Record-breaking Halma grows divi again

18th November 2014 13:52

by Harriet Mann from interactive investor

Share on

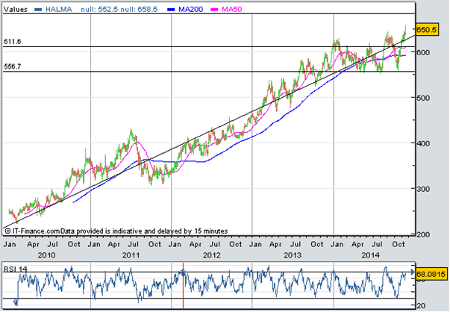

It's not been the easiest period for , with a downturn in one of its core markets proving a drag on profits at the Environmental and Analysis division. But strength elsewhere easily absorbed the impact and the smoke detectors and automatic door sensors firm still had a record year. Another increase in the dividend was no surprise - it's increased the full-year payout by 5% or more each year for the past 35 years - and the share price is currently hovering near a record high.

First-half revenue rose 2% to £340.9 million, driving pre-tax profit up by 9% to £61.9 million. Profit fell by a fifth at the Environmental and Analysis unit to £11.9 million - down 15% on an organic constant currency basis. But Halma beat expectations with 18% growth at the process safety business to £73.9 million, 5% in infrastructure safety to £112.7 million and 4% at its medical arm to £78.4 million. Environmental and Analysis revenue is expected to improve in the second half.

Europe was slow, as expected, but all regions grew sales, with "other countries" growing fastest, followed by the US, which made £104.1 million, or 31% of the total. Expansion in China and India is one of the firm's main strategies, along with acquisitions and research and development investment. Should this go to plan, Numis has pencilled in profit growth of 7% for the year to March 2015.

"Halma again delivered a strong set of results, in spite of a temporary dip in one division," said Investec. "Reversing the trend of first half 2014, profits in the first half of 2015 grew more rapidly than revenue and the issues in Environmental & Analysis looks set to be resolved swiftly."

Impressed by its business model, Numis explains, "it is exposed to less cyclical markets, geared to non-discretionary spend and regulatory drivers which has led to a strong trough-cycle track record."

Maintaining its 'add' recommendation and 700p target price, Numis says:

Halma has proved resilient through the economic cycle with demand driven by increasing health, safety and environmental legislation. Many of its products are sold in highly regulated markets characterised by non-discretionary spend and lower sales cyclicality.

At 650p, Halma trades on 21 times forward earnings, dropping to 19.5 the year after. That's a premium to the sector, but deserved given growth in Halma's earnings and dividend is so reliable. Orders are growing ahead of sales and last year's figure, too.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.