Chart of the week: How to ride the crypto bubble to wealth

8th January 2018 11:27

Cryptos are riding high - will it last?

Is there anyone on the planet that has not heard of bitcoin? I would guess it now has better name recognition than - and that has been around far longer than BTC.

I thought I would start to cover the raging cryptocurrencies, firstly because I see very few articles about the exciting technical aspects of the charts and, secondly, there is enormous interest in them. There are many trading vehicles available from the real thing to ETFs and now to many spread-betting platforms. There are even futures contracts being traded.

Naturally, when a revolutionary asset such as BTC bursts onto the scene, traditional money managers and financial advisors are quick to denounce them as frauds, and the firm advice from them is to never touch them with the proverbial bargepole.

But for investors/traders that are attracted to the extreme action and the almost cryptic definition of them (see below), cryptos have already made many people extremely wealthy -and isn't that the main purpose of investing/trading?

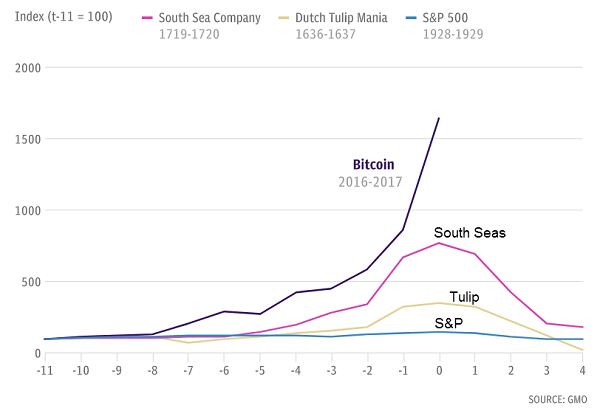

Here in one chart, is the comparison between BTC and other historic bubbles:

BTC is the biggest bubble of the lot -by far. We can laugh at the buyers of tulips or South Seas shares at their tops because we know how that turned out. Will we do the same thing with BTC?

But what are cryptocurrencies? Here is the definition of Ethereum - a BTC rival currency - from Wikipedia:

Ethereum is an open-source, public, blockchain-based distributed computing platform featuring smart contract (scripting) functionality.[2] It provides a decentralized Turing-complete virtual machine, the Ethereum Virtual Machine (EVM), which can execute scripts using an international network of public nodes. Ethereum also provides a cryptocurrency token called "ether", which can be transferred between accounts and used to compensate participant nodes for computations performed.[3] "Gas", an internal transaction pricing mechanism, is used to mitigate spam and allocate resources on the network.[2][4]

Have we all got it? That's great, because I can now move on to the charts.

Here is the Ether chart that shows my traditional 'buy' entries using basic classical market timing methods:

In late November, the market was edging up and, when it broke above a major line of resistance, that gave me my first long entry at around the $340 area. It then moved up swiftly into new highs in late November and formed a 'three down' correction into December.

When it broke up out of that, that gave me my second classic 'buy' entry at the $450 area. And, last month, there was saw a scare when China started to clamp down on the unbridled speculation rampant in that country.

But that was a temporary setback, and now we are moving up above my initial $1,000 target. That is a three-fold move in about a month. As they say, that beats the Building Society!

In Elliott wave terms, the chart is quite clear. The near-vertical rise In December is typical of a third wave, while the setback is wave 4. Now the current rally phase is the final fifth wave and we are now in wave 3 of that fifth wave.

I expect a pullback in wave 4 when wave 3 is complete before moving to a new high - and likely a major top - in wave 5 to come.

The mainstream media (MSM) is full of articles on BTC, and many are saying it is a bubble that will burst. But they were saying the same thing when it was valued at $200! My rule of thumb is this: when the MSM send out multiple warning articles, the trend is very likely to accelerate. We are seeing just that this morning.

And when I see an outrageously high target - I saw one pegged at $1 million last week - I start to look for the exit.

Going back to the Ether definition above, I suggest that not one buyer in 1,000 really understands what they are buying, they are merely jumping on the momentum bandwagon. This is different than other asset manias such as past booms in gold which is an asset you can see, feel and weigh. The fact that the coins are virtual is meaningful - that also describes the wealth tied up in them which will vanish into the virtual ether after the pop.

But my serious point is that you can ride the crypto bubble to wealth - if you skilfully use time-tested chart techniques for entries and exits -and keep an eye on sentiment. Yes, one day they will probably collapse (especially when stocks turn down) but by then, the smart money will be on the sidelines (and even playing the short side!).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks