London office space leads recovery in property sector

20th June 2014 11:21

by Sam Barrett from interactive investor

Share on

In April one of the City of London's iconic buildings, the Gherkin, went into receivership. Given its status as a symbol of the financial services industry and one of the most internationally recognised landmarks in the UK capital, this might have seemed to suggest that the commercial property market was in trouble.

But while the episode does illustrate the risks inherent in the property market, the Gherkin's financial pickle was more to do with interest and exchange rates than lack of demand from occupiers.

In fact, the London office market is in rude health once again, spearheading a recovery in the commercial property sector that is spilling out from London to the regions.

Commercial property

There has been a resurgence of interest in commercial property over the past 12 months, as businesses have started expanding again and investors perceive a healthy upside.

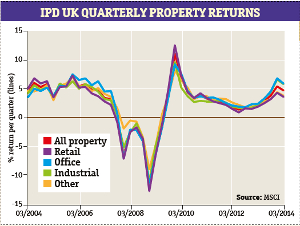

The sector got off to a strong start in 2014. The IPD UK Property Index showed a total return of 1.6% in March, and 3.9% in the first quarter.

Phil Tily, IPD's head of UK and Ireland, says: "The broader UK commercial real estate market continues to show signs of recovery and growth, with March proving to be the strongest month of 2014 so far."

Capital values recorded in the IPD index have risen for 10 consecutive months, with growth of 6.8% over that period, although the index is still some 30% below the peak in 2007 before the financial crisis.

Over 12 months, commercial property has seen total returns of 12.7% - easily outperforming hedge funds, shares, commodities, bonds and even prime central London houses, according to James Roberts, head of commercial research at Knight Frank.

That summary hides a more complex picture, though. Of the three main subsectors that make up commercial property - office, industrial and retail - the last is undoubtedly still the weakest link. Shops have been struggling to recover from the carnage on the high street that took place during the recession.

But even there, the outlook is improving. This is a direct consequence of growth in consumer spending. As Savills recently summed up: "2014 will be a year of improving optimism and declining savings ratios. There will be more money spent on the nation's high streets, shopping centres (and computers), but confidence will remain fragile."

Regional disparities

The positive index figures also mask regional disparities. Central London has led the way so far, with rents for prime office space in the West End and City soaring by 20% during 2013.

But that's expected to ripple out to the rest of the country during 2014, as demand from occupiers grows in the face of limited supply of new offices. Savills tips Cardiff, Leeds and Birmingham as three of the regional cities best positioned to benefit.

For investors, the consensus is that the overall outlook for 2014 remains buoyant. A number of forecasters were predicting overall returns in double figures at the start of the year. Among the most bullish is George Shaw, manager of the - purchased in March by Standard Life - who recently upgraded his total return forecast from 11.5% to 15.5%.

"Demand for central London assets, both retail and offices, will remain strong in 2014," says Shaw. "Yield compression in regional markets is also expected to continue, and the scale will depend on the extent to which buyers unable to secure assets in central London switch their focus to these alternatives," he adds.

James Roberts at Knight Frank is also bullish; he says that with the rebound well underway, investors need to look to the periphery to get the best returns. "In search of value, investors now need to get their hands dirty, looking at those assets that have in recent years been the "PIIGS" [Portugal, Italy, Ireland, Greece, Spain] of UK property," he says.

These are assets, he explains, "that became distressed due to the severity of the 2008-2012 crisis, but thanks to a return of normality are now looking oversold".

For the private investor, commercial property has a number of important attractions as an asset class. "We see it as an important form of diversification in a client portfolio, alongside equities and fixed income," says Patrick Connolly, head of communications at AWD Chase de Vere. "Commercial property has different dynamics but it can offer consistent long-term returns, particularly through the income stream."

"It's certainly a way to reduce volatility in your portfolio and in many ways is a better proxy for the domestic economy than equities," adds Jason Hollands, managing director of communications at Bestinvest. "If you look at the FTSE 100, some 77% of revenues are earned outside the UK, and 30% in emerging markets."

Of course, buying individual properties on anything but the very smallest scale is not an option.

Property fund and trust options

For most investors, property funds are the favoured option. There are several choices to be made, between funds that invest directly in property - so-called "bricks and mortar" funds - and those that invest in the shares and securities of property companies; and between open-ended funds (unit trusts or Oeics) and closed-end vehicles such as investment trusts or more specifically, real estate investment trusts (Reits).

Open-ended funds are the mainstream choice. Their chief disadvantage is liquidity: if many investors want to sell their units at the same time, it is not easy to dispose of properties quickly to repay them.

The classic instance of this problem involved the New Star UK Property unit trust, which had to halt withdrawals at the end of 2008 when the market crashed.

Demand for central London assets, both retail and offices, will remain strong in 2014"George Shaw

As a consequence, most property unit trusts are sitting on 20-15% in cash or other liquid assets today, which dilutes the return (though it may also reflect the difficulty of finding good-value buildings to buy when there's an influx of cash).

Closed-end funds don't suffer from the liquidity issue, as you can exit simply by selling the shares at their current market price; but these are therefore more volatile, and at the moment many are priced at a significant premium to asset value, which is a deterrent to investment. Values are also likely to plummet in a downturn.

And for all the double-digit total returns being trumpeted by forecasters, you're unlikely to achieve that as a retail investor, thanks to manager charges and dilution. A return of 7% comprising 4% capital growth and 3% income yield is more realistic, says Connolly.

Investing in a basket of property shares via a fund is also possible. is the main UK-focused option available. Over the 12 months to 31 March it provided a stellar 23% return.

But Connolly says: "We don't think funds investing in property shares offer the same diversification or income stream as bricks and mortar funds."

Last year's return - also enjoyed by many of the property Reits - may also prove a one-off boosted by the kick-off of the recovery cycle, so don't expect spectacular returns; but as the economic recovery continues, property should provide the steady growth and income it has done in the past.

Three fund picks for property exposure

Money Observer Fund Award 2014 winner is the first pick of both advisers among bricks and mortar UK funds. It has returned 8.7% over 12 months, and 18% over three years with a yield of 3.9%.

"It has a very good team, and the portfolio has a bias towards London and the South East, which we like," says Hollands.

For a fund that looks beyond the UK, he picks the recently launched , which made its debut in January.

It has the same management team as F&C's existing property funds, and Hollands says: "We like the fact that it can also go short."

Among investment trusts, the issue is that most UK-focused trusts are trading at a premium to their net asset value, never a desirable situation for an investor.

Ben Willis, head of research at Whitechurch Securities, says he favours F&C UK Real Estate. "F&C has an established track record of investing in property and as a group is responsible for managing over £5 billion in UK commercial property assets," he points out.

The trust focuses on investing in direct bricks and mortar commercial property, he says, and offers a 6% yield. Although it is on a premium, this is currently under 4%, compared to others in double digits.