What you really think of Royal Mail shares

10th October 2014 09:04

by Lee Wild from interactive investor

Share on

It's hard to believe that a year has passed since the controversial IPO. In that time shares in the letters and parcels giant have soared and fallen. But, crucially, they remain significantly higher than the 330p float price. To celebrate, Interactive Investor has carried out a survey to see what investors now think of Royal Mail shares, and what they would do next.

But before we look at the results, it's worth recapping on the circumstances that form the backdrop to the poll.

In less than a month, punters lucky enough to subscribe for Royal Mail shares at the IPO price could have banked an 80% profit. At their peak in January (618p) they had rocketed by 87%. Even now, falling steadily since the spring, so-called Sids are currently sitting on a paper gain of 22%; not bad.

Of course, that early success was always going to spell trouble for business secretary Vince Cable and his handling of the float. Bankers came in for heavy criticism, too - there was clearly an incentive for advisors who were also buying a stake in Royal Mail to gives the shares away cheaply.

It was reported at the time that JP Morgan told ministers they could have got £10 billion for the postal business, about three times as much as it eventually received (not including £800 million of debt). An informal review launched this summer into the way government handles future IPOs is ongoing.

Still, what's done is done, and a 37% plunge since February to 402p has returned the business to more realistic multiples. An average of the analysts we polled puts Royal Mail on a forward price/earnings (P/E) ratio of 12.2 with a prospective dividend yield of 5.5% for the year to March 2015.

(click to enlarge)

Serious headwinds remain, however, not least intense competition at the parcels business. The company and rivals have already warned on this and both and TNT Post, in particular, pose a real threat. It's just put by £18 million to cover a big fine from the French regulator, UK industry watchdog Ofcom is investigating Royal Mail's pricing structure, and mail volumes continue to fall. The company remains incredibly inefficient, too, and high fixed-costs mean a 1% drop in revenue can wipe out profits by 14%.

On the flipside, results for the six months to 26 September are due on 19 November, which could reignite interest in the shares. Given that the third quarter includes the crucial Christmas period - the postal firm’s busiest time of the year - any comments on industry trends could be hugely significant. Royal Mail generates lots of cash, too, and costs linked to its modernisation programme will drop out in time, underpinning dividend growth.

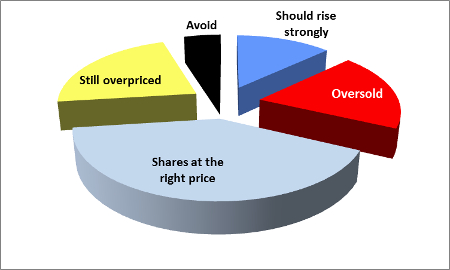

So, what did you make of it? Incredibly, three-quarters of those who took part in our survey thought the sell-off had gone far enough and that Royal Mail shares were, at the very least, "at the right price." Among the most bullish, 13% were "very positive" on the outlook and believed the share price should rise strongly. Another 19% said the shares were oversold, but acknowledged that the company faces challenges.

Not everyone was so confident. Over a fifth of respondents still thought Royal Mail shares were too expensive, implying they had further to fall, and 5% would avoid the stock completely.

(click to enlarge)

Whatever your opinion, Royal Mail shares remain incredibly popular and consistently rank among Interactive Investor’s most-traded stocks. Around half of new Royal Mail investors also continue to hold the shares.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.