Our Winter Portfolio outperforms market by 60%

5th January 2018 17:15

by Lee Wild from interactive investor

Share on

Now in their fourth year, Interactive Investor's pair of seasonal portfolios are used to difficult starts, and this year was no different. But we also know that the theory behind the strategy says things will improve. And they have!

That's because historic data proves that equity markets typically outperform over the six winter months from November to April. With help from Stock Market Almanac author and mathematician Stephen Eckett, we identified the stocks with the best track record of returns over the past 10 winters.

Our so-called Consistent Winter Portfolio contains the five most reliable companies of the past decade - each has risen at least 90% of the time. To make our Aggressive Winter Portfolio, stocks must have a 70% success rate over the winter months.

Our reliable basket of shares has netted an average annual profit of 18% over the past 10 years versus just 3.5% for the FTSE 350 index. There's more risk in the aggressive portfolio, but average annual profit has been 32%, almost 10 times the benchmark index.

Christmas present for investors

With few headwinds and the global economy tipped to grow fast in 2018, investors have been happy buying risk assets like equities. Indeed, the Santa rally we write so much about, and on which the Winter Portfolio strategy is partly predicated, was spectacular this year.

The first phase of Brexit negotiations was passed successfully last month, and Donald Trump finally had one of his policies rubber stamped by US lawmakers; his US tax reform will have a significant benefit for US corporate earnings especially.

This had a dramatic effect on the fortunes of our Winter Portfolios. After a grim first month, both consistent and aggressive baskets of shares staged a strong recovery in December, up 6% and 8% respectively. Our aggressive portfolio beat the benchmark index's sub-5% gain for the four weeks by 60%!

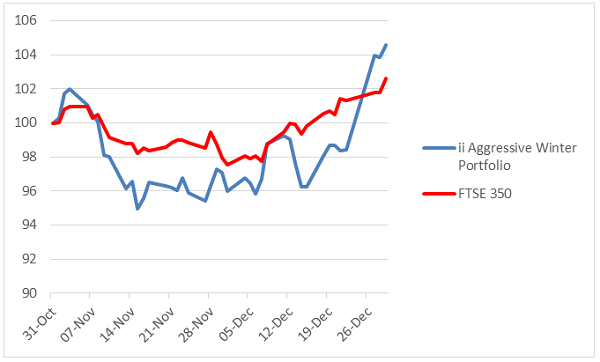

Aggressive Winter Portfolio

Having lagged the index in November, our Aggressive Winter Portfolio turned a near-3% loss over one month into a 4.6% gain for the two months to 31 December.

Only failed to make a profit for investors over the festive period, although, despite giving up some of November's hard-won gains, the builders' merchant is still up 3% this winter.

But it was a stroke of luck at serviced offices firm that guaranteed a stunning four-week period this time. Stocks make it into the portfolios based on strong past performance, and IWG ended last year's seasonal strategy up over 30%.

A takeover approach means IWG rocketed almost 31% last month to stand 20% higher than its portfolio entry price. We're told an indicative proposal for a cash bid has been made by funds managed by affiliates of Brookfield Asset Management and Onex Corporation. There are no guarantees this will happen, or what the purchase price will be. Watch this space.

After a near-6% rally in December, shares in housebuilder are back trading at around levels not seen for a decade. The sector typically does well in the first quarter of the calendar year, but domestic stocks received an early fillip from progress in Brexit negotiations. Look for a trading update next week.

Equipment rental giant had a better month, too, up almost 5% following "solid" first-half results. Sales rose 19% at constant currency as the UK firm helped clear up after a devastating US hurricane season.

It's Christmas update time for the retail sector, which is when investors typically get excited about tracksuits-to-trainers chain . This year is no different, and the shares rose 2% last month. They’ve gone even higher since ahead of their update in less than two weeks' time.

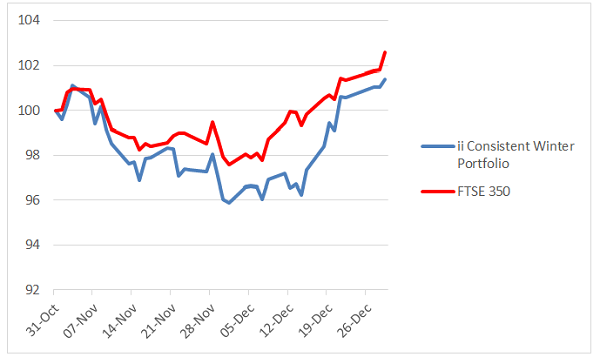

Consistent Winter Portfolio

Down 4% in its first month, our Consistent Winter Portfolio returned 5.6% in December to give a gain since inception of 1.4%.

All five constituents generated healthy returns, but hotelier gets the crown after an 8.5% rally in just four weeks. Already doing well, we hear that Donald Trump's US Tax Cuts and Job Acts Bill will reduce IHG's group effective tax rate -currently in the low 30s - by mid to high single digit percentage points from 1 January 2018.

Strong full-year results triggered upgrades at caterer , but business success is overshadowed since by the sad news of chief executive Richard Cousins' death in a plane accident in Australia. Our sympathies go out to his family and friends.

Heat treatment specialist has had such a strong run these past 18 months that pushing higher would not be straightforward. Still, the second month of this strategy has been much better than the first, with 5% upside in December.

Analysts at Barclays believe recent weakness is a "buying opportunity". Investors would appear to agree. "With good exposure to the growing industrial end markets, and a strong secular underlying improvement in margin, we see further positive momentum in 2018," the broker says.

Both speciality chemicals firm and Irish building materials company rose 3.5% last month, but the latter is still down 6% for this year's strategy. Bad weather in the US and lingering concerns over the $3.5 billion paid for Ash Grove Cement have weighed on CRH.

Croda, however, is one of the most reliable companies around - it's risen during the winter months for at least the past 13 years - and is now up almost 6% since the end of October.

Stephen Eckett

Stephen Eckett started his career with Baring Securities and then later worked for Bankers Trust and SG Warburg, during which time he worked in London, Hong Kong and Tokyo. After settling in France, he co-founded Harriman House which has become a leading independent publisher of financial books in the UK. He also writes books on finance including, most recently, the Harriman Stock Market Almanac.

--------------------------------------------------------------------------------------------------------------------------------------

ii publishes information and ideas which are of interest to investors. Any recommendation made in this article is based on the views of the writer, which do not take into account your circumstances. This is not a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised investment adviser. ii do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.