US bull market shows no signs of relenting - Asset allocation panellists

10th November 2014 12:57

by Jim Levi from interactive investor

Share on

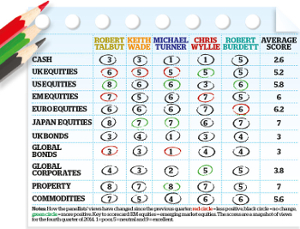

The "bad news is good news" paradox may apply in the UK, Europe and Japan, but it does not seem to apply in the US. Back at the beginning of September the S&P 500 index broke through the 2,000 barrier to an all-time high (though it has since retreated to below 1,900).

It means that overall, investors in US equities over the past five years have made a 180% return. It has been a long bull market, but as yet shows no signs of petering out. And the performance is supported by the underlying economic data, which shows the economy growing at more than 4%.

"The banking system is repaired, the corporate sector is performing well and the central bank seems to be in control of events," says Robert Talbut of Royal London. "I see no reason to become twitchy yet about US shares." Indeed, Talbut has now raised his score here from 6 to 8.

The US way

"The attraction of the US market is the stability it offers and its economic strength, but shares there are fully priced by most people's standards. There is better value elsewhere, but US quality might prevail in the coming months."

Interest rates in the US are expected to rise next year, but not by much. Weak commodity prices - notably oil and base metals - could keep inflation low and keep those rate rises to a minimum. Keith Wade of Schroders forecasts the rises will begin in June next year and rates will hit 1.5% by the end of the year.

Michael Turner of Aberdeen makes a broadly similar forecast. As Wyllie puts it: "Interest rate rises could be deferred because of low inflation, which means the central bankers don't have a gun to their heads."

Property

Four of the five members of the panel currently wax enthusiastic about property shares, and the average score has now risen to 7. Turner, raising his score from 7 to 8, sees evidence of institutional investors "piling into property". "The economy is stabilising, yields on commercial property are attractive. If it is right to be in equities, why should we be worried about people not paying their rents?"

Talbut now looks for rent rises as well as capital gains in UK commercial property. Burdett agrees we are "in a potential sweet spot" for property assets. "But we need the economy to continue to do well," he says. "We are seeing signs of rental increases, but property in the South East looks fully valued."

He describes the commercial property sector as a complex area to invest in. "It takes much longer to buy a building than to buy shares in BP, and you could not switch a portfolio easily from say retail property to industrial or office property." He keeps his score neutral at 5.

Overall, our panellists continue to favour equities over bonds. Turner stresses the importance of the global supply of liquidity in the financial system. "While the US and the UK are not yet raising interest rates, the US is now reducing liquidity in the system," he says.

"But this is being offset by possible growth in liquidity in Europe and Japan. Meanwhile the competition in the savings arena from bonds looks negligible. We are positive on equities, but not exactly gung-ho."

Chris Wyllie concurs: "The big story is still the absence of competition from bonds."Echoing the catch phrase of Margaret Thatcher, he believes "there is no alternative to equities".

The five panellists

Chris Wyllie is chief investment analyst of Connor Broadley, a financial planning and investment management firm with £200 million under management.

Rob Burdett is co-head of multi-manager funds at Thames River Capital, with £1.5 billion under management. It is a largely autonomous business within the F&C group, managing funds of more than £100 billion.

Michael Turner is head of global strategy and asset allocation at Aberdeen Asset Management, with £177 billion under management.

Robert Talbut is chief investment officer at Royal London Asset Management, with more than £40 billion of assets.

Keith Wade is chief economist and strategist at Schroders, which has £203 billion of assets under management.

Emerging markets

Robert Talbut complains that the emerging markets equities sector is becoming increasingly diffcult to score. "It is a very important sector in terms of its share of the global economy," he says, "but it is becoming an increasingly unhelpful label to put on a range of stockmarkets which are behaving very differently from each other."

An obvious example is the recent performance of the stockmarket in India, compared with that in Russia. While India has this year seen a 40% gain, Russia is down 20%.

"The prospects for India are very different from those in Russia, and you could similarly say the prospects in China are very different from those in the Middle East," he says. "There is no doubt there are some very attractive markets within the sector and the investor cannot ignore it altogether."

Most of our panellists favour Asian stockmarkets over Latin America or Eastern Europe. But there is also overall uncertainty about the effect of the rising dollar on emerging markets performance. In the past the strong dollar has not helped the sector, as US investors have been encouraged by their strong currency to repatriate funds back to Wall Street.

At Aberdeen, Michael Turner says: "Our emphasis in emerging markets has always been on Asia, whereas in Latin America lacklustre commodity prices are not helping." However, Chris Wyllie thinks the medium to long-term valuation case for emerging markets is still strong. "But there may be another air pocket for this sector to go through in the shorter term," he warns.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.