Outlook for bitcoin as Flash Boys move in

23rd March 2018 13:33

Bitcoin seemed to have been given a gift on Sunday, when a letter to G20 finance ministers from governor of the Bank of England Mark Carney in his capacity as outgoing chairman of the Financial Stability Board (FSB), stated that crypto didn't pose a risk to the financial system. This was interpreted by crypto market participants as signalling that there would not be a regulatory clampdown, but that may have been premature.

In the G20's Tuesday meeting, finance ministers agreed that cryptocurrency regulation did indeed need to be looked at and action internationally coordinated. The press statement released after the discussion focused on bringing crypto assets into compliance with rules on money laundering and terrorist financing.

In part, it read: "We commit to implement the FATF standards as they apply to crypto-assets, look forward to the FATF review of those standards, and call on the FATF to advance global implementation. We call on international standard-setting bodies (SSBs) to continue their monitoring of crypto-assets and their risks, according to their mandates, and assess multilateral responses as needed."

Carney's FSB letter initially led to a $1,000 rally in the bitcoin price, pushing the cryptocurrency back above $9,000.

G20 ministers agreed to gather more data on the crypto markets with a view to bringing forward proposals in July, Argentina's Central Bank chief Frederico Sturzenegger said at the post-meeting press conference.

The FSB also said that cryptocurrencies "lack the traits of sovereign currencies", which was taken in some quarters as a positive for crypto, although it is hard to see why. Regardless of the delayed international moves to co-ordinate action, nation states continue to pursue their own course, with some treating crypto as an asset, as the US Inland Revenue Service does, and others, such as the UK's HM Revenue & Customs (HMRC), leaning towards the currency view.

In both cases the governments regard gains as taxable, although in 2014 HMRC introduced a grey area around whether crypto gains represent a taxable event depending on whether they are a result of trading in the same way as foreign exchange or spread betting gains. Such gains are currently tax-free in the UK, so that might change if the UK decides to follow the FSB's view and designate crypto an asset not a currency.

Japan targets Binance exchange

Although bitcoin has hung onto most of its gains since the G20 meeting, reports emerged yesterday that Japan's Financial Services Agency (FSA) was pushing to close the Binance crypto exchange in the country. Hong Kong-based Binance has grown rapidly in recent months with around 10% of its customers thought to be in Japan.

Although the exchange at first denied it was being targeted by the authorities, it received a notice today from the supervision bureau of the FSA warning it that it needn't to register with the authorities under the relevant regulations. Theoretically, failure to do so could result in closure. An initial report from Nikkei said the government was looking at police action to force closure for non-compliance, but there is no reference to that in the FSA letter.

Japan has a licensing system for crypto exchanges that was introduced last year, and 16 companies are currently listed. Others are waiting to be approved, but the procedures are in flux while the authorities conduct on-site inspections following the hacking on the Coincheck exchange in February, which led to the loss of $534 million worth of XEM tokens of the NEM network.

The market has been a sea of red for the past two days as the bitcoin rally stalls on the latest regulatory uncertainty out of Japan. Bitcoin is currently trading at $8,483, down 3.8% over the past 24 hours, according to Cryptocompare, with Cardano and NEO among the bigger losers today, off 8%.

Source: TradingView Past performances is not a guide to future performance

One bright light this week has been EOS, the blockchain platform that is yet to launch but has received substantial backing. Unusually, EOS is running a year-long initial coin offering (ICO), but the token is already trading on crypto venues. The price started rising after the announcement on Tuesday by Everipedia, a sort of Wikipedia on blockchain effort, announced that it would be airdropping its token to EOS holders sometime in June.

Everipedia launched in 2015 as a fork from Wikipedia and claims to have more content. Last month, the project raised $30 million in funding from venture capitalists. The IQ token will be the incentive mechanism inside the Everipedia ecosystem, that will encourage users to upload and edit content. EOS has risen 30% over this week.

Altcoins bottom, bitcoin to $91,000

Tom Lee, arguably Wall Street's leading crypto analyst and head of research at Fundstrat Global Advisors, has called a bottom for altcoins, but doesn't see them advancing much right now he said in a report this week: "We believe the current purgatory period will last for 150-175 days, implying a bull market for alt-coins really starts mid-August to mid-September."Altcoins refers to all coins other than bitcoin and Ethereum.

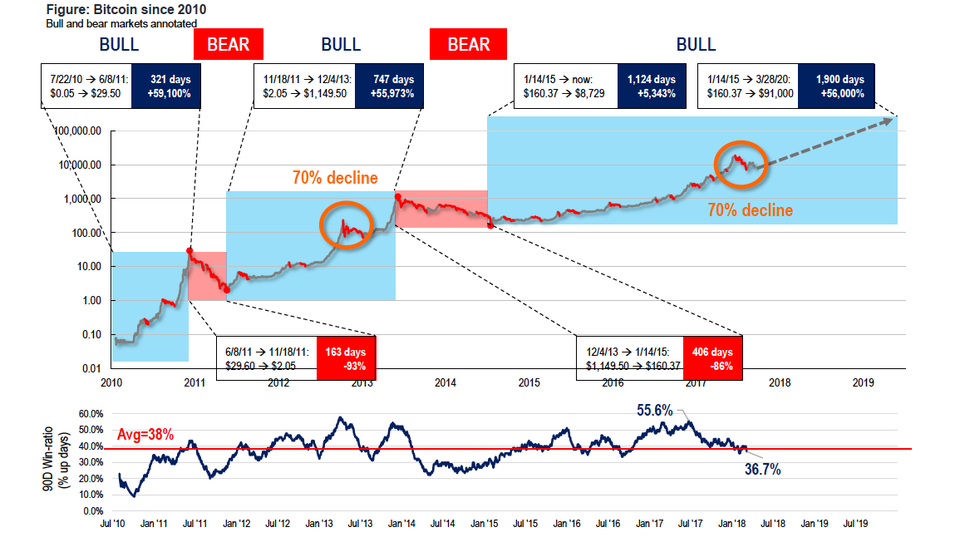

FundStrat has developed a contrarian indicator called the Bitcoin Misery Index which Lee says indicates that bitcoin has also bottomed. Lee has put a price target of $91,000 by 2020 for bitcoin, based on recoveries from previous bear markets.

Source: Fundstrat Global Advisors Past performance is not a guide to future performance

UK Fintech leadership, Coinbase complaints

The UK government is making strides towards establishing the City of London as a fintech hub, with a government-sponsored conference held yesterday. John Glen, the junior finance minister, told the Innovate Finance conference: "In our upcoming fintech strategy, the government will announce further work with the Financial Conduct Authority and the Bank of England to consider these issues in more detail."

Twitter chief executive Jack Dorsey was in London to attend the conference on behalf of Square, the payments start-up, the other company he leads. He made some ultra-bullish comments to the Times about bitcoin, claiming it would be the "single currency" in the world within 10 years.

A report by Sky News said that Twitter was planning to ban crypto advertising following the lead of Facebook and Google, but provided no source for the story. Twitter has not confirmed the claim. Messaging app Snapchat has this week announced a ban.

Elsewhere, US exchange Coinbase has been upsetting its customers in Europe and the US. The Sunday Times recently reported on customers in the UK complaining they were having difficulty getting their funds out of the exchange. Since then, Coinbase has announced it has secured Barclays to provide banking services.

The situation in the US, where Coinbase has access to banking facilities, is not much better though.

Withdrawal delays and other problems at the exchange have seen complaints mushroom, according to research by ValuePenguin. It looked at 2,271 complaints logged with US consumer protection agency, the Consumer Financial Protection Bureau, and found that 40% of customers complained that money was not available when promised.

The complaints arose from the high transaction volumes and customers trying to get money out when the market started to fall in late December, overwhelming the exchange's customer support resource.

Crypto's "Flash Boys"

In a sign of how crypto is attracting seasoned financial professionals and the market is maturing, a group of traders, technologists and senior executives, formerly from some of America's major financial institutions, are planning to launch a futures exchange and clearing house for both cryptocurrencies and traditional futures contracts. Called the EverMarkets Exchange, it hopes to one day rival the likes of the CME and Euronext. Participants will be able to post collateral, pay fees and settle futures with crypto, with positions held in smart contracts on blockchain.

Jim Bai, chief executive and co-founder of EverMarkets, a former trader at Citigroup, said: "EverMarkets is designed to bridge and modernize both the cryptocurrency and traditional financial markets. Coupling the power of blockchain technology with our market expertise, this exchange strives to create a marketplace that is fair for everyone and provides superior transparency and efficiency."

Bai hopes the exchange will help to decrease volatility and make price discovery fairer for all traders, and is seeking a licence from US futures regulator, the Commodity Futures Trading Commission.

The people behind the launch have been likened to the figures featured in Michael Lewis's book Flash Boys, which looked at the activities of high-frequency traders on Wall Street.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks