Income ideas: Where to find inflation-beating 5% plus yields

5th April 2018 10:42

by Kyle Caldwell from interactive investor

Share on

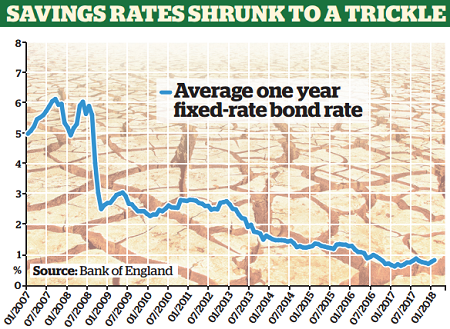

Before the financial crisis of 2008 and the era of loose monetary policy that hit our shores thereafter, returns in excess of 5% could be procured by simply handing over savings to a high street lender.

These days are long gone, as over the past decade banks and building societies have cut rates to the bone; that's reflected in the chart below, which shows how the average one-year fixed-rate bond rate has fallen over the years to below 1% today.

Rate cuts came thick and fast following the Bank of England's (BOE's) move to lower the cost of borrowing to historic lows. In a further blow to savers, the BOE stifled competition by offering banks cheap money via its Funding for Lending Scheme (FLS), which began in 2012.

As a result, banks' appetite for savers' money waned; it all culminated in rates hitting all-time lows in the summer of 2016, after the base rate was cut to 0.25% in the wake of the Brexit vote.

Nearly two years on, the landscape has improved, with Moneyfacts, the data firm, noting that interest rates across the savings market have risen for 13 consecutive months.

Competition has returned, thanks to the rise of the challenger banks, while the savings market in general has been given a much-needed boost by the odds shortening on another interest rate rise or two taking place in the coming year.

In addition, the FLS 'cheap money' tap was turned off at the end of February, so in theory traditional banks will once more be looking to savers for the funds they need to lend to borrowers.

But despite the brighter picture, the reality is that for the foreseeable future, savings rates will remain well below the yield that can be procured on the stockmarket.

The index, for example, yielded 4% at the start of March, whereas the best-paying cash ISA was offering 1.4%.

This gap will likely narrow in the next couple of years, but in the continued 'lower for longer' environment the stockmarket route will continue to offer richer income pickings.

The dilemma facing those entering the stockmarket in search of income today, however, is a question of timing, as various types of investments have enjoyed a strong run since the financial crisis.

As a result, although high starter yields of 5 to 7% can still be found, there's less choice on offer.

According to Gary Potter, co-head of the multimanager team at BMO Global Asset Management, investors looking to construct a high-income portfolio through funds need to cast their nets far and wide.

He adds that the last thing income-seekers want to see is their capital "fluctuate wildly in value".

That's a predicament facing investors today, due to the risk of overpaying for an asset following the strong run enjoyed by bond and equity markets since the financial crisis.

Source: Bank of England Past performance is not a guide to future performance

Funds paying 5% or more

Therefore, to achieve a higher starter yield of 5% or more, investors need to be willing to stomach higher levels of risk.

In the fixed income market, high-yield bond funds and emerging market debt funds are the two main options.

High yield looks 'well-supported' at present, according to John Husselbee, who runs a number of multi-asset funds for Liontrust.

"In the current climate of synchronised global economic growth, the backdrop for high yield is positive," says Husselbee.

He picks out (5.5% yield) and (5.4%) as two options.

According to Husselbee, the 'three Cs' are key to short-term market sentiment: China, commodities and central banks. The longer-term outlook, he adds, will be shaped by the 'three Ds': debt, deficits and demographics.

"As things stand today, a downturn or recession is not on the cards. If this was the case high yield would not be an attractive place to be [because of the greater risk of default attached to such bonds], but in a period of higher growth high yield looks well-supported."

Emerging market debt is also on the risky end of the fixed-income spectrum. But in order to compensate investors, higher yields are available. One fund in particular that stands out is the , which has a yield of 5.3%.

As a general rule, interest rate rises in the US are a headwind as they make emerging market debt more expensive to service for bonds that are dollar-denominated.

It should be pointed out that these days more and more emerging bonds are issued in local currency and this should provide some protection from interest rate rises in the US, which are likely to take place in 2018.

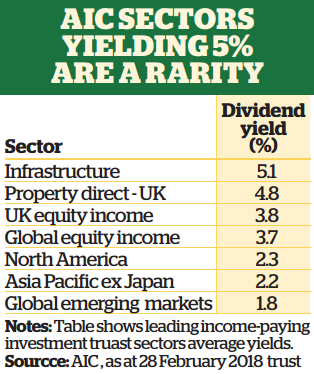

In the case of equity funds there's a shortage of choice on offer for investors seeking yields of 5% plus. As the table below shows, the vast majority of conventional equity and bond fund sectors yield less than 4% - a consequence of strong capital performance, which has reduced yields. The only option available is to buy one of the handful of specialist income funds, which use a special technique that involves selling derivatives to other investors in order to boost the income produced.

Source: AIC Past performance is not a guide to future performance

Capital growth is therefore sacrificed, so when stockmarkets are riding high don't expect these funds to keep up. Equally, in extreme periods when stockmarket volatility reigns, these funds are never going to top the capital preservation league tables.

Husselbee favours Insight Equity Income Booster (6.9% yield) and (5.5%), in addition, others have favoured (6.9%) and (6.8%).

At a time when there's a shortage of bargains, it is arguably even more important than usual to be diversified in terms of asset type and not focus solely on the equity or bond markets.

Alternative sources of income are where value can be found, says Potter, with yields of 5% plus on offer. He runs various funds including the , yielding 4.7%, and has a 20% weighting to alternative funds, which he says provide an 'income kicker'.

Infrastructure and property

A variety of income sources reduces risk by ensuring there's not an over-reliance on one type of asset. "The diversification provides the airbags. The more airbags you've got on a car, the more likely you are to survive a crash," says Potter. He names infrastructure and property as the two main areas that are 'uncorrelated' with the up-and-down fortunes of equity markets.

He owns , an investment trust yielding 6.4%, and , yielding 5.7%. Both invest in government-backed assets, but the high yields on offer come at a cost, as the premiums are pricey at 7.6% and 5.8% respectively (to 15 March).

Other more obscure ways to achieve a high yield are available, but the risks are even higher. Adrian Lowcock, of fund manager Architas, says that investors need to be careful not to be seduced by a high yield that may ultimately prove to be a value trap.

He adds: "A high yield suggests a higher level of risk, as you are being compensated for taking more risk with a higher income. The higher yield could mean that a dividend is unsustainable and likely be cut. Long-term success in investing for income involves being able to buy funds or companies with a low but growing yield, as this supports the share price of the company as the profits and dividends grow."

Richard Stammers of European Wealth, a wealth manager, argues that taking a total return approach is logical, with higher-yield investments being satellite holdings as opposed to the core of a portfolio. He adds: "The reality is that at this point in the cycle, those who want high income have to move up the risk scale in order to get it."

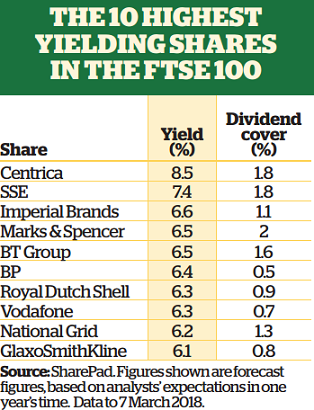

When looking for individual shares with high yields, care needs to be taken, as promises of high income very rarely come without a catch. Instead, a high yield typically reflects the fact that a stock is out of favour, and due to the share price falling the yield (dividend as a percentage of current share price) has risen.

Therefore, investors risk 'catching a falling knife' by buying a high-yielding share that goes on to tank - a so-called value trap. A year ago, for example, Carillion was one of the highest-yielding shares in the FTSE 100, but it entered liquidation earlier this year after bucking under the weight of a huge debt pile.

Is the dividend sustainable?

The question direct equity investors need to ask themselves is whether the dividend is sustainable.

When searching for the answer, the first port of call is the dividend cover score, which is calculated by dividing earnings per share by the dividend per share. As a rule of thumb, a low dividend cover score - around 1.5 or lower - suggests dividends are vulnerable, as the company is using most if not all of its profits to fund the dividend.

A figure of two or more is viewed as comfortable because it is a sign the business is not over-distributing. Dividend cover of less than one indicates a company is having to borrow to pay dividends. Those firms that do hand back more cash than they can afford risk damaging their longer-term growth prospects through lack of investment in the business.

Source: SharePad Past performance is not a guide to future performance

Our table, above, lists 10 shares in the FTSE 100 that have a forecast dividend yield of 6% or more.

Four of the shares have a dividend cover score of below one: , , and . "Also consider whether the dividend is covered through company savings (retained earnings), the dividend history and what is the outlook for the business like. Then it is a case of weighing up whether the dividend likely to grow," adds Lowcock.

He says high-yielding shares that look relatively well-placed to pay dividends include BP, and Vodafone, despite dividend cover looking questionable in all three cases.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.