Woodford booted out of UK equity income sector

23rd March 2018 10:05

by Kyle Caldwell from interactive investor

Share on

Neil Woodford has become the latest name to be ejected from the Investment Association's (IA) UK equity income sector.

His flagship fund, , failed to beat or match the yield on the over the past three years. Those who fail this hurdle over this time period are expelled from the sector.

Over the three-year period LF Woodford Equity Income produced an average yield of 3.5%, below the FTSE All Share index yield of 3.6%.

A spokesperson for Woodford Investment Management says the way Neil Woodford invests is "not dictated by yield considerations".

"Throughout his 30-year investment career, Neil has focused on delivering positive long-term total returns through a combination of income and capital growth for his flagship equity income funds.

"He believes this strategy is in the best interests of his investors; he has never been willing to sacrifice capital to supplement income in the short term and his portfolio construction isn't dictated by yield considerations," adds the spokesperson.

The yield requirement used to be tougher, as funds previously had to achieve a yield of 110% over a three-year rolling period to retain their place in the sector. Last March, however, the yield requirement was lowered following the expulsion of around a fifth of the sector, with 20 or so funds failing the yield test.

Most funds that have been expelled tend to end up in the IA's UK all companies sector and this is where LF Woodford Equity Income will now reside. Other income funds that sit in the sector include and Woodford's former funds: and .

As our sister site Money Observer has previously highlighted, the yield requirement is controversial as it can punish strong performance.

For example: Fund A starts the year at a price of £1 per unit and ends the year at £1.10 per unit, producing an income of 5p over the year. The historic yield of the fund is therefore calculated as 4.55% (5p/110p).

Fund B, meanwhile, starts the year at a price of £1 per unit and ends the year at £0.90 per unit, producing an income of 5p over the year. The historic yield of the fund is calculated as 5.56 % (5p/90p).

The spokesperson for Woodford Investment Management adds that ahead of the yield requirement for the sector being watered down by the IA, it had recommended that the trade body should instead remove the headline yield target, as it does not effectively capture the impact of dividend growth over the long term.

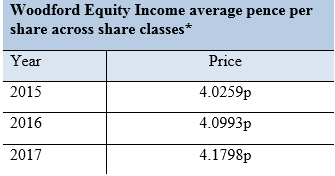

"Neil's focus for the LF Woodford Equity Income fund (and his previous equity income funds) has been, and always will be, on delivering a particular level of income per share, rather than a specific yield. From the outset, Neil said he would aim to deliver 4p based on the launch price of £1, and grow that income each year. That commitment remains," says the spokesperson.

Source: Northern Trust

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.