Woodford Patient Capital: The full report

24th April 2018 16:55

by Graeme Evans from interactive investor

Share on

On a day of more negative headlines for Neil Woodford, the fund manager has sought to reassure shareholders in that the investment case remains "compelling" despite recent disappointments.

He told them: "Patience has been required to get to this stage and it remains a prerequisite for investing in this part of the asset class."

Woodford added that there were many businesses in the portfolio with the potential to become multi-billion dollar companies in the next five years.

The trust, which launched three years ago with a focus on long-term capital growth through quoted and unquoted companies, revealed in its annual report that net asset value (NAV) declined 2% alongside a 7.2% share price fall in 2017.

• Neil Woodford interview: Your questions answered

• Woodford Patient Capital rally comes to painful end

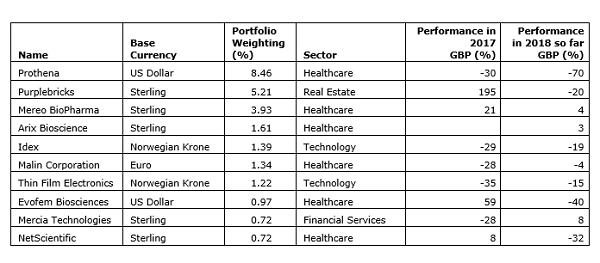

An upturn in fortunes followed in 2018, until this week's disastrous update from Irish biotech firm , which is the second biggest holding in the trust.

The blow for Prothena, which fell by as much as 70% on US markets, came after the Nasdaq-listed firm said that Pronto, the most advanced drug in its pipeline, had been discontinued after it failed two medical trials.

Woodford vowed to retain the holding and said the company was a much broader business than just its lead drug, with "multiple shots on goal" and a technology platform that is extremely valuable.

He added that Prothena's performance should not overshadow the progress that many of the portfolio companies have made.

Source: Morningstar Past performance is not a guide to future performance

Woodford pointed to Benevolent AI, the London-based start-up using artificial intelligence to discover new drugs, which announced last week that it received US$115 million in additional funding from new and existing investors.

This will enable it to hire more people and expand its focus to new diseases. This new investment now values the business at just over $2 billion.

Oxford Nanopore, which is the largest investment in the portfolio, is now valued at $1.5 billion after the DNA sequencing business completed a further £100 million fundraising.

More than half the portfolio is focused on healthcare, with other investments in the sector including stockmarket listed , whose shares grew by 21% in 2017 and by 4% in the current year to date.

Around 60% of the portfolio is in the early stages of growth, although those showing more maturity include online estate agent .

Its shares trebled in 2017, contributing 6.57% to the overall performance of the portfolio, having grown its number of local property experts to 650 last year. In March this year, it received a strategic investment from one of Europe's leading digital publishers, Axel Springer, but the stock has still slumped 20% in 2018.

Also, since the year end, the trust saw the exits of and AJ Bell, having generated rates of return for shareholders of 24% and 17% respectively.

With 68% of the portfolio invested in unquoted securities, the net asset value (NAV) tends to lag business progress as the valuations of unlisted companies will only be revised on milestone events such as a fundraising round or IPO announcement.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.