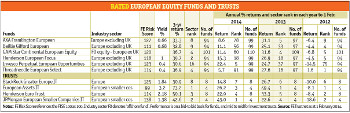

Top-rated European equity funds for 2014

14th March 2014 17:52

by Helen Pridham from interactive investor

Share on

Even when Europe was going through severe difficulties at the height of the euro crisis, fund managers were making the point that they were investing in companies not countries, and that Europe, like the US and Japan, is home to many world-class businesses which can prosper even when times are hard.

Adding more general equity income and growth-oriented holdings that invest in firms around the world can help you secure a globally diversified portfolio of funds and trusts.

To find out the methodology behind Money Observer's Rated Funds, read: How 2014's Rated Funds were chosen.

Baillie Gifford European

is a member of our current Premier League. It is managed by Tom Coutts, who adheres to the Baillie Gifford house style of long-term, low-turnover investing. Coutts focuses on trying to select the right companies rather than deciding on the fund's geographical exposure on the basis of economic trends, and avoids sticking close to index weightings.

Another aspect of his approach is to be contrarian: he invests in companies where the prevailing market mood is fear, apathy, uncertainty or disgust, as this increases the chance the company's shares are cheap.

European Assets IT

Manager Sam Cosh looks for companies that can grow within their niche, regardless of any problems in the wider economy. He says he has a hugely varied universe of 2,500 companies to choose from, which are little known and under-researched.

However, he also believes in limiting the risk of losses by prioritising quality businesses with strong balance sheets. This trust will be attractive to income investors because it has the highest yield in its sector, although this is partly funded from capital.

Henderson European Focus

won our best European small fund award last year. It can invest wherever the manager John Bennett sees the best opportunities. The number of holdings in the portfolio is limited; the fund has a large-company bias in order to exploit sector themes, but it includes mid-sized companies to provide an additional source of gains.

Bennett and his team also undertake their own fundamental research of unloved and under-researched areas of the market. He aims to make gains by anticipating change and inflection points in companies and industries. A long-term commitment to the investments he backs helps him capture these gains.

Invesco Perpetual European Opportunities

The is a past winner of our best European fund award. Manager Adrian Bignell focuses on finding companies he believes can do well in a low-growth environment. This can include companies with strong growth in returns on capital employed, or restructuring stories.

He also looks for cash-generative companies with shareholder-friendly management. Central to all of this is valuation. In Bignell's opinion, current valuation levels still underestimate the ability of European companies to deliver healthy returns to shareholders over the longer term. But with the rate of earnings downgrades starting to slow, he sees encouraging signs for the future.

JPMorgan European Smaller Companies IT

The is another past winner, this time of our best European trust award. It is managed by Jim Campbell and Francesco Conte. Its portfolio typically consists of between 50 and 80 stocks, skewed towards the top end of this range when the managers are feeling positive in their outlook and are able to find more attractive opportunities.

The size of companies they invest in reflects the trust's benchmark, the Euromoney European Smaller Companies ex UK index, which covers businesses worth between £72 million and £3.2 billion. The managers do not follow any particular investment style.

Threadneedle European Select

won our best European large fund award last year. David Dudding, the manager, says the secret of its success has been to focus on good business models. This means looking for companies with pricing power that enables them to sustain high returns over long periods.

When considering suitable investments, he takes into account Threadneedle's in-house economic and thematic outlook, while a large research team helps analyse companies and assess their business models and competitive advantages. Dudding then takes the best ideas for his portfolio, which is quite concentrated with typically between 45 and 65 stocks.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.