Low to medium-risk investment routes to income

3rd May 2013 16:43

by Faith Glasgow from interactive investor

Share on

Just like the so-called "spring" of 2013, the UK's economic recovery is proving an elusive beast, increasingly irritating by its continued absence: growth has apparently been nipped in the bud and the base rate seems set to remain frozen at its current low point for the foreseeable future.

Against that depressing backdrop, it's unsurprising that investment income has become such a mainstream buzzword. Those approaching or already in retirement have never had greater need of additional investment payouts to supplement their pension income, in the face of continuing suppressed annuity rates and disappointing pension fund performance.

Such demand will grow over coming years too, as retiring baby-boomers inflate the income-seeking population in the developed world. At the same time, dividend reinvestment has become a key element of total returns for investors who don't currently need an income stream.

Historically, income-seeking retirees have been directed firmly towards the risk-averse end of the investment spectrum, but the financial crisis has shifted the goalposts. It is misleading to define any investment as risk-free, given the negative real return on most cash accounts and government gilts. Right across the spectrum, income-seekers are having to accept more short-term risk to their capital if they need decent returns.

Increasingly, they also need to think laterally about income generation. Jackie Beard, director of research at Morningstar, emphasises that it's important to look beyond funds with the word "income" in their name: "There are more sources of income than those specifically labelled [as such]," she says. Another approach is to focus on the combination of income and capital growth, drawing a sustainable payout from that pot of total returns rather than fixating on income per se.

So where should you look? Below, we round up some ideas for lower-risk profiles.

Investors looking for a higher level of risk can find ideas in:Medium to high-risk investment routes to income.

LOW RISK

Cash

Before the days of bank collapses and minimal interest rates, cash was the obvious safe haven for risk-averse investors. But those days are gone, and those who hold cash must accept the risks that now come with it.

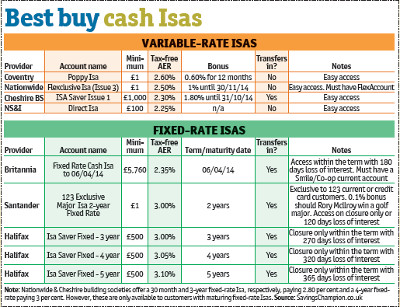

"One-year best-buy fixed-rate ISA [rates] are now more than 35% lower than they were this time last year (at 2.25 rather than 3.5%), and two-year rates are down 30%," says Sue Hannums, co-founder of SavingsChampion.co.uk.

That fall is a reflection of the government's Funding for Lending scheme, which makes ultra-cheap funding available for banks to boost mortgage and business lending. "The FLS has been a disaster for savers," Hannums adds. "The appetite for providers to raise money to lend by offering competitive interest rates has all but dried up, which has left savers floundering for decent returns."

In particular, the many ISA investors looking for a new home for their maturing fixed-rate bonds will have to accept a painful drop in available rates (unless they are with the Nationwide or Cheshire building societies - see note in cash ISA table above).

After tax, no taxable easy access or fixed-rate accounts keep pace with inflation at 2.8%, so cash ISAs remain the key tool for committed cash savers, including non-taxpayers. But only a few widely accessible accounts match or outpace inflation, with a few others offering restricted access to existing customers only. The best rate, 3.1% from the Halifax, is a five-year bond, introducing the additional risk of opportunity loss if interest rates improve significantly during that time.

Another income route worth exploring is Nationwide's FlexDirect current account, which pays 4.89% interest (3.9% after basic-rate tax). Interest is paid monthly and there is no monthly fee on the account. However, customers need to pay in at least £1,000 a month, and Nationwide will only pay interest on balances of up to £2,500.

LOW-MEDIUM RISK

Bond funds

Historically, gilt and investment-grade corporate bond funds produce a steady and secure income stream for risk-averse investors. But recent events have changed all that. Gilt yields remain very low and concern has been growing that the overall corporate bond market may be coming to the end of its 30-year bull run.

However, Andy Parsons, head of investment research at The Share Centre, believes "a huge rotation out of debt and into equities" is unlikely. He says: "There may be some movement out of bonds, but remember the biggest holders of debt are the pension funds, which are bound by strict rules of asset allocation. They won't be going anywhere.

"But people have to appreciate that the phenomenal returns of 2009-10 were a one-off and that they should now go into bonds specifically for the income stream. Any bit of capital growth is an added bonus," he stresses.

Parsons says the safest approach is via the flexibility of a strategic bond fund that can shift its focus right across the bond universe from UK and international sovereign debt to investment-grade and high-yield bonds, as circumstances dictate. He picks out M&G, Invesco Perpetual and Legal & General as three investment houses with outstanding debt teams.

At Mattioli Woods, investment manager Ben Wattam agrees there is still a place for bonds in income portfolios, although investors are likely to have to use equities as well to boost yields. "Bond yields have fallen, but they still offer stability, especially in times of stress. High-yield bond funds may offer the highest yield, but we prefer the risk-reward dynamics of investment-grade or carefully chosen strategic funds," he says.

But Damien Fahy, head of research at FundExpert.co.uk, makes the point that retirees with a long-term income requirement need that income to keep pace with inflation - and bonds, with a fixed payout, don't do that. "Bonds are a short-term diversifier, not a long-term solution," he comments. "Our analysis shows that in the past 10 years a typical investment-grade bond fund has cut its payout by around 26%."

Retail bonds

The attraction of new issues of retail bonds by UK companies is that investors know exactly what their income is for the fixed five to 10-year period of the bond, there's a low minimum subscription of just £2,000 and they can also trade them easily on the secondary market if need be. "The pace of issue of retail bonds has picked up, with around 15 deals in 2012, and more are coming up," says Eden Riche, head of debt capital markets at Investec. "They are also trading very well on the stockmarket."

However, the risk attached depends on the issuing company: recent launches have come both from secure, rated issuers such as the London Stock Exchange (paying 4.75%) and unrated companies such as mortgage lender and property company (both paying 6%).

Housing market opportunities

An interesting opportunity, providing a reliable (and "ISA-able") income stream for investors looking to diversify their portfolios, is the Castle Trust Income & Growth HouSA.

This is a fixed-term bond of three, five or 10 years, available to anyone with £1,000-plus to invest. It's linked to the performance of the UK housing market via the Halifax house price index, rather than to bond or equity market performance.

HouSAs pay a fixed income of 2-3% (depending on the length of your chosen bond), regardless of what's happening in the housing market. But at the end of the term, the capital returned reflects the full gain or loss of the rise or fall in the Halifax HPI. There is no guarantee that you'll get back what you put in, so you have to be prepared for some potential capital loss.

However, a £1,000 HouSA invested over any 10-year period since the Halifax HPI was launched in 1983 would have returned some growth, with uplift ranging from 8 to 191% of the original investment.

On average, it would have gained 91% over 10 years, in addition to 3% income, paying a fixed total of £291, a total annualised return of 7.9%. (These figures take into account a 3% initial fee, so the initial investment is £970.)

Property funds/trusts

Anna Sofat, managing director at Addidi Wealth, picks out direct property funds as an interesting proposition. "For the past five years they've been pretty unloved and done nothing much, but nothing stays down forever. So there's a decent chance of some capital growth. Meanwhile, open-ended funds such as , which I would use for more cautious investors, are paying 3-3.5%," she says.

More adventurous investors willing to accept potential share price volatility could look at a direct property investment trust.

MEDIUM RISK

UK equity income

Relatively risk-averse investors have tended to fight shy of equity income funds, but they are probably not doing themselves any favours by getting hung up on the risk of capital fluctuation. Fahy warns: "Lack of volatility on dividend income is too often overwhelmed by a fear of capital volatility."

Importantly, equity income funds provide capital growth potential as well as an income stream, and if you choose the right fund you can build year-on-year dividend growth into that as well. Over a long retirement, that's an important consideration.

However, FundExpert.co.uk analysed the UK equity income sector and found that in 2012 a fifth of funds either cut dividends or increased them by less than inflation. In contrast, the most dividend growth-focused funds generated double-digit dividend growth. The strongest contenders are those with a longer-term history of growing payouts, including , and . The FundExpert website includes an income tool focusing on yield, payout growth and consistency over the past 10 years.

"Many managers want companies with a sensible dividend policy and steady income growth, because it shows good financial discipline," comments Andy Parsons. "We like the big blue-chip-focused funds run by the likes of Neil Woodford because of those companies' global exposures, but we're also looking for funds focusing further down the capitalisation spectrum - , for instance."

Investment trusts

Closed-ended funds, because of the potential for share price volatility if the markets get choppy (regardless of what's happening to the trust's underlying assets), are inherently more risky than their open-ended counterparts. But they are a great place for reliable income, because they are allowed (unlike unit trusts) to withhold some of the dividends received from portfolio companies and build reserves to boost their payouts to shareholders in leaner years.

As a consequence, the most consistent "dividend heroes", including , , and , have paid steadily rising dividends for up to 46 consecutive years, according to the Association of Investment Companies.

The difficulty is that income is so sought-after that income-oriented sectors have tended to trade at a premium to net asset value - infrastructure being a notable example. But it could be worth paying a little over the odds for a high-quality income trust offering income certainty and consistently trading on a modest premium, particularly if you're investing for the long term.

Beard points out that there are lots of options open to income seekers beyond the traditional income-oriented sectors. "You can look in almost any sector for income now. It may not be a large dividend, but it may well be rising, and there are potential capital gains as well," he says.

Fund choices for income hunters

Low-medium risk

Damien Fahy, of FundExpert.co.uk, said: "We like fund, yielding 5.07%, which has a defensive bias compared with its peers, although there is limited scope for payout growth."

Jackie Beard, of Morningstar, said: ", yielding 3.2%, and , yielding 3.4%, are investment trusts conservatively run by the well-respected Mark Barnett at Invesco Perpetual and trade on a modest discount."

Medium risk

Andy Parsons, of The Share Centre, said: " can invest across the board in the UK but has a focus further down the size spectrum. It's paying around 3.7%."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.