The Insider: City deals uncovered

15th October 2014 13:16

by Lee Wild from interactive investor

Share on

Synthomer slump overdone

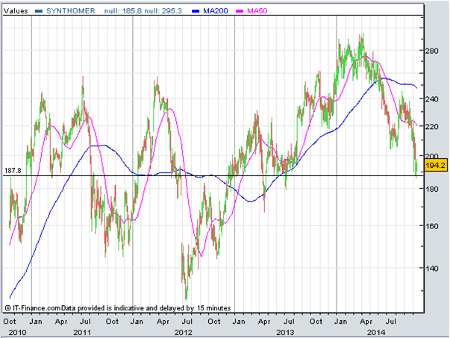

share price has slumped by a third since April, even after reassuring in August that full-year results would be no worse than last year. Clearly, the fear is that Europe, where the specialty chemicals company makes a large portion of its profits, is heading back into recession.

But as the share price approached a key level of technical support at just under 190p, non-executive director Dato' Lee Hau Hian piled in and spent almost half a million pounds building up his stake.

On the board for 20 years, he snapped up 252,000 Synthomer shares - 108,832 at 195.8p and 143,168 at 194.8p. He now owns almost 66.4 million shares, or 19.53% of the company.

Synthomer's polymers are used by industry to improve everything from paint and adhesives to condoms and rubber gloves, but weak demand from the European construction industry, especially for flooring and coatings, has been a problem in the recent past.

But the company generates lots of cash and has just decided to cut the level of dividend cover from 3 times earnings to 2.5 times. The City now expects an 8p dividend for the full year, giving a prospective dividend yield of over 4%. But Synthomer may also sell unwanted land in Malaysia. If, as promised, it returns excess cash to shareholders - an estimated 5.5p per share in 2015 and 7p in 2016 - the forward yield rockets to 6.8% and 8.2%, respectively.

(click to enlarge)

Last months, Charles Pick at Numis Securities made Synthomer one of the broker's Top Picks. "With the revised dividend policy clarified, income funds will be attracted and ditto deep-value orientated parties," he wrote, upgrading his target price to 306p.

Long-serving CEO Adrian Whitfield announced in July that he would step down, but he will hang around until June next year, plenty of time to find an able replacement. Synthomer trades on less than 10 times forward earnings, dropping to just 8.3 for 2015. If, as Numis expects, earnings grow by 16% next year and 11% in 2016, the shares could be in better health when Whitfield hangs up his boots.

Ashtead tests support

Global stockmarkets are in disarray and confidence is low, but equipment rental company published record first-quarter profits just a month ago and full-year results are expected to exceed forecasts.

So is non-executive director Michael Burrow right to sell 80,000 shares at 924p a pop? Well, it's hard to blame him. The former managing director of the investment banking arm of Lehman Brothers Europe pocketed £739,000 from the sale. He has 20,000 left.

And Ashtead shares traded at record highs last month, up three-quarters in a year. But at 924p, Ashtead shares trade on a respectable 16 times forward earnings, dropping to less than 14 for the year to March 2016.

(click to enlarge)

"The shares are currently trading on a CY2015 EV/EBITDA of 6.8x, at the top of the historical trading range but at a rating we feel comfortable with at this stage of the cycle," said Barclays a month ago. Investec Securities reckoned further earnings upgrades are likely.

Of course, there's little Ashtead can do about negative sentiment around the wider stock market, and the shares are testing the 200-day moving average. But the business is a sound one and, barring any catastrophes, tends to do well at this time of year.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.