Tactical Asset Allocator buys Japan as QE plans expand

13th November 2014 14:49

by Ceri Jones from interactive investor

Share on

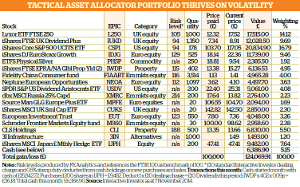

The tactical asset allocator portfolio is up over 3.7% this month - impressive progress, given that last month the climate was very uncertain. It begs the question: where next? Five years of gains in almost every asset class have left most investments looking expensive.

In the US, the S&P 500 has broken record after record, and stands at a new high of 2,031. The Labour Department says 214,000 jobs were added in October, a good solid number even if it was lower than economists were hoping for.

Even Europe and Japan have made good money for investors in the last five years. European blue chips have risen nearly 25% since 2009, although there are fears of weakening growth after poor data from Germany, while a further dip in eurozone consumer price inflation in September has revived the deflation spectre.

To view the tactical asset allocator's holdings and trading chronology, click here.

Rallying Japanese market

Despite its bad press, the Japanese market has actually made more than 50% over the five years, and is still rallying on expanded central bank stimulus and the news that the Government Pension Investment Fund will double its domestic equity allocation to 25%.

In the fixed income market, bonds enjoy a ready market. Exchange traded funds (ETFs) enable smaller investors to better gain access to the bond market, and fixed-income ETFs have taken nearly half of the record $73.3 billion (£46.24 billion) of assets attracted by the sector in the first 10 months of the year.

These scenarios raise the question of how low interest rates and quantitative easing (QE) have influenced the real economy (as opposed to their impact on financial markets).

QE has also undoubtedly been successful in boosting liquidity, keeping the markets flowing and loosening the monetary reins when rates were already low; but nonetheless, you could say GDP has been relatively unresponsive.

Economic growth forecasts

The Organisation for Economic Co-operation and Development has cut its global growth forecast to 3.3% for this year, reflecting the Chinese slowdown and challenges in the eurozone.

Confoundingly, however, the Confederation of Business Industry is predicting the UK economy will grow 3% this year - the fastest pace since the financial crisis - and is apparently unfazed by the eurozone. A longer rear view will be required before the real benefits of QE become clear.

What seems certain is that central banks won't raise interest rates as fast as had been expected. Equally, it is by no means sure that rates will climb back to anywhere near their historical norms, as economic growth will be held back by ageing populations and persistently high debt levels.

In the UK, it is looking increasingly likely that interest rates will remain on hold beyond next year's general election. The consumer prices index could fall below 1% in the first quarter of 2015, from September's five-year low of 1.2%, and the recent decline in the oil price - Brent crude is around $82.86 in London - could push it down by another 0.5%.

If inflation dips then below 1%, Mark Carney, governor of the Bank of England, will have to write an open letter to the chancellor explaining how he will ensure that inflation returns to the Bank's 2% target. Rates will stay low and the day of reckoning for overstretched mortgage borrowers will be delayed again.

Difficult to read

This uncertain backdrop will make stock markets difficult to read. Expect many steps forward and many steps back. Perhaps expensive assets will just become even more expensive. If interest rates remain low, equity returns won't need to match traditional levels to attract investors.

One strategy when the market suffers short-term jitters is to hold cash, in preparation for buying opportunities ahead.

Currently, only precious metals and some commodities are tumbling, with gold falling below the $1,200oz threshold and silver trading below $16oz, a price not seen for half a decade.

Some investors have been flooding into gold exchange traded products (ETPs), reading this as an opportunity to increase their gold holdings: inflows into gold ETPs have reached a seven-week high.

But many commodities are now trading close to their marginal cost of production, so prices cannot fall much lower without triggering a supply response. Silver, long the bane of our portfolio, falls into that category, and there are any number of experts predicting it will rise from the ashes.

Low prices in oil and some industrial metals such as nickel are also attracting bargain hunters who argue that the global slowdown has been overstated.

We're not convinced, however, and won't be adding to our commodity positions. For one thing, commodity prices can sometimes fluctuate widely over just a few days, as they are increasingly led by derivatives trading rather than by basic supply and demand.

Evidence from the Commodities and Futures Trading Commission has also revealed that certain large traders are distorting the market. These are assets where it is becoming impossible for private investors to have much visibility.

Japan and Europe relatively cheap

The best opportunities will probably still come in the equity sector. While US stocks look most overpriced by historical measures, Japan and Europe are both still relatively cheap.

Haruhiko Kuroda at the Bank of Japan has already embarked on the biggest ever QE programme and has increased its printing from around ¥60-¥70 trillion this year to ¥80 trillion (roughly $720 billion).

Prospective investors have to assume that as far as stock market trajectories are concerned, QE works, even if there is still no firm evidence it translates into growth in the underlying economy.

The portfolio is taking a stake in the iShares MSCI Japan Sterling hedged fund. For those who prefer active exposure, heads the one- and three-year performance tables, but Morningstar OSBR says it has "concerns over the stability and resourcing of the Japan desk".

Lindsell Train Japanese Equity, which nudges it over both time periods, has been managed by Michael Lindsell himself since February 2004 to good effect. In investment trusts, meanwhile, the Baillie Gifford team are well regarded.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.