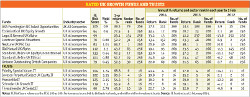

Top rated funds for capital growth

14th March 2014 17:44

by Helen Pridham from interactive investor

Share on

Growth-oriented UK funds are for investors looking to build up their capital.

Such funds may be for use in retirement, or to ensure that the value of a nest egg keeps up with inflation and can be dipped into occasionally without being depleted.

Our rated UK equity funds are split into three sections, with income-oriented holdings and a focus on UK smaller company funds completing the line up. You can also read the methodology behind how we chose our Rated Funds, which number over 160 in total.

To see the full list of Money Observer Rated Funds, click here.

AXA Framlington UK Select Opportunities

is an Editor's Selection. It is managed by the highly respected Nigel Thomas, a manager with over 30 years' experience whose management style we admire. Thomas considers general economic themes and trends.

He gets his investment ideas from a wide range of sources, investing in UK companies of any size. He finds value in medium-sized and smaller companies, exploiting inefficiencies and undervalued growth opportunities in this area of the market; diversification is achieved through a good spread of companies rather than sectors. He prides himself on his sell-discipline to minimise potential losses.

Ecclesiastical UK Equity Growth

The remainder is invested in good quality out-of-favour companies, often smaller and medium-sized businesses that offer growth opportunities and a possible re-rating. Jackson's aim is to buy into above-average growth at an attractive price.

Fidelity Special Values IT

This investment trust is an Editor's Selection. Since Alex Wright took over management of in September 2012, there has been a marked improvement in its performance.

This has been attributed to Wright's contrarian and value style and bias toward medium and smaller companies. However, he can invest across the size spectrum and some of the good performance has also come from larger company holdings.

Wright's approach is to seek out unloved stocks where he sees a clear catalyst for growth. He uses Fidelity's in-house system to identify companies that will benefit from strategic change.

Legal & General UK Alpha

is included in two of our longer-term model portfolios. It has also been a past winner of our UK growth fund award.

Richard Penny, the manager, looks for shares that he believes can double in price over the next three years. He then takes a high conviction approach, investing a meaningful amount so that the portfolio is relatively concentrated in between 35-55 stocks.

Although the fund can invest in any size of company, most of its portfolio has traditionally been invested in stocks listed on the Alternative Investment Market (AIM). The performance can therefore be quite volatile over the short term.

Neptune UK Mid Cap

was highly commended in our fund awards last year. It invests in companies listed in the FTSE 250 plus the top 50 companies by size in the FTSE Small Cap index.

We feel it is a good way to get focused exposure to these companies, which tend to outperform their larger brethren. Manager Mark Martin runs what is described as a balanced, three-silo strategy with investments in recovery, structural growth and turnaround stocks. This is designed to reduce volatility and maximise risk-adjusted performance over the business cycle.

Old Mutual UK Alpha

This fund is an Editor's Selection. management was taken over in 2013 by Richard Buxton after he decamped from Schroders, where he had an excellent long-term record of running UK equity funds.

We are confident he will be able to maintain the same performance with this fund. He is focusing on maximising long-term capital growth through a high-conviction portfolio, concentrated on 35 to 40 large cap UK companies that he believes have strong business models, healthy balance sheets and as yet unrecognised potential.

Schroder UK Growth IT

This trust is another Editor's Selection that has seen a recent change of manager: following Richard Buxton's departure from Schroders, Julie Dean has taken over the helm.

Dean previously ran a highly successful open-ended fund, , and will be investing in the same style. The portfolio will be tilted to reflect turning points in the business cycle.

The main changes to its previous policy include allowing up to 5% of net assets to be invested in smaller cap stocks and AIM stocks, and an increase in the number of stocks in which it can invest, although the portfolio remains relatively concentrated.

Standard Life UK Ethical

is a current member of our Consistent 50. It is managed by Lesley Duncan, who can invest only in stocks that meet Standard Life's ethical criteria.

This means they must first pass the negative screens, so that companies involved in activities such as alcohol, tobacco or weapons production are excluded. The majority of shares in the portfolio also have to pass four of the six positive screens.

Otherwise she adheres to the group's "Focus on Change" philosophy to help find potential investments and identify key factors driving their market prices.

Unicorn Outstanding British Companies

This fund received one of our UK growth fund awards last year. is co-managed by Chris Hutchinson and John McClure.

They look for companies that maximise shareholder value. The managers list 10 criteria that companies must meet to quality for inclusion in the fund. In essence, they seek to identify established profitable, cash-generative businesses capable of generating significant growth over the long term, regardless of size. The fund can include large companies as well as those listed on the AIM.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.