32Red wows with double-digit growth

22nd January 2015 14:32

by Harriet Mann from interactive investor

Share on

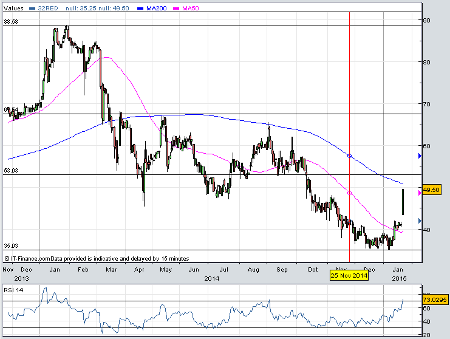

Batting off regulation pressure introduced at the end of last year, 32Red has wowed with its latest, better-than-expected annual update. A rebound in the share price following an awful 2014 is well underway.

Thanks to its mobile service, 32Red's net gaming revenues shot up by a quarter to £32.1 million, the fifth consecutive year of double-digit growth. Improvements to marketing have led to a 17% increase in new players and 15% growth in total active players, with more people gambling through their mobiles and over half of new players being recruited through the platform. Revenues from mobiles were up by 89% on the year, accounting for nearly a third of total casino income. Even without increased marketing investment in Italy, the region generated £1.1 million, up 74%.

So far, it seems the point of consumption (POC) tax introduced in December 2014 has failed to impact 32Red. The rule change means operators need to pay tax if a player is out of the UK but is normally based in it, whereas before operators only needed to pay tax on profits that were generated in the UK. And the upward trend is continuing into this year, with trading in the first 20 days of January up 31% year-on- year. No wonder the shares rocketed by a fifth on Thursday to 50p. They were just 36p less than two weeks ago.

"It is too early to gauge the lasting effects of the new licensing regime on the UK remote gaming market which came into force on 1 November 2014," said the company. "However, there are fewer brands legally accessing the UK marketplace and 32Red's revenues in the month of December reached record levels."

Daniel Stewart is confident 32Red can take advantage of the market unease caused by new regulations. However, it will not escape the POC tax in 2015, and the broker believes profits will suffer. That said, downgrading its share price from 95p to 75p still implies plenty of upside potential.

"The stock continues to trade on a reasonable multiple (.4.4x FY`14E EV/EBITDA) and pays an attractive dividend of c. 6%. We remain buyers of the stock with a new target price of 75p."

Numis Securities is more optimistic, reiterating its £5 million EBITDA expectations for FY2015 with a 'buy' recommendation and 80p target price.

"With this performance we find the FY15E P/E of 7x hard to believe. The company has, once again, hit our targets and started a new trading period at a sprint. We had been concerned that the new regulatory regime in the UK might disrupt 32Red but there is no sign of it. On the contrary, December trading was a new record and January has got off to a very strong start."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.