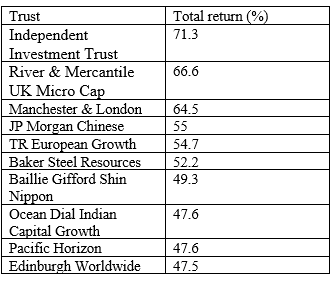

Top 10 investment trust winners in 2017

2nd January 2018 10:07

by Kyle Caldwell from interactive investor

Share on

Unless you have been sitting in cash, the chances are you have seen your portfolio rise in value over the past 12 months. Stockmarkets across the globe have been in fine form, in the case of both developed and emerging economies.

Thanks to the rising tide there's a greater chance than usual that investment trust fans may see one or two of their holdings appear in our table below, which showcases the investment trusts that topped the performance tables in 2017.

That's because usually, a certain specialist type of trust shines in a given year; in 2016 for example commodity-focused trusts had their day in the sun.

But as our top 10 table shows, a wide variety of strategies have enjoyed a hot streak of form over the past year. The figures, which were supplied by FE Trustnet, show the top 10 performing trusts in total return terms (ie including both dividends and share price growth). Trusts deemed to be geared primarily towards institutional investors, however, were excluded.

Top of the table is , up 71.3%. The trust has for years fallen under the radar of retail investors, but its eye-catching performance of late may spark an uptick in demand. However, bear in mind that the trust has subsequently become more expensive, evidenced by its premium rating of 7%.

The trust has been managed by Max Ward since 2000. Ward is a "respected stock-picker", according to Simon Moore of Seven Investment Management, but is "unlikely to be a name that younger investors are familiar with".

Prior to setting up IIT, Ward was a partner at Baillie Gifford and managed Scottish Mortgage. He targets high-growth companies; favouring technology and telecommunication firms. , the trust's top holding, has helped turbocharge performance.

Taking the silver medal, perhaps surprisingly given all the negative sentiment towards UK equities, is , up 66.6%.

In a recent update to investors, Philip Rodrigs, who manages the trust, noted that in the third quarter there were a number of "exuberant" share price moves. He added: "These bullish share price actions suggest the market is increasingly willing to reward strong delivery by micro cap firms and, as a result, quickly take advantage of the discount valuations available in this area of the market."

In third place is , up 64.5%. The trust has a number of fast-growing tech firms among its biggest holdings, a position that has paid off in 2017. A quarter of the trust is invested in , and . It also counts Scottish Mortgage as one of its top 10 holdings.

Completing the top five are , which has posted gains of 55%, followed by , up 54.7%.

The rest of the top 10 is a mixed bag, with a Japan trust featuring (), as well as an India-focused trust (Ocean Dial Indian Capital Growth) and a commodity play in the form of .

Overall, three funds from the Baillie Gifford stable feature: Baillie Gifford Shin Nippon, and .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.