Share Sleuth's August Watchlist

12th August 2014 09:00

by Richard Beddard from interactive investor

Share on

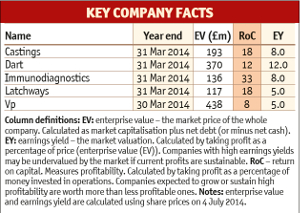

Each month Richard Beddard trawls through annual corporate results for his Watchlist and the Share Sleuth portfolio of companies that satisfy key valuation metrics such as earnings yield and return on capital - and profiles the most interesting candidates.

This month, machining group Castings' strength in Europe is key to the firm, with new emissions rules boosting truck sales and hence Castings' revenues, which increased 12% to March 2014. The company's valuation makes it good long-term value for resilient investors.

Another company growing its revenues is diagnostic firm Immunodiagnostics Systems, despite facing obsolescence in recent years. IDS is currently re-inventing itself, making it risky for investors, but its valuation looks a good price for a successful, established company.

Castings

increased revenue by 12% in the year to March 2014, catapulting the company beyond its high two years earlier. Profit increased by 15%, just short of 2012's high.

But the automotive industry is rather unstable. Big customers such as DAF and BMW exert downward pressure on part prices and seek value around the globe, while demand falls during recessions and economic stagnation. Steel and alloy price rises can squeeze profits.

However, Castings has fashioned stability through self-reliance. Its strategy starts with a cash pile, £28 million at the end of March 2014, which enables it to deal with fluctuating demand and also invest in technology that enables it to provide a superior service. It is able to rapidly prototype and validate new designs using 3D printers and scanners, for example.

Quality and service foster long-term partnerships on favourable terms, which may explain the company's profitability, while some of Castings' success may be due to the trend towards sourcing from foundries in Asia going into reverse. Castings says in Europe, where most of its revenue is earned, it wins on price, quality and service.

The firm is valued at about £193 million, so it is probably still good value for long-term investors who can tough out inevitable downturns. That's about 12 times adjusted 2014 earnings, an earnings yield of 8%.

Dart

full-year results ought to have been cause for celebration, but they seem to have precipitated a capitulation.

Revenues in the year to 31 March 2014 rose by 29%, and adjusted profit increased by 25%. Dart's net financial obligations reduced. Compared with the previous year, almost twice as many holidaymakers flew with Jet2holidays, the company's package holiday business, which boosted its leisure airline, Jet2.com.

However, Dart's third and smallest business, food distributor Fowler Welch, performed less well because of unexpected fluctuations in demand from supermarkets. The company's shares fell in value by 23% on results day.

Weaker-than-expected demand for leisure travel this summer may, says the company, be due to the weather, the World Cup or economic stagnation in the north of the UK, where Dart's airline, Jet2.com, is based. Whatever the reason, it will dent Jet2.com's growth in 2015.

As yet mostly unrecognised losses on derivatives contracts designed to hedge fuel prices and foreign exchange risk were large enough to wipe out profit so far this year, despite Dart's good operational performance.

Additionally, the rejection of Dart's appeal against a ruling that it should pay compensation to a delayed traveller means airlines may now be required to compensate travellers when they are delayed by technical faults.

That said, Dart occupies distinctive niches, albeit in competitive markets. Jet2.com and Jet2holidays operate exclusively from the north of the UK and provide affordable flights, accommodating flight times, generous baggage allowances, seamless connections and friendly service.

Financial complexities make valuations difficult, but a share price of 195p provides a margin for error. This values the enterprise at £370 million, only about eight times adjusted 2014 earnings. The earnings yield is 12%, enough to entice bargain hunters attracted by the possibility that traders have overreacted to bad news.

Immunodiagnostics

5% increase in revenue and 3% rise in adjusted profit would not be especially noteworthy were it not for the fact that the company has faced obsolescence in recent years.

The firm manufactures manual testing kits for determining vitamin D levels in blood. The vitamin D test, or assay, is increasingly being offered on automated platforms that carry out an array of other tests. As suppliers convert assays for their automated platforms, laboratories are using them in preference to manual kits.

IDS's response was to develop an automated platform in 2009, IDS-iSYS. This brought in 21% of revenue in 2013 and 43% of revenue in 2014, more than manual testing kits. Profitability is at the lower end of the firm's historic range, but it still earns a handsome return on capital, and it has no debt and good cash flows.

To make its platform more desirable, IDS is developing a smaller, more efficient version of IDS-iSYS and introducing more assays. The more there are, the more useful the instrument is, encouraging more laboratories to install it.

IDS placed fewer units, net of returns, in 2014, and much depends on its plan to grow outside of the US and Europe; but it may finding a niche for itself in small and medium-sized laboratories.

A share price of 540p values the enterprise at about £136 million or 12 times adjusted 2014 earnings. The earnings yield is 8%. That's a good price for a successful, established company, but IDS is re-establishing itself, making it more risky.

Latchways

By its own standards, , which reported full-year results earlier this month, performed poorly in the year ending in March 2014. Revenue fell by 9%, adjusted profit dropped by 29% and the company's cash surplus shrank marginally. The firm is still profitable though.

In the UK, where it earns 46% of revenue, Latchways was hit by a decline in construction-related spending and the end of a significant Airbus contract. However, it expects business to improve.

Latchways develops and manufactures the ManSafe brand of fall protection systems, lifelines for people working at height, or climbing to or from high work operations. Some of its systems arrest a fall, while others prevent people at risk of falling from getting too close to a drop.

The company says it is the industry's leading innovator and that 40% of its revenues come from patented products such as the Latchways Transfastener, which enables users to move along a cable without detaching and reattaching karabiners. Latchways says cable systems are more discreet, easier to route around irregular buildings and require fewer components than trackways, and they're more durable than rope systems.

Latchway's strengths - high service standards, close customer relationships and innovative products - should enable it to make a profit and resist competition, but are insufficient to entirely overcome a downturn in UK construction. That's why it is trying to expand in North America, where revenue grew by 60% in 2014, and also in emerging markets.

Disappointingly, Latchways' share price has drifted sideways for a few years, without creating obvious value for new investors. A share price of 1,100p values the enterprise at £117 million or about 18 times adjusted 2014 earnings. The earnings yield is 5%.

Vp

revenue rose by 10% and adjusted profit by 8% in the year to 30 March 2014, and the firm seems to be preparing for growth.

The plant and tool hire company aims to capitalise on improvements in the UK and European economies, as well as relatively strong demand from the housebuilding, infrastructure and water sectors.

The company has avoided the boom and bust cycle that has bedevilled some rental companies. Through its ownership of diverse businesses - some in niche markets such as water, transport and oil and gas that experience different cycles from the construction sector - it has managed to be consistently and comfortably profitable.

Vp's returns depend partly on leverage. But as long as Vp remains profitable and stable, it can easily afford the interest payments. Its ownership is one of the keys to stability. The executive chairman owns 50% and has been a director since 1979. Senior management bonuses are linked to relatively long-term goals (at least by the standard of most listed companies): a return on average capital of 12% and three-year earnings per share growth.

But Vp's reputation is also strong in the stock market. The current share price of 665p values the enterprise at £438 million, about 22 times adjusted 2014 earnings. The earnings yield is 5%.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.