Can Lloyds, RBS and Barclays survive economic Armageddon?

31st March 2015 13:30

by Lee Wild from interactive investor

Share on

This year's annual UK bank stress tests will be even tougher, gauging British lenders' ability to survive a global economic slump. And there are a number of changes to parameters used by the Bank of England in the 2015 test, just published. We won't hear the results until the end of the year, but clearly some banks will be more confident of passing than others.

The scenario runs from the first quarter of 2015 to the end of 2019, longer than the 2014 test as vulnerabilities are deemed to be "more persistent in nature". It begins with a big disappointment in global growth, hitting economic output in the euro area, emerging markets and the UK. Volatility spikes and commodity prices slump - oil is seen troughing at $38 a barrel.

Elsewhere, the renminbi is allowed to depreciate 10% against the dollar by the end of 2015, the euro slumps by around 25% against the greenback and by 15% against the pound. A downturn in mainland China is bad news for Hong Kong where property prices plunge, and for other emerging economies - the average currency depreciation in the G20 emerging market economies is about 25%.

Apart from spillovers from the global slowdown, the US gets off lightly and is the beneficiary of safe-haven capital flows. In the UK, output growth turns negative in 2015 Q3 as export demand falls sharply and house prices slump by a quarter, although the 2015 test is less severe for Britain.

Under the baseline scenario, the Prudential Regulation Authority (PRA) expects banks to meet two key capital adequacy thresholds. The common equity Tier 1 (CET1) hurdle rate of 4.5% hurdle rate is unchanged from last year, while a 3% Tier 1 leverage ratio requirement is reintroduced.

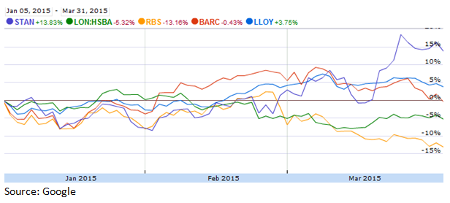

Market reaction

"The fact that the CT1 hurdle rate of 4.5% was left unchanged is positive for the banks in our view, given the average UK bank CT1 rose by 1.4% in 2014," says JP Morgan. "However a 3.0% stressed leverage ratio requirement has been added, and may become the binding constraint for BARC and RBS given increased focus on traded risk in our view."

Although there was no minimum Tier 1 leverage hurdle in 2014, , and had stressed leverage ratios of 3.1%, 2.6% and 2.3% respectively.

"Given the lower stress assumptions for the UK, we continue to see Lloyds as best positioned on capital within the UK banks. Although the EM focus would lead to lower stressed CT1 for and , we believe that both banks will be helped by their large CT1 buffers," added JPM.

"Overall, we note that the 2015 stress test scenarios are more challenging for global exposures, but with a median buffer of 6.9% above the minimum CT1 hurdle rate, we don’t foresee rising concerns on capital due to these tests."

Credit Suisse expected the emphasis on global and emerging market shocks, but admitted that with the PRA and BoE now fully in charge of the test, the procedures appear more detailed and prescriptive.

"We continue to see Standard Chartered (Underperform) and, to a lesser extent, HSBC (Underperform) as more vulnerable to the potential outcomes of the new test scenario," said the broker, although it thinks the stress test could provide a working backdrop for the incoming CEO.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.