Pulling together for P2P profits

7th May 2014 09:20

by Holly Black from interactive investor

Share on

"In 2010 I predicted that crowdfunding would never take off. And I was completely wrong."

Those are the words of Ayan Mitra, chief executive of crowdfunding platform CrowdBnk, which in its single year of operation has generated £910,000 of funding for small businesses. And CrowdBnk is not even one of the biggest players: Funding Circle has been arranging loans for small businesses for three and a half years, has lent more than £200 million in that time, and claims to have created around 6,000 jobs.

Going mainstream

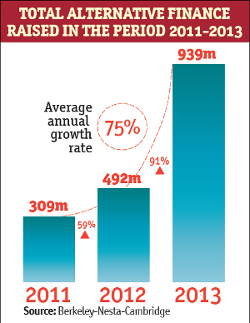

The peer-to-peer and crowdfunding landscape is changing rapidly. Just a few years ago many people had never heard of the concept of lending their cash to businesses and individuals to earn interest at rates that would outstrip traditional savings rates. But the market has expanded quickly, and with crowdfunding regulation now in force, P2P is heading into the mainstream.

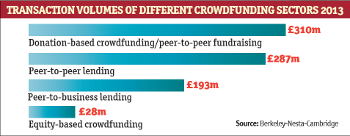

"It started off with bands getting money from their fans to fund CDs in the 1990s. Essentially, it is about going to your community for support," says Mitra. But that is not really where the opportunity lies today. There are two main strands to this sector: equity-based crowdfunding and P2P (also known as debt-based crowdfunding).

Equity crowdfunding involves a business or venture raising capital. A target sum is acquired by raising small amounts from a number of individual contributors.

Mitra says at CrowdBnk a typical investment will be of around £200 for retail investors and up to £20,000 for high-net-worth investors and venture capitalists. There is specific company risk as the investor is actively choosing the project he wishes to back.

Donation crowdfunding offers less conventional returns, usually in the form of the product you have helped to back, depending on how generous you have been. A £10 donation to the Colombian Coffee Company on Crowdbnk, for example, will get you one thank-you email and a free coffee. Invest £1,000 and the founder will take you out to dinner.

P2P works more like a conventional loan, with a person or business borrowing capital on one side and an individual lending it on the other. Lenders earn interest and lend for a fixed period. The interest rate varies between P2P platforms and depends on the riskiness of the loan, which is determined by the amount borrowed and the borrower's creditworthiness.

But someone looking to borrow £5,000 to finance the purchase of a car, for example, will not get that entire sum from one lender. Mat Gazeley, head of communications at Zopa, one of the pioneers in this field, explains that money lent out is diversified into hundreds of mini-loans. You might have £10,000 to invest, but it will only be given to individuals in amounts of £10 or £20 to minimise risk.

Pioneered in the UK

Zopa lenders can see how the money they've loaned has been divvied up, the interest rate they are getting on each mini-loan, and even the age and location of the person who has borrowed from them and what their loan is for. All these details are factored in to give an overall average - or blended - interest rate, which one user (see box on page 27) told us equates to 4.5% a year.

The UK has the most advanced P2P sector, according to Christine Farnish, chair of the Peer-to-Peer Finance Association, a self-regulated body made up of P2P companies. "It started here and the companies here are more innovative. The US is not as diverse in terms of customer base or variety of product," she says.

And as people become more comfortable with the idea of carrying out most of their finances and transactions online, the opportunity for this sector increases. "eBay has helped. Since it began, the whole element of trust and community has really taken off, while people have lost trust in traditional lenders," Gazeley adds.

The first cohort of lenders were "young, tech-savvy people", but Gazeley says Zopa's customer base has now evolved a more mature lender profile - typically in their 50s and lending around £5,000.

But concern has been expressed that lenders are not entirely clear what they are getting into. Zopa's percentage of bad debt is just 0.6% over its lifetime, but this is not a sector without risks.

P2P and crowdfunding are not covered by the Financial Services Compensation Scheme, so if you lose money on your investment, that money is gone. The peer-to-peer lender is effectively an arranger sitting between a borrower and lender in a transaction. Unlike a bank or building society, it holds nothing on deposit and is not obliged to protect your investment - though some do so to a degree.

People have lost trust in traditional lenders" Mat Gazeley

P2P lender Ratesetter, for example, has introduced a "provision fund" to protect lenders against occasional defaults or late payment. This has "ensured every lender receives every penny of their money - a 100% record, unique in the P2P sector," says chief executive Rhydian Lewis.

However, steps are being made to improve confidence in the industry. From April the Financial Conduct Authority is introducing regulation to bolster the checks in place across the sector.

Equity-based crowdfunding is already regulated and the FCA considers it generally unsuitable for retail investors. From April, unsophisticated or non-high-net-worth investors will be able to invest no more than 10% of their portfolio. But it is not yet clear how this rule will be enforced.

As far as P2P is concerned, according to Farnish: "The UK is starting from scratch, rather than trying to fi t it into existing legislation, and that is a good thing." The first aim is to ensure investors receive clear information about the business they are investing in, and extra protection. The FCA, which is focusing on P2P lending in its plans, says consumers will receive an explanation of the key features of a loan. A creditworthiness assessment for borrowers will provide a further degree of safety, as will a 14-day cooling-off period during which a borrower or lender can withdraw from an agreement without penalty.

Christopher Woolard, director of policy, risk and research at the FCA, said in a statement: "Our rules provide clarity and extra protection for consumers, balanced by a desire to ensure firms and individuals continue to have access to this innovative source of funding."

While that is essentially a good thing, Stuart Law, chief executive of Assetz Capital, points out that smaller firms are likely to flounder under the weight of the administration.

"Well-established, credible P2P firms will have no problems adapting to the new regulations, and I'm confident we meet or exceed the recommendations already. But for small lending platforms it will be an enormous drain on resources," he says.

Gazeley agrees that tougher rules should build "an added element of trust". "Being regulated," he says, "means we can do a lot more, such as qualifying for ISA inclusion."

But obstacles remain for the sector. The market is praised for its rapid expansion, but some critics fear it is reaching saturation point. An abundance of investors offering up capital for borrowers means interest rates are coming down on P2P loans, while a plethora of equity-based crowdfunding projects means many businesses struggle to meet their targets.

A scroll through CrowdBnk's website shows the extent of this latter problem. With just 33 days of funding time left, music business Mash Machine had raised just 6% of its ambitious £1.5 million target, while acupuncture venture DIYacu.com had achieved only 11% of its £20,000 target with three days to spare. Many businesses raise nothing. There are opportunities for investors and entrepreneurs in this arena, but the industry is changing quickly, so investors need to keep their eyes open.

For Christian Gardner of Lowes Financial Management's view on P2P lending, read: Viewpoint: Is it time to give peer-to-peer lending a chance?