What are the odds of an interest rate rise in May?

24th April 2018 09:44

by Tom Bailey from interactive investor

Share on

Inflation fell below expectations in March, throwing doubt on whether the Bank of England will raise interest rates next month.

The Consumer Price Index (CPI) for March fell to 2.5%, down from 2.7% in February, while the Consumer Prices Index including owner occupiers' housing costs (CPIH) fell to 2.3% in March, down from 2.5% in February. The CPIH measure of inflation is now at its lowest level since last March.

According to the Office for National Statistics changes in the price of goods and clothing had the biggest downward effect on the rate of inflation, principally for women's clothing.

At the same time, notes Pantheon Macreconomics, the decline in inflation represents a passing of the UK economy's post-referendum import inflation.

"The fall in inflation primarily reflected a decline in core goods inflation to 1.9%, from 2.4%, which subtracted 0.20 percentage points from the headline rate," they note.

While noting the role of clothing costs to reducing inflation, the economics research firm added that at the same time "other components of core goods inflation also declined, suggesting that retailers as a whole have largely finished passing on higher import prices to consumers."

The March CPI rate of 2.5% was way below the BoE's forecast of 2.8%.

Opinion, however, is divided on whether this will force the BoE to delay raising rates in May.

According to Philip Smeaton, chief investment officer at Sanlam UK, the latest inflation figures show "the squeeze on living is easing." In addition, data released yesterday, showed that weekly average earnings had started to outpace inflation.

"These positive signs of a strengthening economy could be all the BoE needs to pull the interest rate lever in May - moving policy back towards monetary normalisation," says Smeaton.

In contrast, Pantheon Macroeconomics argues that inflation undershooting BoE forecasts "suggests that investors have concluded too hastily that a May rate hike is a done deal." It adds the decline in inflation reduces the BoE's need to raise rates more than once this year.

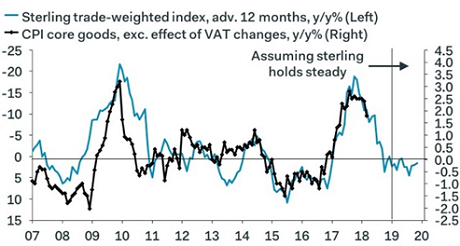

Pantheon Macroeconomics expects CPI inflation to continue to fall sharply towards 2% later this year. In addition, as Pantheon Macroeconomics' chart below shows, past movements in sterling suggest that core goods inflation will continue fall this year. This undermines the case for the BoE raising rates.

Whether a rate rise comes in May or later this year, however, it is unlikely to offer much help to savers feeling the pinch of inflation - even if it does continue to fall.

Source: Pantheon Macroeconomics Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.