Shares to buy, hold and sell

2nd December 2014 11:34

by Rebecca Jones from interactive investor

Share on

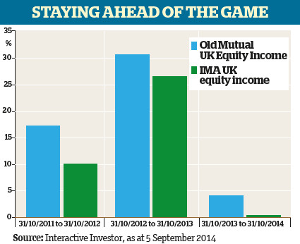

Stephen Message, manager of the strongly performing , talks Rebecca Jones through some of the stocks he has been buying, holding and selling.

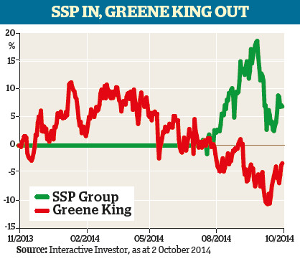

Buy - SSP Group

Message bought food and beverage retailer SSP Group (SSPG) during the firm's initial public offering (IPO) in July this year, but he claims the purchase was an unusual move.

"Typically, I shy away from IPOs, as valuations are too high in my view, but I felt the valuation here was compelling," he says.

Message initially paid 210p a share for SSP, which operates cafes and restaurants in airports and railway stations around the world. The firm is now a top-20 holding, accounting for 2.6% of his portfolio. With the share now trading at around 235p, he has already made a modest profit.

This is headed by former chief executive Kate Swann, whom he credits with turning WHSmith's fortunes around by reducing the company's costs and improving its profit margins.

"Today SSP's operating margins are mid-single digits. Swann has a track record of delivering, so I think there is real scope for meaningful margin growth in this business. That in turn is good for dividend growth," Message comments.

SSP is now set to focus more on improving costs and profitability rather than growing its top line, which leads Message to conclude that the company is "in charge of its own destiny" and has little to fear from global economic shocks. That perspective makes it "a great long-term buy and hold".

Hold - Booker Group

Message invested in cash and carry business for 40p a share when he took over the Old Mutual UK Equity Income fund in 2009. With shares now trading at 139p and the company accounting for 2.5% of his portfolio, he is happy to hold his position.

He says: "[The firm] has evolved under the current management team from a fairly indebted company with a poor balance sheet into one making a much better profit, while dividend growth is really strong. So it's not a recovery play now, but it's an interesting growth situation."

Message believes Booker's acquisition of German retailer Makro in May 2012 should continue to boost its prospects in the medium to long term.

"There is meaningful scope to improve profits there. It will also allow the company to build on its 'delivered' platform; alongside in-store cash and carry, this part of the business - which supplies goods to the catering industry - is going to be quite strong," he says.

He admits, however, that the firm's share price has struggled this year: shares are now trading at 20% below their March peak of £176.50. He attributes this to fear of "broader deflation in food retail".

Sell - Greene King

Message saw a big opportunity in the shares of pub chain in 2010, when the firm was trading on a p/e ratio of nine times and paying a healthy 5.5% dividend. At that point he bought into the company for around 450p a share. At its peak the holding accounted for 2.5% of his portfolio.

"We bought when the chain was growing in a shrinking market - a lot of pubs were going bust, yet there was a trend, which has continued, towards casual dining out. The firm was also rolling out the franchise by adding around 50 pubs a year, and consumer confidence was improving," he says.

Message was proved right: Greene King shares traded at a heady 913p at their peak in January this year. However, as the company's share price rose so did its P/E ratio, while its dividend decreased, so he sold out in April.

"We sold purely by virtue of the fact that the shares had done so well. It re-rated from a P/E of nine to 14 times and its dividend yield came down to 3.5%, so the value wasn't there. It's nothing to do with the pub sector; I just don't think a dividend yield of 3.5% for that business is fair," he says.

Message says Greene King's success is typical of that enjoyed by numerous UK mid-cap firms over the past two to three years, which makes finding value in the space increasingly difficult.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.