Oriel rates Lord Rothschild's RIT Capital "positive"

20th August 2013 10:16

by Tanzeel Akhtar from interactive investor

Share on

Iain Scouller, contributing analyst at Oriel Securities, says, following a couple of years of poor performance, is now generating better returns and on a 9% discount the trust is rated positive.

Despite the recent changes in management, Scouller says he will retain his positive stance due to RIT Capital offering something different to many other funds given its multi-asset approach and defensive qualities.

Between August 2012 and April 2013 RIT Capital was rated neutral by Oriel but since April this year the company has retained a positive rating.

In 2012 RIT Capital saw management changes with the exit of investment director Mikael Breuer-Weil and the appointment of Ron Tabbouche. The first half of 2013 saw further changes with the resignation of David Haysey, head of public equity and manager of the RIT global quality portfolio.

Recently chairman of the trust Lord Rothschild appointed his 51-year-old daughter Hannah Rothschild as a non-independent, non-executive director. She is currently editor at Harper's Bazaar UK.

RIT's net asset value (NAV) at end-June was 1,342p, a 13.8% total return over the first half of 2013. The NAV has risen a further 2.7% to 1,378p at the end of July.

Scouller reports the gains were driven primarily by the quoted portfolio, which added 12.2% to NAV. Real assets was the largest detractor, taking 2.4% off NAV due to weakness in the price of gold. In comparison, the FTSE All Share TR rose 8.5% and MSCI World (£) TR rose by 16.0%.

RIT Capital largest contribution to NAV in the period came from the externally managed quoted portfolio which rose 16%, adding 87p to net asset value (NAV).

So far, the best performing portion of the portfolio was absolute return and credit, government bonds and currency, which despite only accounting for 3% of NAV at 30 June, added 1.9% , to NAV, indicating a substantial return.

Major shareholders of RIT Capital include: Lord Rothschild 13.45%, including 2.85% held indirectly; the Rothschild Foundation 7.54%; Investec Wealth and Investment 3.59%; and Five Arrows 4.39%, including 3.80% held indirectly.

RIT Capital is a self-managed trust and has no fee arrangement with a third-party manager.

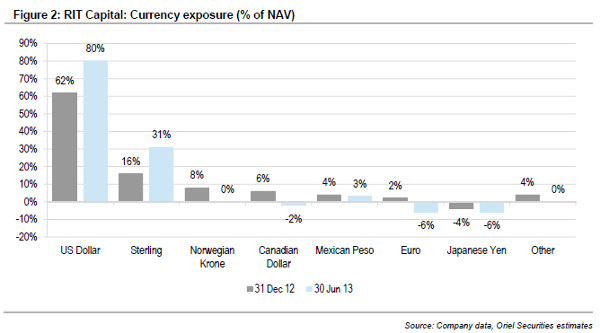

Recent changes to RIT Capital include its US dollar exposure from 62% to 80% of NAV, the company has also doubled its sterling exposure from 16% to 31%.