Trust Awards 2014: Private Equity

14th July 2014 09:54

by Fiona Hamilton from interactive investor

Share on

Winner: HarbourVest Global Private Equity

is a large, diversified private equity fund of funds, which has achieved creditably steady progress since its December 2007 launch.

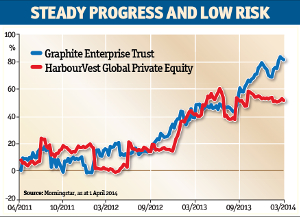

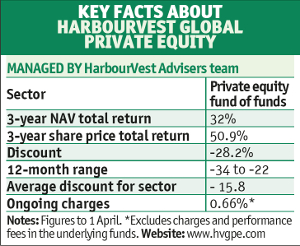

As with most other private equity trusts, it made only modest gains over the past 12 months, but its three-year net asset value (NAV) returns have been consistently above average.

It offers a relatively low-risk way for investors to diversify their portfolios with some private equity exposure. The share price discount to NAV has contracted over the past three years, but there is scope for further narrowing if the manager's efforts to improve liquidity in the shares and gain a premium listing on the London Stock Exchange come to fruition.

Its prime focus is on the US, where private equity is most firmly entrenched, but it also invests in other regions and has offices in London, Hong Kong, Tokyo, Bogota and Beijing, in addition to its headquarters in Boston, Massachusetts.

The fund's comparatively steady progress has been achieved by investing in a range of HarbourVest funds, which themselves have well-diversified portfolios of funds and direct investments. As at end the of March the investment split by geographical category was 67% US, 22% Europe, 6% Asia Pacific and 5% rest of world.

The three largest sectors in the portfolio are medical/biotechnology, consumer products, media/telecoms. By portfolio vintage 14% of investments were made before 2005, 54% between 2005 and 2010, and 32% subsequently.

The managers target a total return of 5% more than the MSCI World index over the investment cycle. To maximise chances of achieving this, the fund is almost invariably fully invested, with some gearing and a substantial pipeline of forward commitments.

The portfolio is currently valued at $1.26 billion and is 4% geared. The investment pipeline is valued at a demanding $565 million, but this is substantially offset by cash and a credit facility to 2018, which together total $448.7 million.

The company is keen to obtain a premium London listing, but to do so it needs to enfranchise all its shares. This is impossible if the majority of shares are in US hands. It is hoped the listing will be gained by the end of 2014. This should secure entry to the FTSE All-Share index, stimulate demand and help reduce the discount.

Highly commended: Graphite Enterprise Trust

Well-diversified, with stakes in 374 underlying companies, is very similar to the category winner. It also has a well-established manager and achieved creditably steady gains in recent years.

It differs most significantly in that only 15% of its assets are in North America, with the rest split between the UK and continental Europe.

It entrusts nearly three quarters of its assets to funds run by third-party managers, including Cinven, Permira and CVC Capital Partners. Graphite is happy to pay up for third-party managers with good pedigrees in specific sectors.

Graphite Capital, which has managed the trust since its 1981 inception, specialises in funds investing in UK mid-market investments, which make up the remainder of the trust's portfolio.

GPE is very conservatively run. Around 10% of its assets are usually in cash, and its underlying investments are mainly in mature, profitable companies with stable revenues and cash flows. Despite the drag on returns from holding cash, the trust has been well ahead of the FTSE All-Share index over most periods.

More than half its investments by value have been made since 2010 and this could act as a brake on returns over the next year or two.