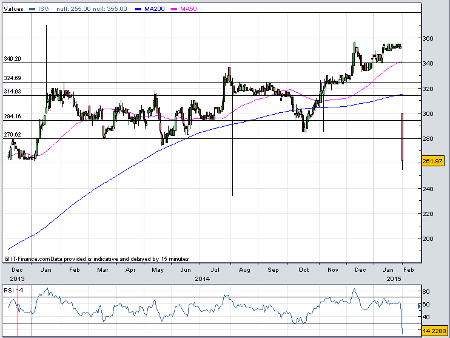

ISG collapses after profit warning

2nd February 2015 14:21

by Harriet Mann from interactive investor

Share on

appeared to have done well over the last year, but poor performing construction contracts are expected hit year-end profits hard, easily offsetting gains made elsewhere. Having had a good look at the numbers, management has found a £7 million hole in expectations. It's not pretty, but at least one analyst believes the glass is half-full and that the effects will be brief.

Blame the UK Construction division. Three contracts won over 18 months ago are causing problems, and protracted discussions regarding another won in 2012 have forced the group to make a "significant" provision against the contract.

There are other issues, too. Its London Exclusive Residential construction activities - high-end residential work - are getting the can at a cost of £6 million, which accounts for the losses incurred in the year-to-date. Another £11 million provision is associated with the closure of its Tonbridge office as management have been unable to collect some payment from projects within the division.

Nick Spoiler, an analyst at WH Ireland, has downgraded his year-to-June pre-tax profit by nearly half to £8 million with an EPS of 15.6p. But he, like management, is optimistic for the year after.

"We would usually carry across our downgrade to the following year. However in this instance, on the assumption that the construction division remains loss-making on an underlying basis, and that the other businesses continue to perform in line, we would anticipate that we will be broadly maintaining our FY 2016E forecasts (£18.1 million/35.1p)."

ISG has contracts with Nespresso, Primark, and Louis Vuitton, and has left its mark across much of the UK. The proof was in the pudding back in December when it managed to beef up its order book to over £1 billion, helping push its market value to seven year highs. And its latest update wasn't all bad news; its order book remains strong and its other divisions, including the rest of its construction business, are performing well.

With net cash of £38 million and strong visibility, ISG's UK Fit Out and Engineering Services, UK Retail and International divisions have scope for outperformance in the second half of the year. But this wasn't enough to support the share price, which collapsed by nearly 30% to 260p.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.