Quindell - doing things the hard way

10th November 2014 11:34

by Lee Wild from interactive investor

Share on

Last week, we questioned whether management team were insane. Well, the jury's still out, but the legal outsourcing firm certainly doesn't make things easy for itself. In the latest twist, what should have been two simple director share deal statements have required a 922-word explanation; ammunition, it seems, for sellers to drive the shares to 88p, a fresh 18-month low.

Clearly, Quindell must have been pressured by AIM to publish Monday's statement. While it is not unheard of for directors to borrow money to buy shares in their own company, or for them to use their existing shareholdings as security, it is certainly uncommon. It's complicated, too, which adds to the air of suspicion that swirls around the controversial business.

Joint house broker Cenkos Securities recognised the confusion over the structure of the purchase among investors last week. It issued this response:

1) the Directors have only currently transferred a percentage of their total holding as security (i.e. proportionate to the purchases)

2) we have confirmed that the executive directors are only using the loan to buy equity

3) the balance of the 52m shares could provide further firepower for share purchases or additional margin security if required

4) EFH cannot sell any stock unless the directors default

All three directors have therefore simply increased their shareholdings (and have not sold or "cashed-out" any stock).

On Monday, Quindell sought to clarify a couple of other issues.

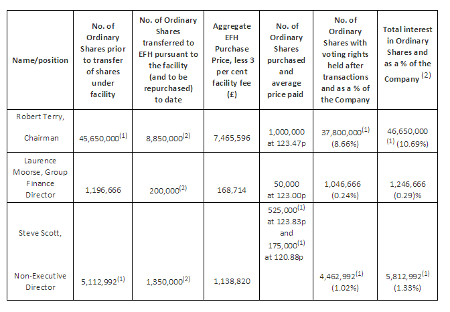

Of the shares transferred to Equities First Holdings (EFH), which is, in return, providing the funds for share purchases to directors, only some of the money has so far been used to buy Quindell shares. And Quindell has provided the following chart to demonstrate. Even this, however, requires some explaining.

(click to enlarge)

Let's use Rob Terry as an example. The table shows that he started by owning 45.65 million shares, of which 8.85 million were then transferred to EFH. EFH then took a 3% fee and handed the £7.465 million that was left back to Terry. So far, he’s only used it to buy one million Quindell shares at 123.47p.

It's the same for the other directors. They haven't spent all the money raised from this loan facility, which means they have a warchest for further share purchases.

"We have made this further announcement to ensure the market is aware of the actual number of shares transferred to date under the Agreements," said chairman Rob Terry on Monday. "Further announcements will be made when more shares are to be used to fund further purchases of Quindell shares in the future.

"For clarity, purchasing shares at the current valuation has been the motivation for entering into the Agreements. The Agreements are purely to provide funding for a two year term and I and Laurence intend to use the funds received under the Agreement to purchase Quindell shares and to cover any associated potential tax liabilities and margin calls relating to the Agreements, with Steve Scott intending to do the same and also cover certain other tax liabilities.

"The Agreements would not have been entered into if the board did not remain confident of meeting full year market expectations and of the company's longer term prospects."

Terry also repeated that directors "relied upon assurances" from EFH that is would not sell the Quindell shares under its ownership during the two-year loan period, or let them be used for short-selling purposes.

Cenkos says:

In our view these director share purchases this week, combined with the recent Aviva telematics win, and comments from the likes of RSA about the growth in industrial deafness cases, point towards a strong Q4 trading picture. The shares trading on a P/E of under 2x clearly do not reflect the fundamentals across any of QPP's business segments and we expect management to deliver on FY14/15 cash flow targets. BUY.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.