Greece could re-ignite investors' interest in emerging Europe

4th October 2013 17:04

by Holly Black from interactive investor

Share on

For a fund manager, investing in Eastern Europe is a little like trying to do your job with one hand tied behind your back. The MSCI Emerging Europe index consists of just five countries, which may not seem particularly narrow or restrictive when you consider the wealth of investment opportunities available in single markets such as North America or the UK. But emerging Europe is a little different.

The market in Russia is the largest in the index, but it consists of just 30 listed, investable companies.

To find out why Russia offers interesting prospects for long-term investors and how to take advantage, read:Low valuations in Russia could lead to long-term gains.

Hungary's market, the smallest, has only three. Yet a posse of fund managers find opportunities in this enclave of the investment world.

Russia, Turkey, Poland, Hungary and the Czech Republic might not be as sexy as Asian emerging markets or as dynamic as the African frontiers, but for long-term investors who can hold their nerve, significant rewards could be had. Here, Holly Black makes the case for the latter four countries.

Turkey

Turkey leapt onto investors' radars last year when it achieved impressive GDP growth of nearly 9% and was promoted to investment-grade status by ratings agencies. Its reputation has been hampered this year by violent protests in the country in the spring and the trouble along its border with strife-torn Syria.

Julian Mayo, at Charlemagne, debunks some common misconceptions about Eastern Europe.

Myth: Turkey is hampered by Syria Turkey has a pivotal location and is bordered by countries that, in the long term, will become important trading partners. Once liquidity and market conditions improve in Iran and Kazakhstan, for example, Turkey will be a principal beneficiary. The country will also benefit from being firmly plugged into the eurozone recovery. A fall in its currency value in the past six months has made it a relatively cheap place for countries to trade.

Tom Wilson, manager of the Schroder Emerging Europe fund, calls the country "tricky" and picks out as problems a large current account deficit, and a reliance on imported energy and external funding that makes Turkey vulnerable to fluctuations in global liquidity. Julian Mayo, director at Charlemagne Capital, is confident domestic demand will remain strong, but the country is battling inflation of more than 8%.

Peter Taylor, manager of the , thinks Turkey is still one of the most attractive options for a stockpicker, pointing out that "a lot of well-run companies in the consumer and banking space are trading on good multiples." He believes the country is the easiest of the Eastern European states for investors to understand, because "it is a classic emerging market growth story, like India or Brazil". In terms of companies, he likes discount supermarket BIM, which "has a staggering track record", and Akbank, which is growing its loan business and trades on a low multiple.

Poland

Poland was one of the few countries in Europe to avoid a recession in the wake of the global financial crisis, so it is unsurprising that its strongest sector is financials. While other countries struggled, Poland's government benefited from low debt levels and its banks enjoyed far better capitalisation than their developed market counterparts.

Julian Mayo, at Charlemagne, on Poland.

Myth: Poland is too strongly leveraged to Germany Germany is definitely one of Poland’s strongest trading partners, but the rest of the eurozone is more important to Poland and, surprisingly, almost as important is North America. The US is seeing a much stronger economic recovery than the eurozone, and Poland is benefiting from that.

However, Baring Emerging Europe fund manager David Reid says: "Investors don't seem to have realised the structural advantages these companies have over their peers."

But valuations are expensive. Poland's well-capitalised pension schemes are largely restricted by law to investing in domestic equities, and this puts a floor under share prices. Future reform should ease this situation and make valuations more attractive. But right now, says Wilson, the premium is difficult

to justify. He adds that Poland has been the only drag on performance in his fund in recent months, although infrastructure investment in the lead-up to the Euro 2012 football tournament did boost construction and employment.

The Czech Republic and Hungary

What about the other member countries? Together, Hungary and the Czech Republic account for just 5% of the MSCI Emerging Europe 10/40 index, with just a handful of investable companies between them.

Wilson invests in just one company in each country. The Czech Republic, he says, has attractive valuations and dividend yields but a comparatively weak earnings outlook. Although valuations in Hungary are "compelling" and growth is stronger, he believes it has just one investable stock.

Mayo too thinks the country is becoming "less interesting" and points to flaws in government policy. "You don't know when the government will change the rules, and that means it's hard to be confident long term in policy stability," he says. He is also wary of the Czech Republic because the market is small and not very liquid.

If liquidity is such a prevalent issue among these companies, doesn't that make investment in the region quite restrictive? "Yes, but there is enough opportunity between Russia and Turkey and Poland," says Mayo. "You have three pretty large economies and they are not poor countries, they are middle-income markets," he adds.

Bain agrees: "It is frustrating. Russia is a fantastic consumer story, but it's difficult to access. Hopefully, the market will expand, and in the next two years the 30 companies we can access now will become 50."

Of course, in a few weeks emerging Europe will welcome a new member to its fold, as Greece is officially downgraded from developed market status in November. Although this may widen the range of investable companies, none of these managers seem overly excited by the prospect of the new constituent.

Taylor is concerned that Greece is still struggling with significant macroeconomic uncertainties, and he doesn't believe it offers the growth potential of, say, Turkey. Wilson is more positive. "It's generating a lot of interest," he says. "Greece has had six years of recession, wages have dropped significantly, tourism is up 20% year-on-year, the current account is improving markedly and it should have a primary surplus in 2014." Still, he concedes that there remains much for the country to do and structural reforms are needed.

But perhaps a country such as Greece joining the index, relatively familiar and better understood by investors, could bring some much-needed attention to the region.

Emerging slowly

The long-term prospects for emerging Europe may be promising, but investing there is not going to be an easy ride. For those convinced of the story and able to sit tight for several years, now, when valuations are unlikely ever to be cheaper, is a good time to buy in. "Emerging Europe generally is the least fashionable region for investment, which makes it an interesting valuation opportunity," says Reid.

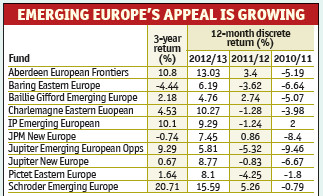

However, the volatility of the region cannot be denied. There is little continuity in the performance of emerging Europe funds: three-year total returns vary from gains of almost 21% to losses of just as much. Bain says if you believe oil prices are set to remain around $100 a barrel, Russia should be a sound investment; but there is more to these countries than that.