Spotlight on New City recovery

29th January 2014 14:07

by Lindsay Vincent from interactive investor

Share on

All betting systems have their flaws, some terminal - but when it comes to equities, history shows that gambling against the crowd is one approach that invariably pays off.

Nevertheless, timidity and fear are powerful forces, and they tend to hold sway when it comes to putting money on the table.

Take the mining industry. The HSBC Global Mining index was down by 22% in the year to 8 November 2013, marking a third year of negative returns. Yet not so long ago this was a sector that had investors throwing their hats in the air.

China was the destination for ever-rising amounts of coal and minerals, and at ever-rising prices. The outlook was sweet. Both investors and miners deluded themselves and, today, while the search for oil reserves is as relentless as ever, the globe is covered with mothballed mines, along with grandiose projects that were placed on hold or cancelled when metal prices headed south. Near-perfect conditions, then, for the counter-cyclical investor.

Enter Will Smith, 53 and lead manager of a mining and commodities curio, . This is one of four resources entities managed by New City Investment Management, a subsidiary of CQS - a $12 billion (£7.4 billion) hedge fund enterprise.

Dividends race ahead

Smith has had a torrid and testing time since the spring of 2011, and in 2012 alone loyal investors suffered paper losses of more than a third.

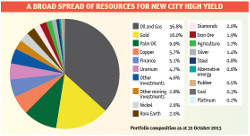

The £100 million investment trust has net assets of some £109 million, with 70% in equities and the rest in bonds and convertible loan stock.

Gearing of 22% takes gross assets up to £145 million as at 31 October 2013.

The fund's shorter-term growth record may be dismal, but the rate of increase in dividends, paid quarterly, is impressive, in keeping with the trust's aim.

"Our dividends have increased by 175% since 2004-05, with a 15.7% annualised rate of growth over the past five years," Smith says. "The resource culture of the last boom period was all about growth. Now that expansion has been scaled back, it is all about returning money to shareholders."

To achieve this goal, Smith has radically reshaped the fund's portfolio in favour of oil and gas stocks, which now represent around one third of assets. In part, the switch was funded by reducing gold investments.

"The need and long-term reason for holding gold hasn't changed. Since 2008, nothing [with regard to the financial crisis] has been creditably solved but I can understand why the price has fallen. There was more money to be made elsewhere - but the interesting thing is how emerging nations have stepped up their purchases."

Here, investors may yet prove to be firmer hands, he says, than the speculators who flocked to, and then exited, exchange traded funds that provide exposure to the yellow metal.

Smith's enthusiasm for oil reflects the great US "fracking" revolution and a view that insufficient emphasis has been given to the spectacular returns on offer. He cites the Permian basin, in west Texas.

The innovation of horizontal drilling "is delivering a huge amount of oil - not gas - and some producers are getting a 60% return. You can't get those returns elsewhere, so why bet on a 20/1 exploration shot in Africa when you can get these unparalleled returns in North America?"

Vermilion Energy, one of his largest single investments, excites him hugely.

Unconventional techniques are extracting vast amounts of light oil from its core asset in Alberta, Canada, and profit margins are improving as the technology is brought to bear.

The stock now yields 4% and by the end of 2014, he says, it will have additional annual cash flows of $600 million when gas supplies from its Corrib field, off the west coast of Ireland, come on stream.

Canada represents 40% of the trust's mining assets and Australia 30%. The latter is home to another key holding for the fund, Sirius Resources (not to be confused with AIM-listed ).

Horizontal drilling is delivering a huge amount of oil - not gas - and some producers are getting a 60% return."

"Last August Sirius was down to its last few hundred thousand dollars," Smith says.

Suddenly, it hit pay-dirt, in the shape of "the most exciting discovery in Australia in the last 10 years - the Nova nickel structure to the east of Perth".

By value, exploration companies now account for 20% of assets, a level "at the lower end of the scale. We are looking more to companies that are in production."

"The great thing about London is that it is the centre for mining finance," he adds, and , with its stable of resources funds, is a key port of call for many in search of speculative financing.

"But you have also got to get out there," he says. That means travelling to remote parts of the planet, working long days and all hours.

"There is a lot of spivvery, and as the tide goes out, a lot of it is being revealed. In mining, corporate governance is crucial."

Lots of holdings

Smith's trust has a seemingly huge number of holdings, 220. But "with every play you do in Australia or Canada, you get warrants attached".

The bond component of the portfolio has also been diversified, he says, and some are being sold to finance a higher level of convertible loan stock.

"We have 8% in convertibles and I expect to see more. Convertibles are coming to the fore again as people need alternative financing. Equity markets are closed to these guys right now."

The two largest holdings in Smith's trust are non-mining and are also the most exotic - and . With palm oil prices depressed, REA, a London-listed palm oil producer with estates in Indonesia, "has not been a stellar performer", he says; but palm oil is an ingredient of numerous products and "a great way to play rising populations and rising wealth".

New Britain, whose home exchange is Port Moresby, Papua New Guinea, is different. Its products, shipped to the company's refinery in Merseyside, are fully certified as coming from sustainable plantations. Thus its oils fetch premium prices.

"We aim to invest with a careful eye toward the social licence. It is very important," Smith says.

It is also important, in his view, to appreciate that equity valuations for the extractive industries are in a trough.

"Absolutely. All the 'hope value' has been wrung out of them and some companies are trading at cash or below. By and large, prices are below the levels of 2008, with gold mine prices well below."

However, seeds of the next bull market have already been sown, Smith believes. Metals "are a diminishing supply", and the large number of projects that have been deferred, delayed or cancelled means supply will fail to match demand, he says.

"Global GDP growth of 2 to 2.2% over the next two years means we'll be having [supply] problems."

Smith accepts that China's consumption of iron ore is critical for that segment of the mining industry but, across the board, China "is not an overwhelming component of global growth".

Global urbanisation, in countries such as India, Indonesia and Vietnam, will be the key driver.

Unbridled optimism is a prerequisite in the mining industry, but he is pragmatic about the outlook: "Supply constraints will drive the next bull market."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.