Our Winter Portfolios still ahead as strategy nears end

13th April 2018 17:30

by Lee Wild from interactive investor

Share on

There's no getting away from it, despite a promising start March ended up being another grim month for stockmarkets. Leading UK indices dived to levels not seen since late 2016 and only managed a partial recovery by month-end.

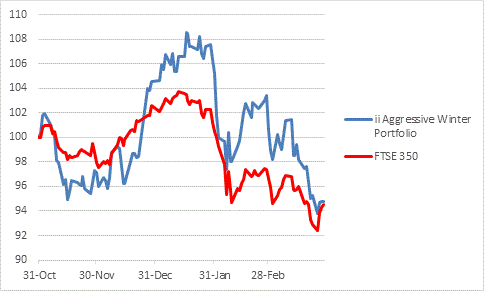

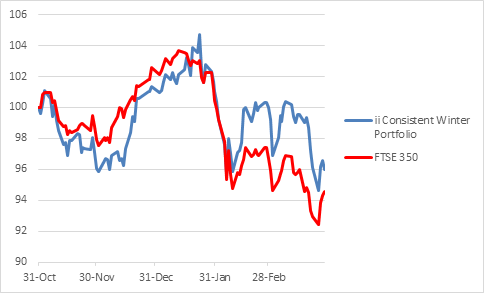

That's clearly not great news for our pair of winter portfolios, which lost ground over the period. However, despite the wider market suffering significant falls every month this calendar year, our portfolios are still beating the benchmark index over the first five months of this six-month strategy. Add in dividends earned, and the margin of outperformance is greater still.

What's more, April is historically the second most profitable month for equities, according to the Stock Market Almanac, returning on average 2.1%. That should spell better news for many stocks in our portfolios which are higher beta, so should outperform in rising markets.

Remember, statistics form the basis of both interactive investor's winter portfolios. Historic data proves that equity markets typically outperform over the six winter months from November to April. With help from Stock Market Almanac author and mathematician Stephen Eckett, we identified the stocks with the best track record of returns over the past 10 winters.

Our so-called Consistent Winter Portfolio contains the five most reliable companies of the past decade - each has risen at least 90% of the time. To make our Aggressive Winter Portfolio, stocks must have a 70% success rate over the winter months.

Our reliable basket of shares has netted an average annual profit of 18% over the past 10 years versus just 3.5% for the FTSE 350 index. There's more risk in the aggressive portfolio, but average annual profit here has been 32%, almost 10 times the benchmark index.

Miserable March

Donald Trump is rarely far away from the action, and it was a trade spat with China that undermined confidence last month. But tit for tat tariffs have not yet escalated into a full-blown trade war, and China has appeared more conciliatory in recent days. Optimism came too late for the March performance data, however.

Both the and FTSE 350 benchmark index fell heavily in March, down 2.2% to 6,866 and 3,842 respectively.

Selling did most damage to our Aggressive Winter Portfolio, which lost 5.8% of its value over one month. A 12% decline at and 8% drop at were the culprits. The Consistent Winter Portfolio fell 4%, torpedoed by the former star performer .

With one month of the winter strategy to go, the benchmark FTSE 350 index if down 5.5% compared with a 4% decline for our consistent basket of shares. The aggressive portfolio is down 5.2%.

Aggressive Winter Portfolio

Source: interactive investor Past performance is not a guide to future performance

High street fashion chain JD Sports has been a reliable performer in previous winter strategies and was up 10% at one stage briefly this February. But it fell over 12% last month after paying almost £400 million for US rival Finish Line.

Equipment rental giant Ashtead has enjoyed double-digit gains for the portfolio this season, but March was a toughie despite decent third-quarter results. The shares remain good value and the business should benefit from Trumps tax cuts.

Builders' merchant has been a disappointment for a number of months, so further weakness in a difficult period for markets was no surprise. Workspace provider was down in line with the market and remains up 6% for the strategy. High-yielding housebuilder did best last month, down less than 1%.

Consistent Winter Portfolio

Source: interactive investor Past performance is not a guide to future performance

InterContinental Hotels Group has been a great stock for our consistent portfolio, trading up almost 13% in the past few months. But March was poor, and the hotels giant fell 9%.

Caterer ended March 6% lighter and down 12% over the five months, while high-flying heat treatment specialist gave back 3%. Speciality chemicals firm and serial outperformer outperformed the market in March, down only 1.2%, which leaves just one stock to cover.

In a classic case of 'best till last', Irish building materials firm was the only constituent in either portfolio to register gains last month. The shares added 0.3% as full-year results at the start of the month came in as expected. There's still a lot to do to if it's to break even by the end of April, but it remains a solid company with great prospects.

Stephen Eckett

Stephen Eckett started his career with Baring Securities and then later worked for Bankers Trust and SG Warburg, during which time he worked in London, Hong Kong and Tokyo. After settling in France, he co-founded Harriman House which has become a leading independent publisher of financial books in the UK. He also writes books on finance including, most recently, the Harriman Stock Market Almanac.

-------------------------------------------------------------------------------------------------------------------------------------------

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.