US Fed changeover poses key challenge

5th February 2014 11:53

by Jim Levi from interactive investor

Share on

As the new year has got under way there has been a definite change of mood among our asset allocation panel members - and it is towards greater caution.

They fear complacency in financial markets, even though the consensus seems to be that the world's major economies may be in a synchronised growth phase for the first time since 2007.

Robert Talbut at Royal London sums up the mood thus: "There is a very dangerous consensus around at present. It says: 'Growth will be strong, equities will do well and everything will go OK'. I think it is right to be guarded about this year and to expect things not to go as smoothly as the consensus tells you it will."

Rob Burdett at Thames River says: "We take on board the views of other asset managers and we have not found many who are outright bears. But many think it is time for at least a pause. Now is a time to be active, so we have changed no fewer than eight of our 11 scores."

The five panellists

Chris Wyllie is chief investment officer at Iveagh Private Investment House. He is also the head of portfolio management at Iveagh Wealth Fund, with £250 million under management.

Rob Burdett is co-head of multi-manager funds at Thames River Capital, with £1.5 billion under management. It is a largely autonomous business within the F&C group, managing funds of more than £100 billion.

Michael Turner is head of global strategy and asset allocation at Aberdeen Asset Management, with £177 billion under management.

Robert Talburt is chief investment officer at Royal London Asset Management, with more than £40 billion of assets.

Keith Wade is chief economist and strategist at Schroders, which has £203 billion of assets under management.

There may be trouble ahead

Although our pundits suspect there may be trouble ahead, they are uncertain about the form it will take. It could come in the shape of a hard landing in China, a new euro crisis, a re-run of the US's fiscal cliff hanger, or one of those "unknown unknowns" Donald Rumsfeld once famously mused about.

Michael Turner at Aberdeen says: "The biggest question hanging over financial markets is: how can we keep up such stellar performance by the major equities markets? I don't hear of many bears in the market at the moment - and that is a worry."

He notes that a leading market bellwether - the average discount on investment trusts - has narrowed to 3.4% - its lowest for decades. In the past, anything below 5% has been a signal for a market pause or worse.

Janet Yellen, incoming chairwoman of the US Federal Reserve - and perhaps the most powerful woman in the world - is "another area of uncertainty".

Michael Turner thinks she will miss Ben Bernanke's support in the tricky task of "tapering" US monetary policy.

Tapering began in December with a $10 billion (£6 billion) reduction in the Fed's monthly bond-buying programme (quantitative easing) and continued with a further $10 billion reduction in January.

"Financial markets reacted surprisingly well [to December's taper]," says Schroders' Keith Wade. "If all goes smoothly and Yellen lops $10 billion off every time the Fed meets this year, quantitative easing will be done and dusted by October."

No smooth ride

But none of the panellists expect her to have a smooth ride. They remember how markets took fright last summer at just a hint of tapering talk. Only the reassurances of central bankers that they would keep short-term interest rates low until unemployment fell significantly enabled markets to recover and gradually gain still higher ground.

Wade says: "Yellen will have to get her communication skills honed pretty well immediately."

Iveagh's Chris Wyllie agrees. He expects the start of her reign to be a "very nervy period". He says: "There is always the chance that she will just run into some bad luck."

Wyllie is sure the Fed does not want its bluff called in the next few months. He adds: "It wants to retain the capacity to surprise the markets. It will want to indicate that tapering can go either way.

"That is what last September's tapering talk was all about. It was a shot across the bows of speculators. If bond yields start rising aggressively on the back of speculation, the Fed would not want to be in a position where it had to stop tapering. If it were, it could be very choppy for markets."

It is said that bull markets in shares are built by climbing a wall of worries. This bull market has had plenty of such worries. But US shares are at an all-time peak and UK shares have nearly doubled since the credit crunch. Japan and Europe (excluding the UK) are catching up fast.

Emerging markets rising again

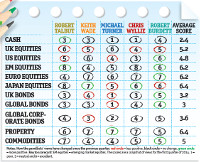

Now four of our panellists think even subdued emerging markets for equities may now be about to join in the fun. However, enthusiasm for UK and US equities seems on the wane. All but one of the panellists have cut their scores for UK equities, which now score an average of 5.2, compared with 6.4 in November. The average score for the US is down from 5.2 to 4.8.

In contrast, the average score has gone up for Japan (from 6.0 to 6.4), Europe (from 5.8 to 6.2) and emerging markets (also from 5.8 to 6.2). Robert Talbut has edged his cash score up from 2 to 3, while the other four have frozen theirs at the level of three months ago.

If the Fed had to stop tapering, it could be very choppy for markets."Chris Wyllie

Talbut's increase reflects his sense that a market hiccough may not be far away and that there could be buying opportunities in its aftermath.

Michael Turner has some sympathy with this view, fearing "an upward spike in bond yields upsetting equities at some point this year", but he is not yet ready to change his score on cash.

On taking his UK equities score down a notch to 6, Talbut comments: "In Britain we are still dealing with the aftermath of a crisis in government finances. And we are still playing the old trick of bloating housing to get growth momentum, instead of investing for higher productivity and exports. It is not the right strategy."

Burdett has shaved his UK equities score from 7 to 5 as part of a more cautious stance overall for him at the outset of 2014. "Our scores now range between 4 and 7, so we are not now using anything like the full range of scores available," he says.

"We recognise that markets have come a long way in the past two or three years and produced some phenomenal returns, but that has been from a very low base."

He points out that the UK had the strongest momentum towards the end of 2013. "We had a really good run from the UK, in particular in the final quarter," he says. "Yet the UK economy is far weaker than the US economy."

Chris Wyllie and Keith Wade are both concerned about the effect of a strong pound on corporate earnings. Wade has nudged his UK score down from 7 to 5. Wyllie goes from 5 to 4, observing that fund manager surveys show most of them are currently overweight in UK equities.

Fear factor too low

Michael Turner worries that valuations in the UK may be getting a bit "toppy", with discounts on investment trusts "now at their narrowest since 1970" and sending a clear signal that the fear factor among investors may be too low.

Turner also thinks there is a risk that the era of superlow interest rates in the UK may come to an end at some point this year, perhaps to halt another housing bubble.

For some time Chris Wyllie has been the only member of the panel underweight in the US market. Now he is no longer alone. Michael Turner has joined him - cutting from 5 to 4.

We are still playing the old trick of bloating housing to get growth."Robert Talbut

"US equities is the sector most vulnerable to unknown unknowns," he says. Talbut, meanwhile, also lends support to the Wyllie camp, trimming his score from 7 to 5.

Burdett has gone against the grain, raising his US equities score from 5 to 6.

He says: "The US is not cheap, but the economy has strong momentum. I think the market could become even more overvalued."

Burdett has joined the three other overweights in European equities, raising his score from 5 to 7, as he sees potential for a recovery in corporate earnings. "The European economy is fragile but it is still improving," he says.

In the Japanese market the major change of heart has come from Keith Wade, whose score jumps from 4 to 7, while Chris Wyllie has edged up from 5 to 6. No panel members are now underweight on Japan. Emerging markets seriously underperformed in the past year and are now the sector with possibly the most potential.

Burdett has now joined Talbut and Wyllie among the overweights. Only Wade is now underweight. There is still not much support for government bonds, where panellists remain predominantly underweight. Only Burdett scores a neutral 5 for UK bonds - up from 4 last time.

He has also raised his score on global bonds from 3 to 4. He notes that bonds now offer a real yield, which may prompt some investors to start rebalancing their investments towards bonds.

Property still finds general favour. None of the panellists is underweight and the average score has crept up from 6.2 to 6.4. Commodities remain out of favour, though key base metal prices such as copper have shown signs of recovery in recent weeks.