Positive returns 81% of the time since 1970 for stockmarket in April

6th April 2018 11:01

by Stephen Eckett from ii contributor

Share on

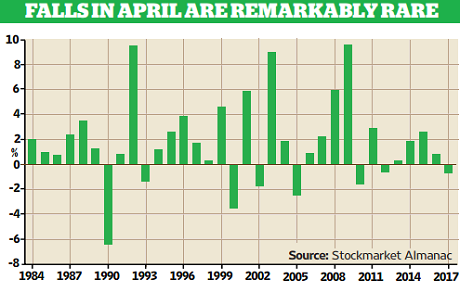

Since 1970 the has fallen in April in just nine years. This is quite remarkable and, not surprisingly, makes April the strongest month of the year for equities. The average return for the index in the month since 1970 is 2.6%. This is the best performance of any month of the year by quite a margin.

However, in recent years the market's performance in April has been less stellar. Since 2000 the average return in the FTSE All-Share index in April has been 1.8%, with positive monthly returns seen in 12 of the past 18 years. Note that the market actually fell in April of last year. The market often gets off to a strong start in the month. The first trading day of April is the second-strongest first trading day of all months in the year.

The market often gets off to a strong start in the month. The first trading day of April is the second-strongest first trading day of all months in the year. The market then tends to be fairly flat for the middle two weeks and then rise strongly in the final week.

Source: Stockmarket Almanac Past performance is not a guide to future performance

Investors need to make the most of April, however, as in the following month the market enters a six-month period when equities tend to tread water (the 'sell in May' effect).

April is the strongest month for the relative to the S&P 500 (in sterling terms). The former outperforms the latter by an average of 1.3 percentage points in April. The UK index has outperformed the US index (in sterling terms) in April in 14 of the past 16 years.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.