How these investment trust portfolios beat their benchmarks

30th April 2018 12:37

by Fiona Hamilton from interactive investor

Share on

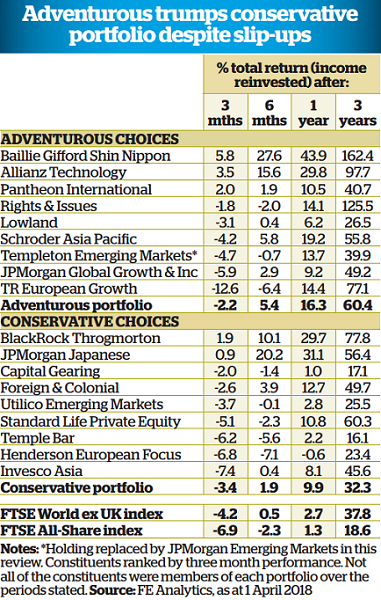

It is a relief that our trust portfolios held up better than both the FTSE World ex UK index and the over the first quarter of the year. , and provided buoyancy for the adventurous portfolio, while the conservative portfolio saw gains from and UK smaller company specialist .

It is disappointing that Mike Prentis, having done an excellent job managing THRG's long-only equity portfolio, has handed over management responsibility to Dan Whitestone. That said, Whitestone has done well with THRG's contracts for difference portfolio, so putting him in control should make it easier to vary market exposure and take short positions through CFDs, which is the trust's unique selling point.

More positively, THRG's flexibility has been increased by removing the limit on its exposure to AIM-listed shares. It can now invest up to 15% in non-UK shares and adjust its charges marginally for the better. We are keeping our holding.

We are also staying loyal to . It was the worst performer among our holdings, as the replacement of its premium rating with a 6% discount turned a 5.5% fall in its net asset value (NAV) per share into a 12.6% plunge in its share price. However, the trust's longer-term returns under manager Ollie Beckett are impressive. The discount is now above average for the European smaller companies sector.

The resignation of Carlos Hardenburg as manager of is more disturbing. We are therefore replacing TEM in our adventurous portfolio with , which trades on a similar double-digit discount, despite having achieved the best three -, five - and 10-year NAV total returns of any global emerging markets trust.

Manager Austin Forey has benefited from the expansion of JPM's emerging markets team recently. He favours a concentrated portfolio of quality growth stocks, which he expects to hold for at least five years. He was cautious about the outlook before the March correction, but he thinks a setback could provide interesting buying opportunities.

Source: FE Analytics Past performance is not a guide to future performance

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.