Shares with an income bent

8th October 2014 11:15

by Heather Connon from interactive investor

Share on

One of the key requirements in retirement is a decent level of income - something that is hard to find as interest rates stay stubbornly low and inflation relatively high.

One of the few asset classes that can still offer inflation-beating returns is equities.

More than 80 FTSE 100 companies currently yield more than the 1.6% rate of the Consumer Prices Index (CPI), and more than 60 are above the higher Retail Prices Index (RPI), which stood at 2.5% in July.

Spoilt for choice

Expand the universe of shares beyond the 100 largest companies to the rest of the stockmarket, and investors looking for inflation-beating yields are spoilt for choice.

Investing in equities is not risk-free, of course. First, there is the risk that the share price will fall, producing a capital loss that may more than offset the attractions of the income yield.

With the UK and US markets close to all-time highs, or even setting new ones, a number of commentators are warning that shares are now due for a correction.

Second, companies can - and do - cut their dividends, so the income from equities is not guaranteed.

But investing in equities should be for the long term, and all the research indicates that over most five-year periods, shares not only perform better than other assets but also provide returns well ahead of inflation.

The best long-term performance tends to come from companies that pay healthy, reliable dividends.

We outline two strategies, one based on high yields and the other on dividend growth, which can be used to build an equity portfolio with a yield above the rate of inflation.

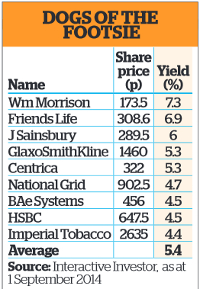

Dogs of the Footsie

Regular Money Observer readers will be familiar with our Dogs of the Footsie strategy. It is very simple to operate: the portfolio is created by selecting the 10 highest-yielding stocks in the FTSE 100, investing an equal sum into each and holding them for a year.

Online stock filtering tools, such as those available on Interactive Investor, can be used to create the basic list, but remember that these are based on historic rather than forecast yields, so you should then exclude any companies that have already warned that their dividend will be cut.

The generous dividend offers compensation in the meantime. Of course, a high yield can be a warning that the dividend is about to be cut and that has happened to some of the companies in previous Dogs portfolios.

However, in many cases, the actual cut leads to a bounce in the share price as investors conclude that the worst is over - and the yield may still be decent even after the dividend falls. Spreading the investment over 10 shares means that dividend increases from some companies compensate for cuts elsewhere.

The strategy has been very successful, beating the wider FTSE 100 over the past one, three, five and 10 years, based on statistics up to the last portfolio update.

The simplicity of its screening, using just one financial ratio, means it is very easy to replicate, and because it is based on a "buy-and-hold for 12 months" strategy, investors can start it whenever they choose.

The current Dogs include a mixture of food retailers and utility companies. Large supermarket groups such as and are currently struggling from the impact of discounters, online shopping and over-investment in large megastores: indeed, these stresses have already forced a dividend cut at market leader , excluding it from the Dogs list. Some are also questioning whether Morrisons' payout is sustainable.

Overall, however, the portfolio yields an average of 5.4% - more than three times CPI inflation and double that measured by RPI. That is high enough to offer a good level of protection against future dividend cuts.

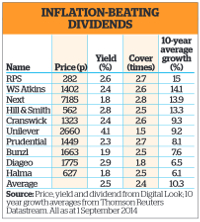

Dividend growth

The second strategy is to choose companies with a long record of increasing their dividends by more than the rate of inflation. We have used 10 years as our benchmark, but you can pick any time frame - the US Dividend Aristocrats index includes only those companies with a 25-year record of dividend growth.

Of course, there is no guarantee that companies that have beaten inflation with their dividend increases for 10 years will do the same over the next decade. It is important to consider factors such as dividend cover, the potential for earnings growth and general economic conditions, as well as historical records.

We then assessed these companies based on considerations such as dividend cover, cash-flow generation, analysts' opinions and the outlook for profits, to assemble a portfolio of 10 shares with a record of consistent dividend increases for at least a decade. We have excluded investment trusts.

It is a varied list, ranging from the consumer food giant through to agricultural business and environmental engineer RPS (RPS). The yield on the portfolio is lower than that for the Dogs, at 2.5%, but is still in line with RPI and well ahead of CPI inflation. The average 10-year dividend growth rate, at 10.3%, is well ahead of the average inflation rate over that period.

Dividend cover for all the companies bar Unilever and is above two times, but we are happy to include those two. Both have broad international strength, while Unilever has excellent emerging markets business and commitment to dividends, and Diageo offers stable earnings and a defensive business.

, the retailer, only held its dividend in 2009 so, although the 10-year average is good, it did not increase every year. We have decided to include it, however, because of its strong cash flow and commitment to regularly returning cash via share buybacks and special dividends.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.