on the one hand and bullish retail investors holding long positions on the other.

Mohamed El-Erian, chief economic adviser at Allianz, thinks bitcoin is at a key moment when it either settles down, from a volatility point of view, and begins to broaden its base of investors.

"Large institutional investors (such as traditional mutual funds, Wall Street banks and established hedge funds) have generally remained on the sidelines, even though their involvement is key to bitcoin's sustainability," he pointed out.

Ripple stakes its claim

A dominant theme for the year ahead will likely be the hunt for the next bitcoin, and Ripple seems to be making the best claim for that mantle right now.

In the course of the past week, the XRP token from US-based Ripple Labs has jumped 100%, reaching a high of $2.41, although it is currently trading at $2.10. Over the year, XRP is up a staggering 33,243%.

In many ways Ripple is a most unlikely candidate to take bitcoin's crown. It is not strictly a cryptocurrency at all. There is no mining involved in the token's "minting". There is a total of 100 billion tokens and roughly 60% of those are owned by Ripple Labs, with 35% in circulation. The token, which acts as a sort of bridging currency for fiat, is designed to faciliate speedy low-cost interbank payments, especially across international borders.

The market capitalisation is the price of the coin/token multiplied by the number in circulation, but not all of those tokens are truly in circulation because the founders received 20 billion, and one of their number – Jed McCaleb – left the company, and his tokens (nine billion) can be sold, subject to the terms of the settlement he reached with Ripple in February 2016 that laid out a specific schedule.

A previous agreement in 2014 between Ripple and McCaleb fell apart. By 2019, McCaleb will be able to offload his entire holding if he so wishes. Although McCaleb has sold some of his holding, at today's price his original nine billion stash is worth $18.9 billion.

McCaleb may well wish to sellout, given that he set up a rival to Ripple in 2014 called Stellar that has also been doing rather well of late, now the 10th-ranked coin with a market cap of $5.5 billion.

Ripple investors should also be aware of the fact that the transaction fees on the network are paid by "burning" XRP - a term used in cryptoland when a portion of currency is removed from circulation. Burning increases the value of the remaining tokens, which means that Ripple Labs in effect accrues 60% of all fees.

Banks and credit card providers keep Ripple in the news

There is no reason why Ripple would all of a sudden dump its tokens on the market, but it is a factor that's worth bearing in mind and highlights the centralised nature of the Ripple network. New cryptocurrencies sometimes pre-mine coins to distribute to team members but, typically, at a much lower percentage than seen with Ripple. It is one of the reasons why crypto true believers often refer to Ripple in an unfavourable light.

With those fundamentals in view, why has Ripple soared to become the second most valuable token, as measured by market cap?

Rumours that Ripple will soon be listed on Coinbase has been cited by some as the pivotal price mover, but the newsflow concerning the utility of the token and its take up is probably more important.

The announcement two days ago that SBI Ripple Asia had brought together a consortium of Japanese credit card companies to test Ripple's settlement technology, was the latest such news. This follows the start of trials a little more than a week ago by Japanese and Asian banks with the goal of reducing costs by as much as 30% in cross-border payments.

The market is eager to see blockchain projects start to bring products to market and Ripple appears to be one of those nearest to reaching that goal.

Ripple rival Stellar recently grabbed the business of Kik, the Canadian-based messaging social network, after it abandoned development on the Ethereum network due to that network's inability to operate at the scale Kik requires to run its native token called KIN.

Ethereum's defenders will point out that there are plans to address its scalability issues by deploying a so-called second-layer solution – similar to the Lightning Network for bitcion – in the form of the Raiden Network.

Rise of the altcoins leaves bitcoin in the shade

A notable development in December has been the rise of the altcoins, with bitcoin underperforming by comparison. Alongside the hunt for the next bitcoin then, the wider surge in interest in other coins and tokens will be a feature of the coming year as investors diversify their holdings.

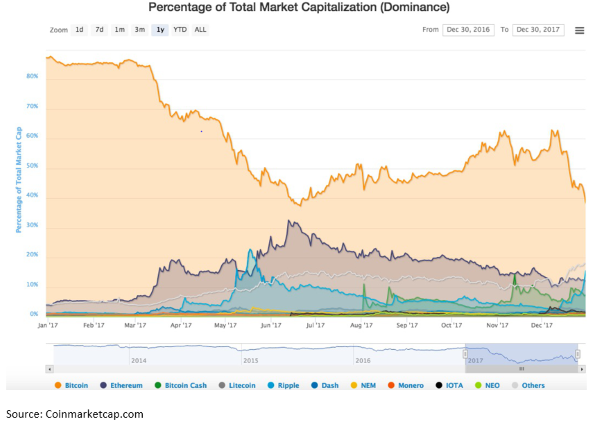

The chart shows the decline in bitcoin dominance. Bitcoin for all of its history has accounted for at least 80% of sector market cap, but since March has been falling to now stand at 38%. Although bitcoin has sunk from its record valuation at $20,000, total cryptocurrency market capitalisation has contracted by $82 billion, from $636 billion to $554 billion today, representing a drop of 12% compared to bitcoin's 35% price reversal.

Among the most impressive altcoin performers is Cardano (ADA), which is building a blockchain platform and has just knocked Litecoin into sixth place, is 2,206% higher against the dollar since 2 October.

Ethereum (ETH) has done even better, up a mammoth 8,388%, although that's over a 12-month period. IOTA (MIOTA), providing a distributed solution for Internet of Things data management with its unique and highly scalable Tangle technology, has advanced 380% since June, but is off 16% in the past 24 hours.

Despite altcoin price appreciation, transaction volumes on the bitcoin network – a key indicator of usage and therefore value – still out-guns all other coins, partly because bitcoin is the main trading pair for altcoins.

South Korean clampdown gets teeth

Helping to set in motion the latest leg down for markets is the South Korea clampdown on cryptocurrency trading, when the regulatory authorities in the country banned the use of temporary anonymous virtual bank accounts when buying cryptocurrencies. In the South Korea retail sector, temporary bank accounts, valid for as little as three hours, can be created by merchants to expedite speedy and secure transactions for one-off large ticket items.

In future, such accounts will not be able to be used by crypto exchange customers to fund accounts or buy coins, and those virtual bank accounts already in exsitence must be associated with a valid ID, although this is already common practice among the main South Korean exchanges, such as Bithumb and Korbit.

The Office for Government Policy Coordination said in a statement Thursday that exchanges found not to be in compliance with the new regulations would be closed.

Bitcoin trades at a 30% premium in South Korea, where there are estimated to be 1 million active cryptocurrency traders. The country, which has a population of 51 million, accounts for approimately a fifth of global cryptocurrency trading volume.

Elsewhere, an executive of the Exmo exchange, Pavel Lerner was kidnapped in Kiev, the capital of Ukraine, on 26 December. His release was only secured after a ransom of $1 million in bitcoin was paid to the criminals.

Petro cryptocurrency to the rescue?

And finally, in Venezuela the Petro cryptocurrency moved closer to realisation.

"It is a matter of days before we announce the first issuance of the 'petro' cryptocurrency," said Jorge Rodriguez, the government information minister. Few details about how the currency is designed or will be managed have been released, although it is now known that it will be backed by five billion barrels of proven oil reserves.

Venezuela's governement says the reserves peg the cryptocurrency to a value of $267 billion.

A date for the launch has not been announced, but the plan still ultimately depends on fiat – faith in the government, and that is still in short supply on world markets with creditors refusing to accept the government's paper.

The extent to which the cryptocurrency is a success will probably be dependent upon its transparency and independence from the whims of government financial policy.

The petro may not be the first asset-backed cryptocurrency. OilCoin, which is tokenizing crude oil, with each token worth a barrel of oil, is launching in the new year as the world's first "legally compliant" cryptocurrency. The initial coin offering begins in January.

Bart Chilton, who was the commissioner of the US Commodity Futures Trading Commission from 2007 to 2014, is one of the coin's team members.

"The price of an OilCoin token will approximate and move in tandem with the price of a single barrel of crude oil. As demand for OilCoin causes the price of a single OilCoin to rise above the price of a barrel of oil, additional OilCoin will be issued and the proceeds will be invested in additional oil reserves," said the project's co-founder, Darius Brooks, former principal at private equity firm TPG.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.