Why Royal Dutch Shell's a 'buy' after Q1 results

26th April 2018 12:33

by Graeme Evans from interactive investor

Share on

Away from the usual headlines about the earnings boost from rising oil prices, a deeper drill into today's first quarter results have revealed a few areas of disappointment for shareholders.

Expectations were already high going into these results, given that shares had risen 15% since mid-March. Oil analysts have been predicting that 2018 could represent a sweet spot for Shell and its rivals, having been through the pain of resetting their financial models in order to cope with an era of lower oil prices.

Now those prices are at much more attractive levels, with Brent crude trading well above the point of cash neutrality for oil majors. According to Shell today, the average Brent price in the quarter was around $67 a barrel.

This resulted in Shell achieving overall earnings of $5.32 billion (£3.8 billion), slightly above the consensus after a very good performance in Integrated Gas. Earnings from this division -now home to BG Group's LNG and exploration and extraction activities - more than doubled to $2.44 billion on higher prices.

So far so good, it seems. However, this strong result in gas covered up misses elsewhere in the business, with first quarter profit at upstream - exploration and production - of $1.55 billion much weaker than the $1.89 billion forecast by analysts.

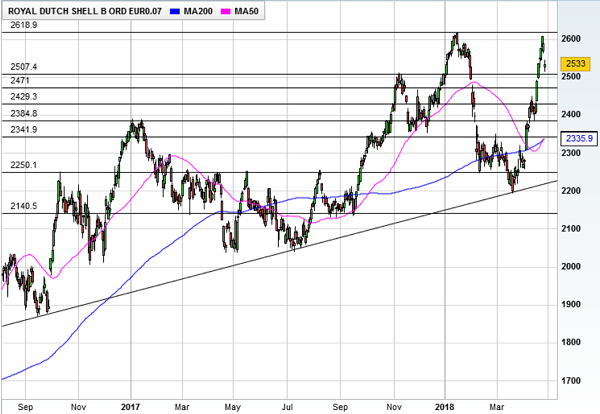

Source: interactive investor Past performance is not a guide to future performance

Downstream - refining - earnings of $1.69 billion were also below hopes, reflecting less favourable refining market conditions and lower contributions from trading activities. Refinery availability is also expected to decrease in the second quarter, compared with a year earlier, due to the impact of higher maintenance.

Aside from the mixed trading performance, cash flow from operations was also weaker than forecast, with Shell reporting a figure of $9.43 billion, against a forecast by UBS for $11.1 billion. The bank's analysts said this may have been caused by taxes paid and timing differences.

However, free cash flow of $5.2 billion is still sufficient to cover interest and the company's first cash dividend since a decision to cancel the scrip programme in November. Today's Q1 dividend of $0.47 a share and future pay-outs will be entirely in cash, rather than the company offering a share-based alternative.

Shell said the free cash flow performance was consistent with its intent to buy back at least $25 billion of shares over the period 2018-2020.

It also pledged to maintain financial discipline, with capital investment being in the lower part of the forecast range of between $25 billion and $30 billion in 2018.

Since 2016, Shell has completed $26 billion of divestments, with a further $6 billion either announced or well advanced. This will help reduce borrowings stemming from the BG acquisition, although UBS noted that net debt of $66.1 billion was still higher than its own estimates for $62.6 billion.

Despite disappointing elements in today's results, UBS continues to back the Anglo-Dutch company with a 'buy' rating and price target of 2,675p. Its valuation is based on a potential 2019 dividend yield of 5.3% and a 2019 free cash flow yield (at a forecast oil price of $65 a barrel) of 9.1%.

UBS has previously estimated that cash returned to shareholders across the industry could rise by 48% in 2018.

As one of its two top picks in the sector, UBS thinks that Shell will be at the forefront of these trends as the company reaps the rewards from its acquisition of BG. The deal attracted plenty of criticism when it was announced in 2015, but is proving the catalyst for the wider restructuring of the group.

Shell is also investing heavily in opportunities to reposition the business for a transition to a low-carbon world. It is focusing on new fuels for transport, such as advanced biofuels, hydrogen and charging for electric vehicles, while in power it is looking towards wind and solar as well as natural gas.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.