Afren proposal attacked

17th March 2015 13:05

by Lee Wild from interactive investor

Share on

A lot has been written about in recent days, and rightly so. A complex recapitalisation will leave bondholders in control of the Africa-focused oil company and shareholders with next to nothing. And with many existing investors having held a long-term interest in the business, information is crucial. It's why a weighty 16-page note written by Barclays detailing Afren's proposals makes interesting reading.

"Afren's proposed recapitalisation protects the business from the consequences of imminent default. However, in our opinion, it fails to provide a capital structure capable of supporting a long term future for the business," writes the broker.

"Pro forma net debt exceeds our revised valuation of the core assets, despite a partial debt-for-equity swap and injection of additional capital that dilutes existing equity holders to ~9%. Once recapitalised, we expect the company - now for all intents and purposes in the control of the ad hoc committee of bondholders - to pursue asset sales to maximise the recovery of value and repay debt."

Even the $75 million open offer for existing shareholders does not indicate that a sustainable recovery "is unlikely to materialise within a reasonable timeframe".

Barclays currently pencils in pro-forma year-end 2014 net debt of $1.4 billion on completion of the restructuring, versus its $1.1 billion valuation of the Nigerian production/development portfolio. And that assumes that Brent crude recovers to $90 a barrel in 2017 and a 15% cost of capital. "In our view, this mismatch makes a corporate sale of the business unlikely, unless bondholders were willing to take further haircuts."

The proposed super senior private placement notes, and the new 2017 high-yield notes that would replace it, are top of Afren's new capital structure. Holders will also get over 50% of the equity. "This is the cost of enabling Afren to continue as a going concern," writes Barclays' James Hosie. "We believe the motivation for bondholders to support the restructuring is due to the risk that a default event would lead to Afren losing claim to its key assets - the producing Ebok and Okoro fields."

What should shareholders do now?

"The stock has option value on the basis that a rapid recovery in Brent towards $90/bbl and the disposal of non-core assets (Kurdistan, East Africa, undeveloped Nigerian fields) enables Afren to accelerate debt reduction," says Hosie. "The restructuring remains subject to 75% shareholder approval, but if rejected an alternative proposal would result in a pro-forma net debt ~$0.3 billion higher, increased borrowing costs and a covenant requiring initiation of a formal sales process before the end of 2015."

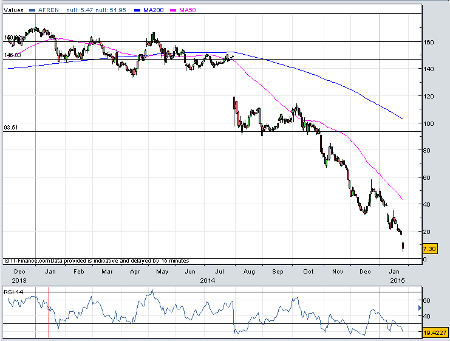

Best-case for equity investors is 5p, reckons Barclays. This assumes that investors do assign option value to the potential recovery of the business through both higher oil prices and asset sales which bring in more cash than expected.

Ebok and Okoro fields are clearly the company's most valuable assets. According to Barclays, using valuations discounted from 1 January 2015 and 15% discount rate, Ebok could be worth about $420 million, or risked net asset value per share of 2p, Okoro $191 million/0.9p and Okwok $370 million/1.8p, out of $1.1 billion, or 5.3p a share.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.