Fund profile: BlackRock World Mining Trust

18th July 2014 09:00

by Rebecca Jones from interactive investor

Share on

Strong management, innovation and increasing income has made a consistent outperformer over the past decade despite turbulent commodity markets.

Launched in 1993, BlackRock World Mining Trust has survived more commodity market cycles than its current manager Evy Hambro cares to remember.

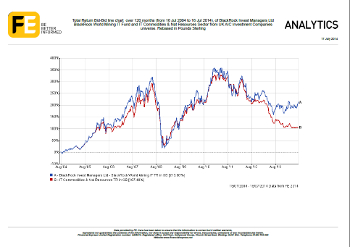

Age and experience, however, have served to bolster both manager and trust with BlackRock World Mining returning over 600% since its inception compared to an average return of around 300% from the commodities and natural resources sector.

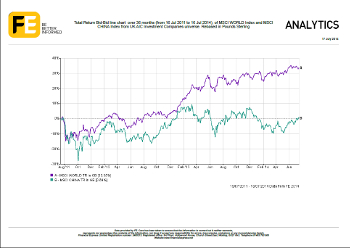

The trust has also enjoyed first quartile performance over 10, five, three and one years, and year to date it has returned 8.8% compared to a loss of 1.3% from the sector and a gain of just over 6% from the MSCI World Metals and Mining index.

Bumpy ride

That, however, was a picnic compared to 2008 - the inauspicious year before Hambro took over - when the trust notched up losses of over 61% compared to an average 53% decline in the sector and 47% loss in the MSCI World Metals and Mining index.

Last year was also a disappointing one for commodities as markets turned sour on producers due to concerns over exuberant capital expenditure and the subsequent over-supply of materials just at the time the world's largest consumer of commodities, China, was slowing its consumption.

This meant another loss-making year for BlackRock World Mining; although at 17.5%, losses were nearly half that of the sector, which shed an average of 33% in 2013. However, Hambro is confident that last year marked the worst of the current market cycle.

"Since June last year the mining sector has done better, and in our view June was the trough of the downward leg of the cycle. We're looking at a lot of the signals compared to previous cycles and seeing a clear pattern developing that shows things are starting to turn around," the manager says.

These signals include the well-publicised re-structuring happening within the large mining companies such as , and which have all cut capital expenditure and expansionary activities in favour of cost saving and repaying shareholders through dividends.

Subsequently, the over-supply that concerned markets last year is beginning to be addressed and, according to Hambro, reduced production volumes are now being reflected in prices as markets expect some commodities to move into deficit over the next few years.

Copper pipe dreams

Occupying nearly a quarter of the trust's portfolio, copper is by far Hambro's biggest bet on a single material as the manager believes that copper producers present good value in current markets.

"In our investment process we first look top-down at the commodity fundamentals examining where we think prices are likely to trade over the next few years and over three to 10 years we think that copper will be well supported and potentially even trend higher. In the second stage of our process we look for value and again, copper fits this criterion," he says.

"Chinese demand for copper is lower in terms of the rate of growth, but the amount it consumes is far higher. For example, if China was consuming a million tonnes of copper and growing at 10%, it would need 100,000 tonnes of additional material, but if it's growing at 5% and consuming 4 million tonnes then it needs 200,000 tonnes.

"That's what people tend to confuse; they see a lower GDP number in China and think 'Oh, well this is bad for commodities', when actually a lower rate of growth is actually fantastic for commodities demand," he says.

The trust's largest overall weighting is in diversified suppliers including Rio Tinto, BHP and Glencore, which make up 40% of the portfolio. Outside of this Hambro has around 10% in gold, 5% in silver and the remainder in nickel, zinc, diamonds and platinum.

Hambro does not, however, have any direct exposure to aluminium as he does not like the price outlook given the current oversupply.

Increasing income

The trust's recent performance has also been bolstered by its income drive, which the board of BlackRock World Mining implemented in 2011 as a way to narrow the trust's discount, which had averaged around 15% since launch.

"Three years ago, rather than reducing the share capital to reduce the discount, instead we looked at whether we could increase demand. We looked at the portfolio, saw income coming in and thought 'Well, let's see if we can get to a 3.5% dividend yield as that seems to be where the investment trust sector trades on a discount of 5% or less'," Hambro explains.

This strategy paid off; the trust is now yielding 4.3% and its discount has narrowed from 17% in 2011 to just 3.8% today.

The large proportion of this income is derived from the trust's dividend-paying stocks, however Hambro also uses derivatives, fixed income instruments paid for through gearing and, more recently, single mine royalties to make up the deficit.

Despite the success of this strategy, however, Hambro insists that growth remains his chief aim.

"The board has been very clear that our primary goal is capital growth and that the income is an outcome of the portfolio and what is going on in the sector. So we're not chasing yield as a primary consideration, we're chasing the capital growth first," he says.