Hedging your ISA against a downturn

28th March 2014 15:25

by Cherry Reynard from interactive investor

Share on

The volatility in stockmarkets at the start of the year should serve as a reminder that economic expansion is no guarantee of stockmarket success.

After several years of strong returns, share prices are no longer cheap, and investors may be considering how they can defend their portfolio against any falls. The decision is made more difficult by the relative unattractiveness of traditionally "defensive" asset classes such as fixed income. Nevertheless, investors have a number of options open to them.

Every hedging strategy has a trade-off and comes with the risk of missing out on the potentially higher returns available from the stockmarket. As such, investors need to decide on the likelihood of stockmarket falls in 2014.

Here, opinion is mixed. Most commentators agree that the easy money was made in 2013, but many believe that the right combination of circumstances could lead to further gains in 2014.

Scope for volatility

If risk assets sell off what sould investors buy?

Andrew Wilson at Towry:

"Assuming that Asian and emerging market equities and debt get pulled down too, then there might be a generational opportunity to add exposure there in the event of a downturn.

"The Japanese equity story is still in an early phase, if Abenomics is to succeed, so one would look to add opportunistic exposure there as well.

"Finally, global property securities could also provide an attractive entry point for the longerterm investor, and have the benefits of being linked to real assets and providing a yield."

For example, Chris Sexton, investment director at wealth manager Saunderson House, says: "Growth will be better in 2014 than in 2013, and interest rates are likely to stay low.

"As a result, markets should make headway this year. Then again, we had a very good year last year, so there is already something in the market prices for this year.

"There is also scope for volatility from the Fed's tapering of quantitative easing. We will be watching the earnings growth numbers because there is pressure on corporate profitability. If there is a market downturn, it is likely to be because corporate earnings are disappointing."

In other words, if company profits do not come through as expected, investors need a Plan B.

In a conventional environment, if an investor were convinced that markets were about to slide, the best strategy would be to move into cash or short-term government bonds. This would protect capital, though it would not protect against inflation in the longer term. But this is not a great investment in the current environment.

Elizabeth Savage, co-manager of the Rathbone Multi-Asset Portfolios, says: "Investors could turn to liquid strategies, such as government bonds or high-quality investment-grade corporate bonds, to offset any threat posed by equity market volatility, but arguably these investments no longer represent a good-value way to diversify."

The same may be true of gold. It proved an excellent way to protect capital in the immediate aftermath of the credit crisis, but has been an extremely expensive hedge ever since, dropping around 18% over the past 12 months.

Andrew Wilson, head of investment at Towry, says the gold price is impossible to value and predict, especially in the short term. As such, it can provide a means to protect a portfolio, but timing is difficult.

Looking expensive

Equally, shares that might otherwise be deemed "safe" also look expensive. Andrew Kelly, manager of the TM Cartesian UK Absolute Alpha and , says "everything comes down to the price you pay", and that some defensive companies have become expensive.

"If a company is trading on 15-16 times earnings, while only generating 3-5% revenue growth, it is rated too highly. Investors have to be careful - these stocks are as vulnerable to disappointment, as are some racier stocks."

Gold, government bonds or defensive shares may protect capital in a downturn; the problem is that they could be very costly to hold if markets go the other way, and investors are rarely good at predicting a downturn in markets ahead of time.

Investors rarely buy at the bottom; it is too psychologically painful. And they rarely sell at the top - the good times too often feel like they will last forever.

But if they are wrong, the opportunity cost is significant: cash pays next-to-nothing, and bonds pay little more.

With conventional options for defending a portfolio unattractive, an investor's aim, therefore, should be to minimise losses in the event of a market rout, while still participating if markets continue to climb.

It is not an easy trick to pull off , but Sexton says that the first thing any investor needs to do if they are worried about a sell-off in markets is turn their attention to their asset allocation.

In particular, he suggests, they need to ensure they are not likely to be a forced seller: "If markets fall 15-20%, can they live through it?"

This means that they need to be out of stockmarkets if they are likely to need their cash within the year. Equally, investors should pay attention to the most basic rules of investment - don't overpay for assets.

Wilson says:"An investor's first port of call should be anything that is cheap and/or underowned. US and UK government bonds are no longer in a bubble, but are still expensive. High-yield debt might have an overdue appointment with gravity."

Essential diversity

Then there is good, old-fashioned diversification. When times are good, it is tempting to put all eggs in the basket that looks the most profitable, but diversification is generally a cost-effective way of managing volatility. However, even this is not entirely straightforward.

Robert Jukes, global strategist at Canaccord Genuity Wealth Management, cautions that no portfolio of assets will provide proper diversification for all time.

He says that even the most well-diversified portfolio needs to be quite dynamic over time: "For example, bonds and equities would normally provide diversification, but this may not always be the case. If the cost of borrowing rises, it can impact on companies' ability to grow earnings.

"Equally, if investors can get more on 'risk-free' assets such as bank savings, the less they should - theoretically at least - be willing to pay for earnings growth. This could have an adverse effect on equity prices."

It cannot be stressed enough that investors must look at diversifying strategies in tandem with the rest of their investment objectives."Elizabeth Savage

Savage agrees: "It cannot be stressed enough that investors must look at diversifying strategies in tandem with the rest of their investment objectives - these strategies must fit within the overall portfolio context.

When incorporated into a diversified portfolio, they can enhance returns, reduce volatility and eliminate undesired risks. But it is important to understand a product's performance drivers and the fact that these might change over time."

Wilson suggests allowing someone else to take the strain, recommending a diversified multi-asset, multi-strategy portfolio as the core holding in any portfolio. This, he argues, should behave as an "all-terrain vehicle", and actually be able to benefit from excess volatility in the market place, as it has scope to add more to existing asset classes and take profit from those that have performed relatively well.

He believes it takes experience and the right constitution to behave in a contrarian fashion, which is often necessary in order to protect a portfolio in difficult markets.

A properly diversified portfolio will inevitably stray beyond equities and bonds. Many advisers now recommend the inclusion of absolute return funds to smooth returns over time. These take three main approaches - they focus either on equities, or on bonds, or take a multi-asset approach.

However, what distinguishes all of these funds is that they strive to generate an "absolute" return, regardless of market conditions. To achieve this, the managers can use derivatives to bet on the price movements of a security, meaning they can profit from both rising and falling markets.

Tim Cockerill, head of research at Rowan Dartington, is one who believes absolute return funds can give a portfolio balance. "We use funds such as the . This takes a very low level of risk and gradually picks up value over the long term.

"If markets head south, funds like this offer some resilience. Of course, we are still reliant on the manager making decent calls, but the evidence is pretty good for this fund."

Downside security

He adds: "We also like the . These are the guys that came out of Standard Life. They are looking for equity-type returns with half the volatility. This fund offers some downside protection, while still capturing a fair amount of equity return."

Cartesian's Andrew Kelly, who runs a long/short fund, says that such a portfolio should still be able to perform as markets move lower: "At the moment, the long/short fund still has a bias to long positions, because we still see some value in the market, but if we were getting nervous about the prospects for the stockmarket, we would increase our short position and take down the long positions, which would give us lower overall exposure to the market."

Wilson goes one step further, suggesting hedge funds may be an option in some markets. He says: "Global macro hedge fund managers could benefit in a more volatile environment, as might trend followers (managed futures funds), although not necessarily immediately.

I don't believe in using derivatives. For a private investor, they are exceptionally expensive and difficult to manage effectively. They erode return day by day."Chris Sexton

"Volatility strategies would be almost certain to make money too, although they could bleed performance in the meantime, so your timing does indeed need to be good."

These strategies may be available to non institutional investors, but usually only through an investment trust structure. Investors could also buy protection in the form of an option. Fund managers will occasionally take this protection on their portfolios if they believe markets are likely to fall.

For example, in November of last year Gervais Williams, manager of the , took out a "put option", a form of insurance, to protect himself in the event of a fall in the FTSE 100 (UKX).

Anthony Bolton, former manager of the , and current manager of its , has historically taken out options in both funds when he believed the market might move against him.

These options are available to private investors, and they may also use spread betting or CFDs to achieve the same effect. However, it is an expensive way to buy protection and, again, involves timing the market, which is generally pretty difficult. Sexton remains a sceptic on the majority of derivatives-based strategies, including absolute return funds.

"In general, I don't believe in using derivatives. For a private investor, they are exceptionally expensive and difficult to manage effectively. They erode return day by day."

Another option may be to try and hold managers who have historically shown themselves to be strong in a downturn.

Among multi-asset managers, this has historically included individuals such as Sebastian Lyon at Troy, or Jonathan Ruffer at Ruffer Investment. Within the mixed investment 20-60% sector, , and all proved strong in the more difficult markets of 2011.

Natural defensive

Among straight equity managers, there are the naturally defensively minded. Of these, Neil Woodford at Invesco Perpetual was probably the best example, but he departs the group in April and investors may not want to risk the uncertainties of his new venture at Oakley Capital.

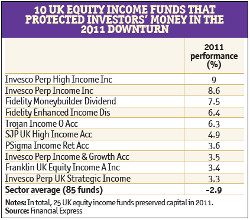

His successor at Invesco, Mark Barnett, has also proved to be strong in declining markets. During the last market downturn in 2011, funds such as the and in the IMA UK equity income sector protected investors' capital.

In the UK all companies sector, the , and also had a strong year. There is no easy solution to hedge a portfolio, largely because defensive assets have been bid higher and cash rates are so poor.

There is a significant cost to conventional portfolio hedges, so investors have to have more confidence in their decision-making. The solution does not lie in a particular portfolio manager, or use of an absolute return fund, or better portfolio diversification, but in a nuanced combination of all of the above.