Hollywood Bowl close to joining exclusive club

4th June 2018 17:15

by Richard Beddard from interactive investor

Share on

Meeting targets in 2018

By the end of the half-year to March 2018, Hollywood Bowl Group had already met its target to open two new centres a year by adding Dagenham and Yeovil, taking the total to 59, spread around the country. It's added Swindon and Southend to its pipeline of future centres, refurbished three old ones, and expects to refurbish at least four more by the end of the financial year in September.

Innovative IT, trained and motivated centre managers, and well situated alleys have increased the number of games people play and allowed the company to charge more for them.

A slick operator since it floated in September 2016, perhaps Hollywood Bowl could be a good long-term investment.

Profitability transformed

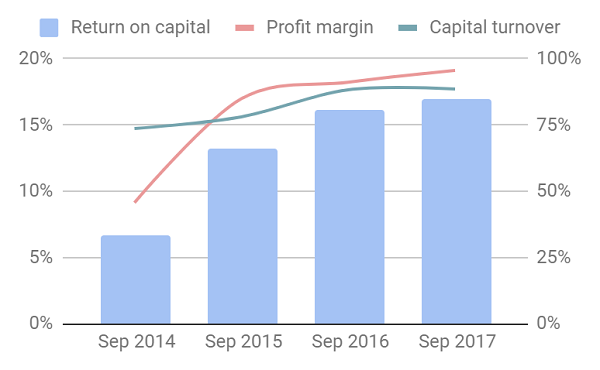

As usual with recent flotations, I can't scrape enough data to satisfy me the business is highly profitable through thick and thin. The chart uses figures calculated from the company's annual reports for the two most recent years and from its prospectus, the document published during the flotation, for the previous two.

Source: interactive investor Past performance is not a guide to future performance

It shows rapid improvement in profitability prior to the flotation, to very attractive levels, but the big question is, can Hollywood Bowl continue to increase, or at least sustain profitability?

The improvement has partly been driven by what the company describes as a “widely reported and notable” shift in consumer behavior, from spending money on things to spending money on experiences. I'm not sure why we've reached “peak stuff”, but the trend is real.

Even within the subset of companies I follow, I see it. At Churchill China, which makes tableware for restaurants (things used in an experience), business has been booming. Next, which sells things, clothes mainly, is experiencing unaccustomed pressure on profitability.

Getting better, and a little bigger...

Profitability has also improved because of changes in the tenpin bowling industry, and at Hollywood Bowl.

The industry is consolidating. In 2010, Hollywood Bowl was spun out of Mitchells & Butlers and merged with AMF. Since then it has opened 16 new centres, and in 2015 it acquired Bowlplex, a third operator, and 11 more centres.

Hollywood Bowl emerged onto the stockmarket as market leader with the majority of its sites in prime locations. It's shifted its emphasis to families, spruced up the centres and deployed IT, including a scoring system that is easier to use and nags customers by email to return and beat their score, dynamic pricing like the airlines, and a pinsetter dubbed 'Pins on Strings' which improves reliability and reduces maintenance costs.

Newly refurbished centres receive these innovations plus virtual reality amusements, VIP lanes featuring action replays, new signage, an upgraded bar, and an American themed 'Hollywood Diner' menu. The company makes impressive returns on its investment in refurbishment, but the benefits wear off. After seven years or so, the refurbished centres will need refurbishing again.

Although Hollywood Bowl believes the UK has far fewer bowling alleys than the population can support, it's quite cautious about opening new centres. It's fussy about location, preferring to co-locate with high profile cinemas and restaurants, and strike deals with developers it already rents space from, like Intu Properties. In the year to September 2017 Hollywood Bowl opened a centre at Intu Derby, a shopping centre, and at the year end it had three more Intu locations in its pipeline.

As well as improving the centres and opening new ones, Hollywood Bowl may acquire centres from other operators and inject its own branding and operating systems.

Debt, and uncertainty

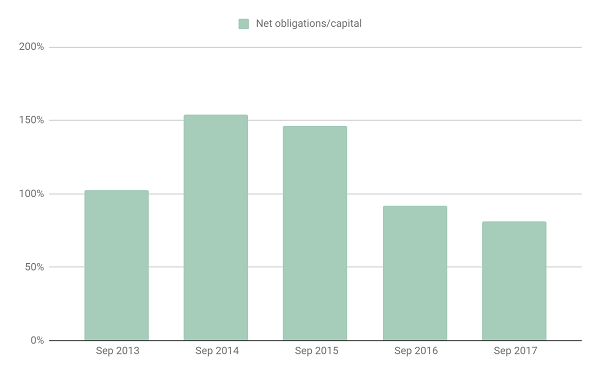

Net debt has fallen a bit since the end of the full-year and almost halved compared to the first half of the financial year ending in March 2017, but borrowings are only a small part of Hollywood Bowl's financing.

Source: interactive investor Past performance is not a guide to future performance

Adding the capitalised value of operating leases to the company's net debt reveals it's mostly financed by landlords. Rent won't be a problem unless profitability in cash terms falls drastically, and the company is sufficiently confident in cash-flow it thinks it could borrow considerably more.

Unfortunately we can't look back and see how it has fared in the past to gain more confidence. It worries me slightly that although the tenpin bowling industry has been growing for the last four years, there are still slightly fewer alleys in the UK than there were a decade ago.

I think the industry is emerging from a period of underinvestment so the gains from acquiring and refurbishing centres are particularly impressive. Over the longer-term, I wonder whether refurbishments will produce such returns and I wonder how resilient profitability would be in a recession, or if our propensity to spend on experiences, rather than things, reverses.

Good for some.

Hollywood Bowl's annual reports present a good impression of management. They're concerned about customers, staff, suppliers and shareholders.

There's a Q&A with Stephen Burns, who joined the company as business development director in 2011, became managing director in 2012, and chief executive in 2014. Burns says that not having the right centre managers is his biggest concern.

The annual report repeatedly describes staff as a "key focus" and "the face of our business". It's easy for companies to say things like this (though not all of them do), but Hollywood Bowl says it enough times for me to believe.

One of the company's key performance indicators is the number of management positions filled internally, 52 in 2017, up from 47 in 2016, and 12 in 2015. It says it spends £130 per head on training and development, which doesn't sound like much, but at least it's counting. The company runs programmes for promotion at every level, and says it gives centre managers the autonomy to "run their own business". It's launched a share scheme, which is open to all staff.

While I like what it says, the board's pay is pretty typical (by which I mean high by most standards except those of other highly paid boards), and the prospectus reveals 70% of staff were on the minimum wage in 2016. Flicking through Hollywood Bowl's page on Glassdoor.com, a company that publishes employee reviews, reveals that centre managers and assistants generally love the working there.

Staff in the alleys and restaurants are more conflicted about long working hours, antisocial shifts, and low pay.

Is it a strike, is it a spare, or is it bed posts?

As usual I score each category from 0 to 2 except valuation, which is scored from -2 to 2:

[1/2] How well does it makes money?

Hollywood Bowl is highly profitable. It may well remain so through thick and thin, but I can't show it has been highly profitable in the past.

[2/2] How will it make more money?

The company's strategy is straightforward and already working. It's getting better, and bigger, but the easy gains have probably already been won.

[1/2] What could go wrong?

Profitability might vary more than the company lets on. In a recession, families will have less money to spend. We may go back to buying more things.

[2/2] Will all stakeholders benefit?

Although I'd rather management showed more pay restraint, and the business relied less on paying the minimum wage, I think it has the right instincts.

[0/2] Are the shares inexpensive?

Not really, they trade at 21 times profit, adjusted for debt.

It's bed posts. A total of [6/10] means Hollywood Bowl is a near miss.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.