How can you spot the next Warren Buffett?

10th April 2014 09:03

by Holly Black from interactive investor

Share on

It's easy to spot the stars among the fund managers. They are the ones with many years of above-average returns, managing billions of pounds of investors' money.But spotting the next generation of stars is rather more difficult. How do you spot talent when it does not yet have the track record to prove its worth?This is a competitive industry and those who want to manage money have to earn their place with years of hard graft, learning their trade and rising through the ranks.

Of those who stay the course, a few will get the chance, as lead managers, to take investors' money and try to turn it into more significant sums. Of those, a few will do well and maybe even become household names.

The next generation of star fund managers

So where is the next generation of great fund managers? And is it possible to spot them at an early stage?

When perusing investment statistics to gauge whether a fund is worth your hard-earned money, the easiest thing to look for is, obviously, performance; a good long-term track record may only be a measure of the past but does give an indication of a manager's ability to generate returns consistently.

In contrast, new managers may not have the all-important three-year history that so many people desire.But Gary Potter, head of multi-manager at F&C, thinks it is important to look beyond such measures. "We want to get involved when a manager is creating that track record, not living off it," he says.

"We have been involved at an early stage when managers or funds have gone on to become household names. But spotting them is hard."Andrew Wilson, head of investment at Towry, says a typical mistake made by investors is to choose funds at the top of the performance tables. "One cannot buy historic performance," he points out.

Darius McDermott, managing director at Chelsea Financial Services, says the past few years has been a "baptism of fire" for new fund managers. While some have been able to use the volatile environment to prove themselves more quickly than they might have done in more docile markets, others will have quickly perished.Wilson says that success in just one type of market is not enough; he wants to see evidence across the entire market cycle. "There are very few Warren Buffetts or Neil Woodfords and, frustratingly, they cannot be identified in advance," he adds.

"That is not to say that it is never worth backing a plausible manager with a sound process even if his track record is relatively short, but rather that the chance of you being consistently successful in this is very small."

Face-to-face meetings

We like to meet managers and look them in the eye"Darius McDermott

Ben Yearsley, head of investment research at Charles Stanley, agrees that for private investors the ability to scout talent is limited.

He recommends that investors look at a manager's history, and always look at discrete periods of performance to judge how they have performed over different time frames and in different economic conditions, rather than just looking at the overall cumulative number.McDermott also likes to investigate the individual's work life before they were a manager. "We want to find out how keen they were to manage money - some take blueprints of funds they would like to run to their chief investment officer, for example."

First impressions

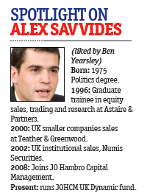

Yearsley is a fan of up-and-coming Alex Savvides at JO Hambro. "A lot of it comes down to first impressions when you meet someone," he says. Yearsley first met Savvides 12 months ago, when the latter had a relatively long track record of five-and-a-half years. His early performance had been strong."I met him and a couple of things struck me; he had a very well-defined process, he knew what he was looking for and could explain it well. I talked to him for an hour and bought into the fund on a personal basis the very next day," says Yearsley.

Yearsley says it is important to pay attention to managers when they speak: do they know what they're talking about; what mistakes they've made and why; what drives the fund and markets? And is the fund house known for bringing in new managers? He thinks the likes of Jupiter, Neptune and M&G all have good histories of bringing on fresh talent.Finding your ideal manager is much the same as when you meet a new partner in life, to an extent: at the end of the day it's the feeling you get about them, and the belief that they can deliver.