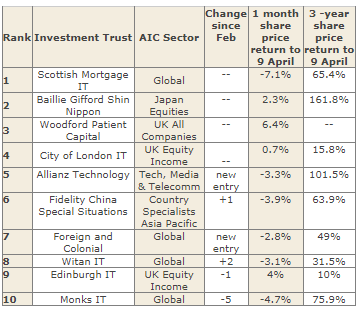

Top 10 investment trusts - March 2018

12th April 2018 10:00

by Tom Bailey from interactive investor

Share on

This past month has been a roller coaster for stockmarkets. However, despite a few changes, the most commonly bought investments hardly changed between February and March.

The market downturn appears to have weighed slightly on , with its discount falling to 1.32%, compared to its 12-month average premium of 1.73%. At the same time, its one month return share price return was -7.1%. Despite this, Scottish Mortgage remained the most popular fund to buy - a position it has held for around a year now.

also kept its position in second place, despite a weakening of investment sentiment towards Japan in recent weeks. Principally, a more protectionist US has spooked some investors. However, while Shin Nippon's share price took a slight dip in March, it has now since recovered, providing a one month share price return of 2.3%.

Catching the eye of investors is its storming long-term returns: as of 9 April its three-year return sat at 162%. At the same time, it's sister fund, , fell out of the rankings in March.

kept its position in third place and has seen a general uptick in performance after a tough couple of years. The trust has been able to provide a one month return of 6.4%. The trust, however, remains on a steep 8.43% discount, still below its 12-month average 6.1%. Its one-year performance remains deeply in the red at -10%.

, known for its cautious approach, also managed to weather recent market upsets. The trust managed a positive, albeit small, one month return of 0.7%.

This month was a new addition to the rankings. Based in Silicon Valley and run by Walter Price, the trust is, as the name suggests, tech-focused. Its largest holdings include many of the big names, including (7.3%), (4.6%) and (3.4%).

Unsurprisingly, the recent falls in tech share prices have hit the trust's performance, with it providing negative 1-month returns of -3.3%. However, although many investors have soured on big tech shares, Allianz Technology Trust appears to increasingly popular among investors. The trust is on a discount of 0.28%, narrower than its 12-month average of 3.51%. With a three-year return of 101.5%, that's not surprising.

Meanwhile, the appeal of was seemingly unhurt the prospect of China-US trade war. Despite a general slip in Chinese equities, and a one month performance of -3.9%, the trust rose up the rankings by one place.

Vietnam-focused has fallen out of the rankings. The fund appears to have had a surge of popularity around the end 2017 and start of 2018. Since then, its performance has spluttered, with its share price still, as of 9 April, down by nearly 6% and its discount at a huge 21.83% (its 12-month average discount stands at 18.41%).

Another new edition to the rankings was . The oldest investment trust in the world, it recently celebrated its 150-year anniversary. This resulted in an increase in positive coverage, perhaps part the reason for its surge in popularity among investors.

Source: interactive investor Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.