Fitful stockmarkets fail to impede progress in Growth Portfolio

20th October 2014 09:40

by Helen Pridham from interactive investor

Share on

Investment markets have been moving in different directions since the previous review. Some equity markets, such as those in the US and Asia, rose, while others, such as UK and European markets, fell. Bonds have been positive.

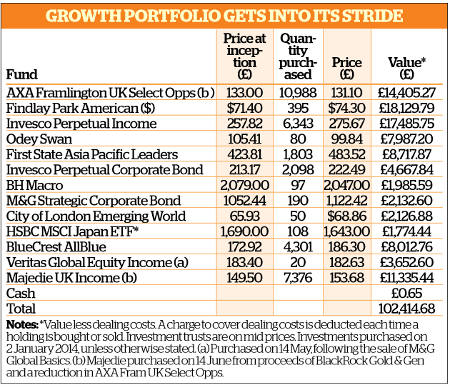

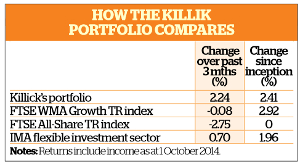

Killik & Co's hypothetical £100,000 Growth Portfolio has also been pulled in various directions, but in the end it has managed to achieve a healthy 2.2% gain over the quarter.

Considering that the FTSE All-Share index was down over the quarter while the FTSE Wealth Managers Association Growth index remained virtually static, the performance of the portfolio compares very favourably. One contributory factor was the favourable influence of currency movements on the portfolio.

To view the growth portfolio's holdings and trading chronology, click here.

Currency movements

Its largest holding, , is domiciled in Ireland and denominated in dollars. The dollar's strength versus sterling meant that, even though the fund's price fell by 2% over the quarter, the fund's sterling value rose by 3.7%.

The dollar has been rising steadily since May, reflecting the growing strength of the US economy. A strong dollar is not such good news for emerging market economies, however, as the strength of the US currency has gone hand in hand with lower commodity prices.

(click to enlarge)

This was one reason for the 3% fall in the fund's dollar price, although its sterling value rose. It could have done worse though, says Mick Gilligan, head of research at stockbroker Killik, as it benefited from its exposure to the Chinese market, which remained relatively strong.

He also points out that Findlay Park American, which now invests mainly in medium-sized companies and has dropped the "smaller companies" part of its name, has somewhat underperformed the US market recently, due partly to its remaining exposure to Latin America.

He adds: "The managers have also been holding around 10% of the fund in cash since early August, which hasn't helped either."

Large US holding

He is still happy to maintain this large US holding. He rates its investment team, led by James Findlay and Charles Park, highly, and he believes "the US economy is still the healthiest of the G10 (group of industrialised nations), and good company earnings are expected to be reported in a few weeks".

The portfolio's strongest performer in the third quarter was , a long/short fund and the previous quarter's back-marker. It has shot forward with a gain of 7.5%.

Gilligan points out that the reason it was not doing so well earlier in the year was that it has been aggressively "short" of the European markets (selling them without owning them, in the expectation that they were going down).

However this stance worked in its favour in August, as did the fact that it was also "long" the US and Japan (holding those markets in the expectation of price rises).

Opportunities

It invests in a combination of global macro and "relative value" trading strategies in bonds, interest rates and foreign exchange markets. As the prospect of interest rate rises increases, there are likely to be more opportunities for the trust to exploit.

Another strong performer over the quarter, rising of 7.1%, was . This year it has increased its exposure to India, where the stock market has performed well, especially since the election of the a new prime minister who has promised to boost the economy.

Rising investor confidence in Asia also reflects the fact that many countries there are exporters and are seen as beneficiaries of economic recovery in the US, where they may expect to sell more goods.

On the downside, three holdings in the portfolio fell during the quarter. The largest was which declined by 1.1%. Gilligan reduced his holding in this fund in June to decrease his exposure to medium-sized companies, which makes up more than a third of the fund.

However, it is still the third largest holding in the portfolio. Fund manager Nigel Thomas still believes the mid-cap area of the market is a fertile source of good investments, but says investors need to be patient.

Oil and gas exposure

The AXA Framlington fund, like another faller, , which dropped by 1.1%, has suffered from its exposure to oil and gas. The AXA Framlington fund has 12% invested in this sector, while Veritas has a 17.6% exposure to the energy sector generally.

Gilligan says: "The oil price has been incredibly weak lately due to fears about the global economy, which has dragged the whole sector down."

The other holding that suffered a slight fall was . Earlier in September the Japanese market had reached its peak for the year, but investors started to become more cautious at the end of the month on the back of worries about the global economy.

Gilligan describes himself as cautious about the future. He says: "The UK market looks weak technically. There has been a failure [of the FTSE 100 index] to go beyond 6900, despite several attempts in recent months."

Other reasons for his caution include a possible interest rate rise and unwelcome fallout from the general election next year. However, he has no immediate plans to adjust the portfolio to take account of either eventuality.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.