Five stocks in the dividend danger zone

25th April 2018 09:57

by Kyle Caldwell from interactive investor

Share on

A new stock has entered our dividend watch screen, offering a forecast dividend yield of 6.5%.

provides fixed-line, broadband and mobile communications services on the Isle of Man. It is a leading player, but has recently been dealt a blow after failing to land a contract to supply the Isle of Man government with mobile telephony services.

Simon McGarry, of Cannacord Genuity Wealth Management, explains: "The Isle of Man government has a vested interest in Manx's success (80% share of the Isle of Man broadband market) in order to help them deliver the social benefits of better broadband connectivity.

"However, in late 2017, the Isle of Man government opted for their main competitor Sure instead of Manx to supply the government with mobile telephony services. As a result, Manx lost roughly a fifth of its post-pay revenues. Pricing also remains more challenging with Manx having limited ability to continue to raise fixed line prices."

The share price, though, has been steady, holding up at around 190 pence per share year-to-date. In addition, the business is viewed as highly cash generative by analysts. It also boosted its dividend last month, despite revenue falling 2.9% year-on-year.

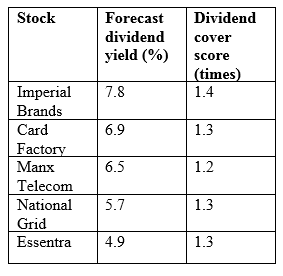

The four other names our dividend danger zone screen has concerns about are: , , and .

Source: interactive investor Past performance is not a guide to future performance

The dividend danger zone screen screens UK shares on the following basis: a market cap of over £200 million, a dividend yield of 4% (higher than the average) and a dividend cover score of below 1.4 times. Two other filters have also been applied: the first filters out companies that appear in a financially sound position to pay off their debts, while the second excludes firms where earnings have been upgraded by analysts.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.