What does BT's "free sport" offer mean for Sky's share price?

10th May 2013 09:29

Shares in fell more than 6% on Thursday as competitor revealed it would offer free Premier League football coverage to its broadband customers.

Unveiling a £10-a-month broadband package, BT confirmed it was the first time in more than 20 years that weekly live matches from the Barclays Premier League would be free to watch. It was also revealed that BT Sport would be taking on BSkyB in pubs and clubs, with a 12-months-for-nine subscription and free installation special offer lasting until 1 July.

Around half the premises taking up the offer will end up paying £135 a month, BT said, while packages for hotels and betting shops could undercut BSkyB by 75%.

"This is a negative for , and BSkyB," notes Nick Lyall, analyst at UBS. "The risk is BSkyB is forced to retaliate."

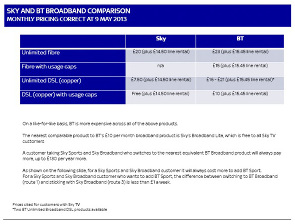

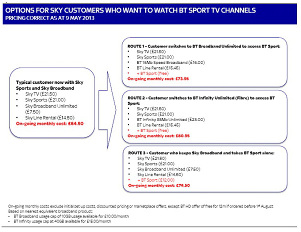

And retaliate it did, setting out the reasons why it believed BT was not cheaper than BSkyB, as shown in the charts below.

BT launch "aggressive"

"BT's new TV offering could hardly be more aggressive," states Daniel Kerven, analyst at Bank of America Merrill Lynch.

"We believe BSkyB will exploit customer inertia, maintain pricing and increase discounts on a targeted basis. It could also consider (external) investment in a quad play."

He has a negative view on BSkyB, explaining: "With BSkyB trading on a 2013 price/earnings ratio of about 15 times, unlevered cash earnings, growing competitive pressures and earnings risk/uncertainty, we maintain our 'underperform' rating."

Nomura analyst Matthew Walker acknowledged the "actual launch is more aggressive than we thought", but maintained a 'buy' recommendation on BSkyB, saying: "While there may be additional weakness in the BSkyB share price as BT lays out its plans and investors ponder the possible impact on churn and TV pricing, we expect the BSkyB business to be resilient."

BSkyB share price movement an "overreaction"

But Laurie Davison at Deutsche Bank was of the view that the BSkyB's share price fall was an "overreaction".

The analyst pointed out there were three "key developments", questioning: "(1) BT giving 'free' BT Sports to all its broadband subscribers. Does this impair Sky's ability to grow BB and triple-play subscribers? (2) BT has cut broadband pricing. Will Sky have to respond? (3) BT pricing at a discount for pubs/clubs - is this a major Sky earnings risk?

"The answer is 'no' on all three; the stock fall looks an overreaction."

Steve Leichti, analyst at Investec, maintained a 'hold' recommendation on the stock, but said while the stock would be a "trading sell" should the share price rally, it would be a buying opportunity if the price hit 750p.

50% BSkyB triple play target "still achievable"

Davison acknowledged that "free" sports would cut BT churn, but insisted that 50% Sky triple play target was still achievable, explaining: "We never assumed BSkyB would be able to convert all of its TV subscribers to the triple play, merely that BSkyB could get from current 34% triple play to 50%.

"Does 50% now look too high?" she asked.

"No - a TV BSkyB subscriber still saves [between] £5 and £15 per month from switching from BT to BSkyB for broadband and talk; "free" BT sports won't change this."

However, Patrick Wellington, analyst at Morgan Stanley, predicted BSkyB would find it harder to make price increases, saying the longer-term impacts could include a possible erosion of the base of c. 4 million basic TV customers of Sky in the face of a YouView/Free BT Sports offer. He rated the stock 'equal-weight'.

With a 'buy' recommendation on BSkyB, Davison advised investors: "The best buying opportunities have come at periods of most intense competitive concern. [BSkyB] is a consumer staple which, even with BT Sports, is capable of 12% earnings per share compounded average growth rate, or 16% with buybacks over the next three years."

Tables source: BSkyB company data, Nomura research.

Editor's Picks