Sainsbury's warns on profits and dividend

12th November 2014 11:21

by Lee Wild from interactive investor

Share on

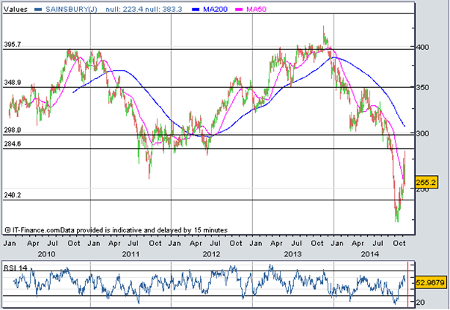

Sales and profits fell at during the first half. Add in a massive one-off charge and the supermarket lost £290 million in just six months. And despite cutting spending and slashing costs, the final dividend will likely be cut by a third. So, after surging by over a quarter since mid-October, it is little wonder the share price has turned lower.

Sainsbury's booked a non-cash impairment and onerous contract charge of £628 million for the six months to 27 September - £287 million relates to canned projects and the rest to loss-making stores - which reduced a £433 million profit in 2013 to a significant loss this time. Put that to one side, and the grocer's pre-tax profit still fell 6.3% to £375 million.

And second-half profits will be even lower. Management blames price cuts and a better performance both on costs and at its banking business in the first half, which will not be repeated over the next few months. Because it has decided to fix dividend cover at two times underlying earnings for this year and the following three years, the payout will fall if profits do.

The consensus estimate before today's results was for underlying pre-tax profit of £677 million in the year to March 2015, down from £798 million last year. "Our dividend for the full year is likely to be lower than last year, given our expected profitability," confirms chairman David Tyler.

According to broker Citi, that implies about a one-third cut to the final dividend, which last year was 12.3p. It would be 8.2p this year, giving a full-year payout of 13.2p, and a still-competitive dividend yield of 5%.

Overall, sales inched lower to £13.9 billion and dipped 2.1% on a like-for-like basis. Retail sales were flat year-on-year. And bosses admit that supermarket like-for-like sales in the sector will "be negative for the next few years."

That's hardly reassuring, but already understood by the City. More crucial is what Sainsbury's plans to do about it. And it does, at least, have "robust plans to address this challenge."

That includes an extra £150 million of price cuts in an attempt to fend off the threat from discounters Lidl and Aldi, and from other, more nimble rivals. Shoppers will see half of that come through in the second half of the current financial year. Under-utilised space - about 25% of the store portfolio - will also be handed over to non-food goods like clothing and homeware.

Alongside that, Sainsbury's will save half-a-billion pounds of operating costs over the next three years, or annual savings of £150-£175 million. Capital expenditure will be slashed to £500-£550 million a year for the next three years, too, equivalent to 2% of sales. It was £888 million in the year to March and £1.2 billion in 2012.

Citi likes the slight profit beat and remains positive:

Overall, we think resetting profit expectations lower while at the same time pulling back on space growth is the right move. We don’t think Sainsbury is being very bold on prices, a c£150 million investment pales in comparison to what Morrisons (MRW) announced, but perhaps what matters is how those price cuts are spread across the product lines.

However, some traders have their doubts. "Slashing stores and reducing costs may not be enough to warrant growth for Sainsbury's, as the likes of Aldi confirmed details of aggressive expansion plan, looking to double UK store numbers by 2022," says Avin Nirula at Accendo Markets. "The supermarket war continues."

We said last month that Sainsbury's is "no special case" and that it is not immune from the same problems which have afflicted each of its closest rivals. There is, however, anecdotal evidence that Sainsbury's is becoming better value compared with peers. The shares are, too.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.