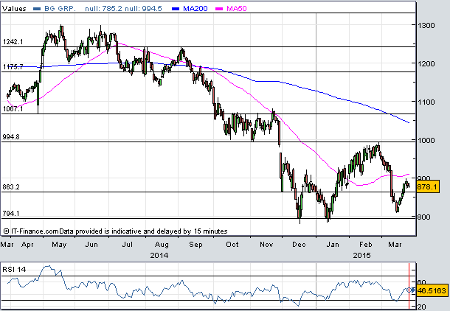

How much is BG Group worth?

25th March 2015 13:09

by Lee Wild from interactive investor

Share on

Despite the plunge in oil prices, and just days after began production at the Knarr oil field in the North Sea, offshore Norway, broker Citi has repeated 'buy' advice and said it still thinks the shares are worth a tenner each.

But it's not the Knarr field that interests Citi. Estimated gross recoverable reserves of around 80 million barrels of oil equivalent (mboe) are a drop in the ocean compared with BG's development interest in the Santos Basin, offshore Brazil. Lula (formerly the Tupi oilfield) has an estimated 7.77 billion barrels, Lara and Saphinhoa 4 billion each, and Cernambi over two billion barrels.

"We have reviewed our assumptions regarding the pace of ramp up of pre-salt Brazil given local supply chain issues and the ongoing corruption issues at Petrobras, as publicly reported," said Citi Wednesday.

Near-term floating production, storage and offloading (FPSO) capacity additions into the first half of 2016 appear on track - the next three vessels are expected to deliver net incremental production of about 100,000 boe/d (or 15%) to BG's current production once on plateau in late 2016/early 2017. But the broker now thinks locally built FPSOs, due from the second half of next year, are at risk. Citi had pencilled in a six-month delay, but now believes it could be as much as 18 months.

That's why the broker has lowered its Brazil production estimates for BG by about 11% on average over 2017-18. However, its 2020 estimate is largely unchanged at 486,000 barrels of oil equivalent per day (boe/d) (v 501,000 boe/d previously). Brazil still represents 60% of BG's upstream cashflows in 2020.

Those anticipated FPSO delays also mean an 8% average cut to 2015-20 estimates. Citi now expects $0.43 this year, $0.808 in 2016 and $1.323 the year after.

"Despite this earnings downgrade, we continue to see BG's valuation screen attractively versus its Big Oil peers trading at 1.25x P/BV [price-to-book value]-end 2017 versus a 2018 ROE [return on equity] of 14%. We maintain our Buy rating, but reduce our price target to 1000p/share (from 1020p) with our earnings changes partially offset by a revised capex profile."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.