Dividend danger zone screen claims first victim

22nd March 2018 10:45

by Kyle Caldwell from interactive investor

Share on

Our new dividend watch series kicked off just a few months ago, but has already claimed its first victim, with announcing plans to cut its future dividend.

Back in the January edition of our sister magazine, Money Observer, we highlighted Inmarsat, a satellite communications company that charges commercial airlines to use its services, as a high-yielding share that was in danger of not fulfilling its income promises. In early March the firm announced that it will cut future yearly payouts in order to invest money back into its business.

At the time Simon McGarry, a senior equity analyst at Canaccord Genuity Wealth Management, who created the dividend danger zone share screen, pointed out that Inmarsat is not a "dividend darling" loved by income investors; instead the high yield it was offering (of over 8%) was a function of its heavy share price fall in 2017. He added that the dividend for the 2017 and 2018 financial years would not be covered by earnings, meaning that a cut looked on the cards.

Six income shares that look shaky

There are now six shares in our screen, with this month's selection, , perhaps the most surprising entrant given that the firm has grown its dividend for the past 15 years. In addition, its management team remains committed to growing the dividend by 10% per year. So what's causing alarm bells to ring?

Regulatory headwinds and the long-term decline of smoking in general are threats to future growth; but for the time being McGarry thinks payouts look safe, despite its low dividend cover score and a debt mountain that needs to be tackled. "There's a risk the 10% annual dividend growth pledge may damage its long-term prospects, but that said, the business remains massively cash-generative with plenty of excess cash after dividends are paid," he comments.

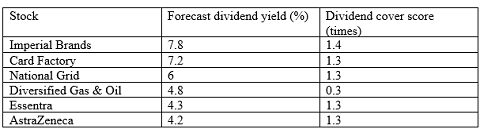

Elsewhere, three of the other five names listed in our table below featured in early February when the screen was last run: , and .

The new entrants are and , although Essentra, which manufactures plastic products, has appeared previously.

The mechanics behind the share screen

The dividend danger zone screen filters through the 700-odd names in the , screening on the following basis: a market cap of over £200 million, a dividend yield of 4% (higher than the average) and a dividend cover score of below 1.4 times. Two other filters have also been applied: the first filters out companies that appear in a financially sound position to pay off their debts, while the second excludes firms where earnings have been upgraded by analysts.

Source: Canaccord Genuity Wealth Management Past performance is not a guide to future performance

Another warning sign a dividend cut may be on the cards

The dividend danger zone share screen takes into account three of the main warning signs that point to a dividend in danger: a high dividend yield, low dividend cover and potentially high debt levels.

There are various other tactics that private investors can use to assess the sustainability of a dividend, including a measure called 'return on capital employed' (ROCE), which can be calculated from a company's accounts. The ROCE is the profit figure divided by the assets of the businesses.

Warren Buffett is a fan, describing the measure in 1979 as "the primary test of managerial economic performance". ROCE is considered more useful than the more familiar return on equity measure, because ROCE also factors in debt and other liabilities.

There's no golden number that dictates what a good or bad figure is; instead investors should look at whether the Roce is rising or falling versus its historical value for that company.

But Terry Smith, manager of the Money Observer Rated , does not consider investing in a company unless it can achieve a ROCE of more than 15%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.