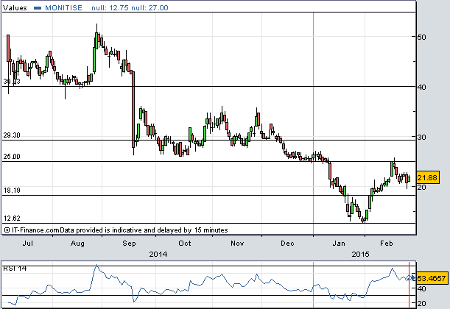

Monitise wins contracts worth millions

26th February 2015 11:56

by Lee Wild from interactive investor

Share on

Up-for-sale mobile payments specialist has won two major multi-year contracts with multi-million dollar aggregate value, proving that the strategic review launched last month is not a distraction.

Of course, these wins do not really change much, other than providing proof that the company is still capable of competing for substantial contracts with big players.

The first of these new deals is with a top 10 US financial institution and existing client, and the second is with a global partner to deploy Monitise's digital banking capabilities in multiple countries for a major European financial institution. It was the subject of a Letter of Intent flagged at the interim results on 17 February.

Monitise is slashing costs and still thinks it will make a cash profit in 2016 after a likely loss of £40-50 million this year. But it's the possible bid for the business and speculation around the take-out price that's exciting investors now.

American banking software firm FIS, and are all thought to have expressed a tentative interest in buying the business.

Says Barclays: "The potential value of the business is clearly difficult to determine given the IP will be worth more to certain potential suitors. The stock trades at 3.5x FY15E EV/Sales at the mid-point of guidance."

After seriously cutting back estimates in response to the January profits warning, broker Jefferies thinks new forecasts "should be achievable". It's now looking for full-year revenue of £91.1 million and an EBITDA loss of £49.2 million, then £120.5 million and a £1.2 million cash profit in 2016. At least the company is funded through to EBITDA breakeven.

"Our sense is that much of the pain of transitioning from upfront licences & associated integration projects to a user-based, recurring model may have already been inflicted," said Jefferies recently. "The ongoing strategic review could throw up favourable outcomes. Despite the recent upheaval, the profile of returns is likely skewed to the upside."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.