Equity engine makes hay for Nifty Thrifty

20th December 2013 16:00

by Richard Beddard from interactive investor

Share on

Once you get used to running a mechanical portfolio, following it is as simple as completing the tasks on a checklist periodically and buying and selling the shares the computer identifies.

The Nifty Thrifty checklist is quite long, though, and to a newcomer probably bemusing.

The objective is to make money relatively effortlessly. Relative, that is, to researching companies individually and picking the best. Ideally, all the effort in following a mechanical strategy happens before the investor starts running it. Once they have decided on a strategy, they should follow the computer blindly.

Blind faith requires three things: trustworthy data, a system that inspires confidence and the fortitude to keep following it.

Selection strategy

Selection strategy

The Nifty Thrifty strategy invests in the biggest, strongest, most profitable companies listed in London at relatively low prices, in so far as we can best identify these factors statistically.

To qualify, a company must be one of the 350 largest companies listed on the main market. It must also have an F_Score, a measure of financial strength, of at least five out of nine. Financial companies and utilities are excluded because some of the statistics do not apply to them.

An algorithm ranks the companies every quarter by earnings yield, a measure of value, and return on capital, a measure of profitability, to find those with the highest combined rank.

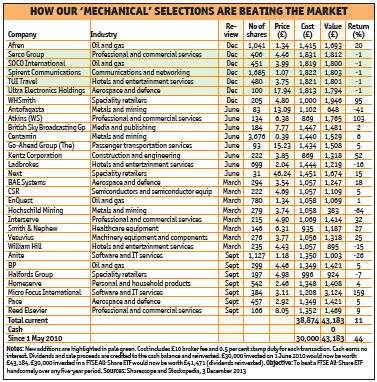

These are, statistically speaking, good companies at cheap prices. We publish the top 25 companies in our table of Nifty Thrifty candidates (see table).

The Nifty Thrifty portfolio contains 30 companies. Seven or eight, those that have been in the portfolio a whole year, are scheduled for ejection every quarter unless - like and , highlighted in dark green - they still appear in the top 25.

This quarter, five of the seven companies scheduled to leave the portfolio did not rank highly enough to remain, so we ejected them, recording the profit or loss in the quarterly ejections table.

They served the portfolio well, three of them earning total one-year returns after costs of around 50%. Only one, , lost money.

We divide the money raised by the number of companies ejected and replace them with that value of shares in the same number of companies picked from the candidates table.

To ensure the portfolio always holds 30 companies, we do not add more shares if, like the companies highlighted in orange, they are already represented in the portfolio.

To maintain diversity, we also exclude companies if the portfolio already holds four others from the same industry, a rule we did not have to invoke this time. The highest-ranking companies remaining are added to the portfolio.

New faces

This quarter's additions are , , , and , ranked 2, 8, 20, 22 and 24 respectively out of 195 companies that meet the Nifty Thrifty criteria.

They are highlighted in light green in the candidates table and also the Nifty Thrifty portfolio table, which is the lineup for the next quarter. New additions show a small loss, the effect of broker fees and stamp duty.

It might be easier to rebalance the portfolio once a year, instead of once a quarter, swapping all the companies at the same time. But any investor starting this way would need to consider the risk of investing a large sum of money in one go - at least £30,000, assuming £1,000 is invested in each holding.

The ranking system is the Magic Formula invented by Joel Greenblatt, a hedge fund manager who systematised some of the techniques he had used to make his fortune and popularised them in a book, The Little Book that Beats the Market.

Test for financial strength

The test for financial strength is a combination of nine statistics invented by Joseph Piotroski, an academic who set out to establish whether simple accounting ratios could improve investors' returns.

What has worked before often fails in the future, so the Nifty Thrifty is a real-time test using the best data available at a reasonable price for investors.

Logically, if a system becomes popular, the shares it invests in become popular too, leading to higher share prices and lower returns.

That fate shouldn't befall the Nifty Thrifty for two reasons. First, it targets unpopular companies on low valuations. Second, it sometimes performs poorly, which should unnerve all but the most committed investors.

No system always wins. Confidence comes from a strategy that wins more than it loses, which is why the Nifty Thrifty requires fortitude on the part of followers who must keep trading when it loses.

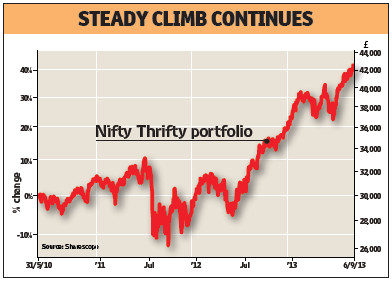

After three and a half years, and a difficult first two years, the portfolio is performing well. Over the past year it has gained 30% in value, compared with 20% invested in a FTSE All-Share exchange traded fund, with dividends reinvested.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.